RarePetro

Oil & Gas 360 Publishers Note: Kevin Olson has assembled great data points about the influx of fifty million barrels of foreign crude oil to the United States, and may offset most of the production cuts. Pushing out any kind of recovery on our producers. This brings up the question: Should Donald Trump, or Congress, get involved in eliminating imports of oil? We could get our heavy oil from Canada and Mexico if the infrastructure was built, and not rely on other foreign countries.

Abstract

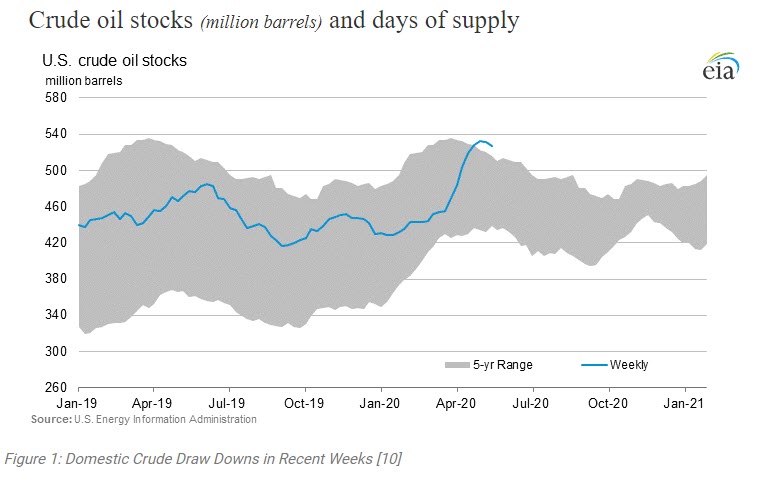

The worst of the coronavirus induced oil crash seems to have bottomed out as storage inventories saw fairly dramatic drawdowns in the final weeks of May, a reversal of events from the past several months. Such relief may be all but eliminated in the ensuing week as an influx of nearly fifty million barrels of foreign crude oil is about to reach the U.S. Gulf and West coasts. The volume of incoming crude may offset most of the production cuts generated by domestic operators and extend low oil prices until the inventories can be worked back down.

Introduction

Crude oil is a global commodity, and almost no one consumes it directly. It must be refined into fuels, feedstocks, materials, and products that consumers buy and use in their daily lives. Some people arbitrarily speak about crude oil as if it is a single, indistinguishably homogeneous substance without any unique differentiation, but this is actually not the case. Crude oil ranges in density and consistency from very thin, light, and volatile to an extremely thick, semi-solid, heavy weight sludge. It can also be considerably more sweet (less sulfur content) or sour (more sulfur content). West Texas Intermediate (WTI) is an extremely high-quality crude oil and is greatly valued due to its premium quality. As a result, more and better gasoline can be refined from a single barrel than from most other types of oil available on the market. Light and sweet crude oil (such as American WTI) typically receives a higher price than heavy crude oil on commodity markets because it produces a higher percentage of gasoline and diesel fuel when converted into products by an oil refinery. Unfortunately, WTI is produced in landlocked areas, making transportation costs more oppressive than a blend produced near the sea like Brent. Although Brent crude is a heavier and lower quality than WTI, its transportation costs are significantly less than the superior American blend resulting in a Brent price that is overall typically higher than WTI. Other heavier sour crude blends, like those from Saudi Arabia, are a lesser quality blend and are usually processed into heavy oil such as low-quality diesel and fuel oil rather than gasoline to reduce processing costs.

Fear has been growing in the past few months about the effects on the domestic and global oil market as a surge of Saudi crude shipments are soon to reach the West and Gulf Coast of the United States. At the beginning of April before OPEC+ struck a new agreement to take 9.7 million barrels per day of production off the market, Saudi Arabia had embarked on an aggressive price war for market share after the previous OPEC+ deal collapsed in early March [3]. Prior to production cut agreements, Saudi Arabia loaded up jumbo tankers and shipped the U.S. large volumes of heavy crude [3]. With the influx of Saudi oil coming to the U.S. by the end of May and continuing into June, the volumes may offset most of the production cuts generated by domestic operators. This may negate crude supply draws that have occurred in recent weeks and extend low oil prices until the inventory can be worked back down. With demand still weak they have few options: dock and unload at low commodity prices or turn into floating storage, at a cost.

[contextly_sidebar id=”vpCV8kPV9aigZUtD7vqi1Rnmx0df4eN7″]

Floating Oil Storage

A total of 43 million barrels of Saudi oil is set to begin arriving on the U.S. Gulf and West coasts by May 24, according to Rystad Energy, and continue through the end of June [2]. The convoy dubbed the “flotilla” is made up of 28 tankers including 14 very large crude carriers (VLCCs) and will join a queue of 76 tankers waiting to unload in U.S. ports as the greatest oil glut in history plays out [2]. While not ideal, the timing of such shipments is tolerable as the Energy Information Administration reported the first inventory decline in months for the week ending May 8th and again May 15th, but it still puts remarkable pressure on domestic markets. Analysts at Bloomberg predict the delivery of nearly 50 million barrels of Saudi crude could reverse a tentative recovery in oil prices.

The EIA reported that commercial crude oil inventories had declined five million barrels the week of May 15th, and the modest draw gave hope that the oil storage problem may soon begin to resolve itself even if total stockpiles were still above the five-year average [3]. “If all the Saudi tankers unload, the crude they carry will offset almost all of the production reductions from March levels in May, effectively maintaining the current high storage filling rates,” Rystad Energy senior oil market analyst Paola Rodriguez-Masiu told Bloomberg [3]. Unfortunately, the Saudi shipment will join the dozens of tankers currently lined up off the two coasts as demand for motor and jet fuel is being destroyed by the COVID-19 pandemic. As of April 30th, there were 34 tankers already waiting in line to offload about 25 million barrels on the West Coast, and 32 tankers lined up off the U.S. Gulf Coast [2]. These ships will be joined by mainly supertankers set to deliver over 43 million barrels of Arabian crude to Gulf buyers and at least 7 million to Pacific users. The volume of oil arriving in May and June is equal to nearly a third of all Saudi crude delivered to the U.S. last year [1]. While West Coast crude stockpiles are currently at 58.2 million barrels, nearing full capacity, the inventory picture is brighter on the U.S. Gulf Coast, America’s refining belt, where crude inventories are 88 million barrels shy of reaching total storage capacity [4].

U.S. Heavy Crude Processing Rates

In general, domestically produced crude oil is light when compared with imported oil. For example, in 2018, 56% of the oil produced in Texas, the largest crude oil-producing state, was relatively light and sweet with an API gravity between 40 and 50 degrees. At the same time, 58% of imported crude oil was relatively heavy and sour with an API gravity of less than 25 degrees [8]. U.S. refineries rely on imports as feedstock to optimize production and maximize profits. As of January 2019, when domestic refineries were operating at 96% utilization, U.S. refineries had more than 3 million barrels per day of coking capacity [7]. This capacity is used to process heavy and medium crude oils efficiently and would likely be underutilized if a refinery chose to only run domestically produced light crude oil because coking units are designed to convert heavy, low-value intermediates into high-value naphthas and distillates [8]. In other words, U.S. refineries are designed to take in a range of crude oils and need medium and heavy oil (mostly from foreign sources) to run efficiently.

This is precisely the reason it would be foolish to eliminate imported oil. Refineries would be unable to run efficiently or produce certain products that can only be created while refining less than ideal crude oil. In January 2019, U.S. refining capacity increased to more than 18.8 million barrels per day, the highest capacity on record [6]. Therefore, imported crude accounted for 19% of crude processing capacity. While the United States does produce medium (mostly from the Midwest and Louisiana regions) and heavy crude oil (mainly from California), imports are still needed to satisfy the wide array of crude needed for refineries across all regions to run efficiently.

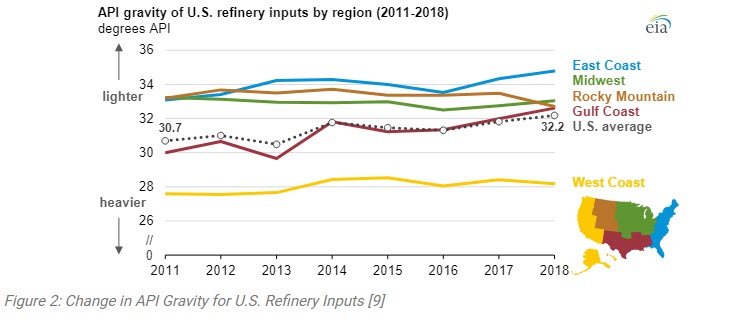

The API gravity taken in by U.S. refineries has slowly gotten lighter over the past decade. Figure 2 shows the national average for API inputs to refineries has increased from 30.7 degrees to 32.2 degrees between 2011 and 2018 [9]. With the exception of the Midwest and Rocky Mountain regions, refineries have been processing higher API gravity crude due to lighter shale oil produced domestically as well as increased crude volumes. The Midwest and Rocky Mountain regions have been getting larger volumes of heavy crude from Canada resulting in a drop in API gravity over time [9]. Due to existing pipeline infrastructure, refineries in these regions readily accept Canadian heavy oil due to minimal transport costs and combine it with higher grade crude produced locally. As U.S. refineries are the most technologically advanced and efficient in the world, the steady growth in U.S. refining capacity has ensured the cost-effective supply of refined products like gasoline, diesel fuel and jet fuel to the U.S. as well as consumers around the world.

Refinery Mix of Imported and Domestic Crude

The United States predominantly produces lighter, sweeter crude oil in the Permian region but domestic refineries largely rely on heavier crudes to run smoothly. Light crude oil has generally received a higher price than heavy crude oil on commodity markets (taking transportation costs out of the equation) because it produces a higher percentage of gasoline and diesel fuel when converted into products by these refineries. One exception is the Buena Vista blend out of California that has historically received a premium price differential to WTI and sometimes has been priced higher than Brent. As discussed above, refineries still require heavier crudes to run efficiently. Although the United States has been producing record levels of domestic crude oil, it continues to import crude oil because of variations in crude oil quality. API gravity, along with sulfur content, determines the type of processing needed to refine crude oil into fuel and other petroleum products, all of which factor into refineries’ profits. This mix of crude types that are used during a refinery run is known as a “slate.” Overall, U.S. refining capacity is geared toward a diverse range of crude oil inputs, so it can be uneconomic to run some refineries solely on light or heavy crude oil [6].

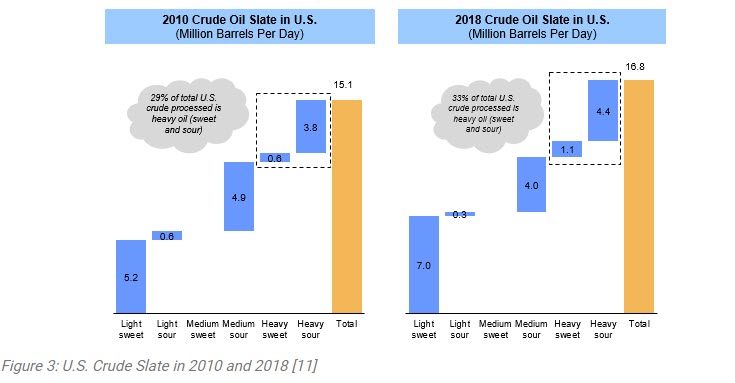

Since 2010 U.S. refineries have altered their crude slate to accommodate more light sweet WTI crude with the explosion of domestic production in the last decade. Through this process, they incidentally increased run rates for heavy and more sour crude blends. Since only 33% of total U.S. crude processed is heavy oil, nearly all imported crude oil is heavy and sour as seen in Figure 3.

Thus, when U.S. refining capacity dropped 30% in the past few months due to the global pandemic, it is logical imports should have dropped a similar 30% in the same time frame. This was not the case as Saudi shipments for May and June are equal to nearly a third of all Saudi crude delivered to the U.S. last year adding to the stockpile of tankers already lining the U.S. coastline [1]. So instead of a reduction in imports, the United States is getting slammed with a glut of imported oil.

Unfortunately, the imported crude blends are not directly interchangeable in refinery systems and cannot solely fill refiners’ slates. Additionally, tens of millions of barrels of oil sitting in floating storage is a bit of an HSE concern. As a result, imported oil will most likely replace the 33% of domestic production that lies on the heavy end of the spectrum (mainly from California) and most of the medium sour production from Louisiana and Gulf Coast. While California heavy blends have sold at a consistent premium to WTI for years, it is the quickest and cheapest source of heavy crude for West coast refining. It will be interesting to see if refineries will elect to refine onshore California crude first over floating offshore foreign oil. Even if that’s the case they will still need some imported oil to run a full slate, but it would be good to see California heavy crude prioritized over imported oil if the slate uses comparable blends. This leaves two likely possibilities for the incoming glut of imported crude: dock and unload forcing medium and heavy domestic production back into storage or sit in floating storage until domestic refineries are available to process the oil oversupply into usable products.

Conclusion

The U.S. refinery system is optimized to use a range of crude oils to make a multitude of products including gasoline, jet fuel, diesel, plastics, tires, paint, and asphalt. The Saudi shipment is a medium sour crude, similar to some crudes produced in Louisiana and the Gulf of Mexico, which is quite different from the light and sweet U.S. WTI crude [7]. As Saudi blends are sold at a discount, more domestic production will be sent to cheaper onshore storage while expensive floating storage inventories are drawn down. While this is only a portion of domestic production, the glut has potential to cause a reversal in trends from inventory drawdowns to inevitable builds once again.

The fact of the matter is, the surge of Saudi crude arriving at the U.S. West and Gulf coasts WILL temporarily throw a wrench in the global oil market. “The expected Saudi deliveries could push U.S. inventories back to builds depending on their timing,” said Sandy Fielden, director of oil and products research at Morningstar Inc. “If the shipments land at a rate that isn’t balanced by falling production or an uptick in exports, then we’ll see a domestic build” [4]. While imported oil cannot completely replace domestic production in order to keep refineries running efficiently, the glut of incoming tankers may force portions of U.S. production into storage to minimize the effects of incoming oil. Such deferred production may lead domestic inventories to begin to build after two weeks of drawdowns, drawing out the pain of low commodity prices.

Since 2008, refining capacity has increased 7.9%, domestic production has increased by 159%, and imports from Saudi Arabia have dropped 69% [5 and 6]. During this time, the United States went from being a net importer of crude oil to a net exporter (until a few weeks ago). While the dream of becoming completely energy independent seems like a great goal, it is impossible to accomplish as domestic refineries require heavy oil compositions with volumes that rely heavily on foreign imports in order to run efficiently. Luckily, the reverse is also true. Foreign countries need light and sweet oil to run their refineries economically and thus a balance has been struck. The influx of incoming Saudi oil will extend lower oil prices longer as refineries do not have the capacity to process all the crude in a timely manner and will force production back into either floating or onshore storage. Depending on the timing of these shipments, the glut of imported oil may force domestic production back into storage at rates greater than the current cut in production. This will result in crude inventories building yet again, resulting in inventory builds keeping downward pressure on prices and extending the pain of the market imbalance. While the timing of such a large shipment is less than ideal in the current market, Saudi Arabia, among other countries, has been a reliable crude oil supplier to U.S. refiners and will continue to play an important role for decades to come.

References

[5] https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRIMUSSA2&f=M

[6] https://www.eia.gov/todayinenergy/detail.php?id=41033

[8] https://www.bicmagazine.com/industry/refining-petchem/crude-oil-production-increases/

[9] https://www.eia.gov/todayinenergy/detail.php?id=41653

[10] https://www.eia.gov/petroleum/weekly/crude.php

[11] https://adi-analytics.com/2019/04/10/u-s-crude-slate-options-in-heavy-oil-constrained-world/