Source: Houston Chronicle

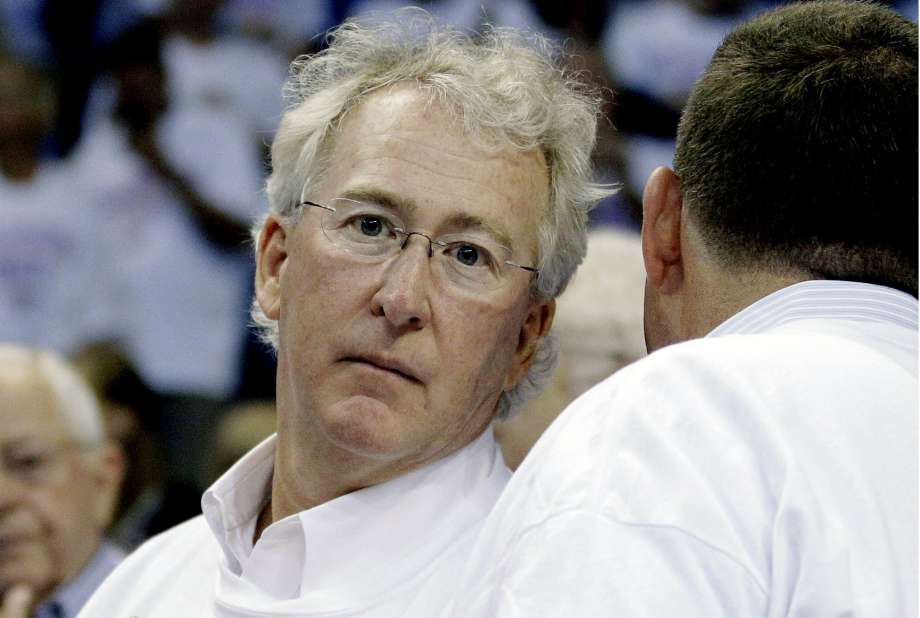

The Permian Basin business of the late shale pioneer Aubrey McClendon merged its assets with its parent company to avoid bankruptcy for now.

Houston-based Permian Sable Resources said Friday it successfully merged its assets with its subsidiary American Energy – Permian Basin and paid almost $400 million in cash in a deal with creditors to cut back the company’s debt by $1.4 billion.

McClendon, who died in a car crash in 2016 while facing federal antitrust charges, had founded American Energy Partners in 2014 about a year after he was ousted from his company, Oklahoma City’s Chesapeake Energy. But American Energy Partners quickly found itself in financial trouble as the last oil bust took hold in late 2014.

The parent company, Permian Resources, was taken over in 2017 by the private equity firms The Energy & Minerals Group, OnyxPoint Global Management and Sable Management. The company was renamed Permian Sable Resources and moved from Oklahoma to a Houston headquarters.

As it continued to falter under heavy debt, Permian Sable Resources and American Energy – Permian Basin agreed this month to merge their assets and restructure.

McClendon’s American Energy Partners had previously splintered into a series of specialized firms, including American Energy – Permian, American Energy – Woodford, American Energy – Appalachia, American Energy – Midstream and more.

[contextly_sidebar id=”wnshgTD1XSD6RRTtslMNFlIYnxHw7CAZ”]

Oklahoma’s America Energy – Woodford had turned into White Star Petroleum, which had its assets acquired last month in a bankruptcy auction by Houston-based Contango Oil & Gas. The Appalachian business is now Ascent Resources and the midstream company is now Traverse Midstream.