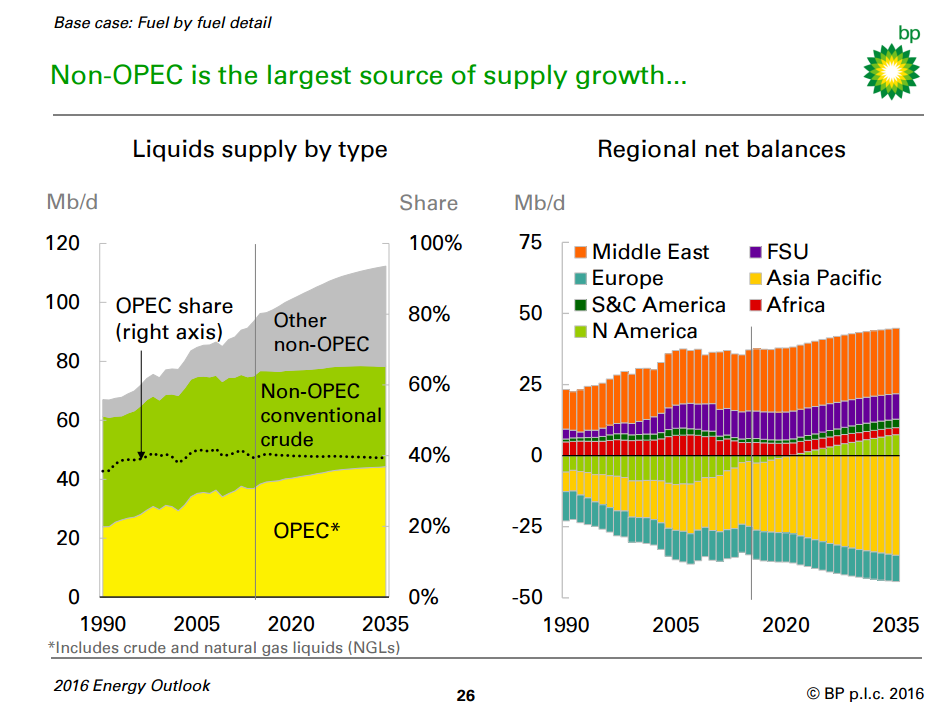

Non-OPEC unconventional sources expected to provide growth in supply through 2035

The continued growth of global economies will continue to drive demand for energy around the world, according to BP’s (ticker: BP, BP.com) 2016 Energy Outlook.

According to the study’s base case scenario, global GDP will more than double in the next 20 years, with energy demand growing by about one-third. BP expects that 80% of total demand will continue to be met through the use of fossil fuels, but OPEC will not be the primary source of that crude supply.

BP expects that OPEC’s share of global markets will remain relatively unchanged over the next two decades, staying at about 40%, with most increases coming from non-OPEC unconventional sources. A supplement to the study titled “The Shale Revolution Continues” said the company expects tight oil production to more than double to 10 MMBOPD globally, driven largely by production in the United States.

Eventually, U.S. tight oil production will be constrained by a limited resource base, the study said, but shale gas is expected to continue growing by 5.6% annually as the cleaner-burning fuel is increasingly used. Natural gas is expected to be the fastest growing fossil fuel over the next 20 years, according to BP.

Rumors of a potential production cut between OPEC and other major non-OPEC producers like Russia pushed prices up, but Saudi Arabia effectively killed any hopes for a deal after a meeting between Saudi Oil Minister Ali al-Naimi and his Venezuelan counterpart ended without concrete plans to lower production. As Saudi Arabia continues pumping near maximum capacity, and Iran and Iraq both look to increase production, the group is quickly running out of spare capacity to supply future demand growth.