Texas E&Ps are preparing for growth, as two companies announced midstream takeaway agreements today.

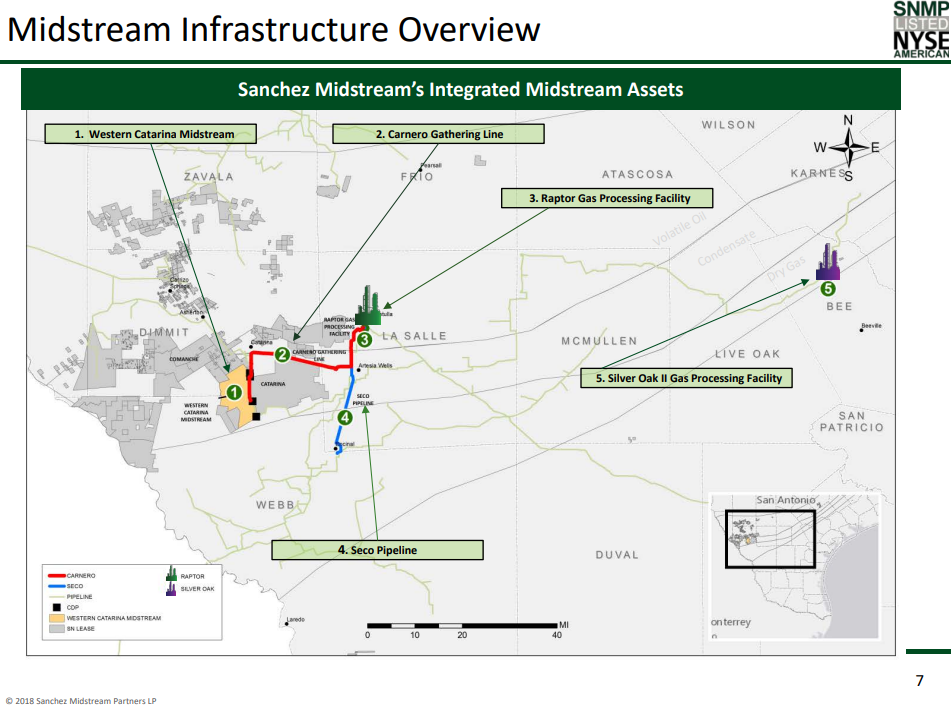

Sanchez Midstream Partners (ticker: SNMP) announced it will expand its midstream JV with Targa Resources (ticker: TRGP), expanding its takeaway in the Eagle Ford. The tow companies have merged their holdings of gathering lines and a gas processing plant to form the Carnero JV, which will expand the midstream capabilities of Sanchez.

The Carnero JV has also acquired Targa’s 200 MMcf/d gas processing plant, which nearly doubles the JV’s capacity. It also owns the Carnero gathering line, which is designed for 400 MMcf/d. In addition, Sanchez Energy will dedicate production from 315,000 acres in the Western portion of the Eagle Ford to Carnero.

Sanchez Midstream is planning to further expand its midstream capabilities, but it is not clear if the company will use the Carnero JV to accomplish this or if it will act separately.

Gerry Willinger, CEO of the general partner of Sanchez Midstream extensively discussed the JV, saying “Having completed the transformation of SNMP to a midstream master limited partnership in 2017, we have worked diligently over the last several months to expand the partnership’s opportunity set in South Texas. As a result of this effort, we are pleased to announce an expansion of the partnership’s joint venture with Targa in South Texas.”

“The Carnero JV enhances our midstream strategy, secures and expands our third-party volumes, and is expected to provide additional stable, fee-based cash flow to the partnership over time.

“The structure of the transaction greatly simplifies our previous joint ventures with Targa, which facilitates greater operating efficiencies and provides a solid platform for the continuing growth of the Carnero JV in South Texas. The transaction is expected to be immediately accretive to the partnership, with benefits that increase as the joint venture services the needs of Sanchez Energy and other producers and marketers in South Texas.”

“Because the partnership’s joint ventures with Targa previously processed gas from the Comanche asset on an interruptible basis, we do not currently anticipate that the new joint venture with Targa will result in a material impact on the full year 2018 forecast released by the partnership last week. That being said, by adding Silver Oak II and the additional capacity of the Carnero Gathering Line to the Carnero JV, our South Texasmidstream assets, which include Western Catarina Midstream and the Seco Pipeline, are strategically positioned to capture the increase in volumes from the significant development activity underway in the Western Eagle Ford without spending any incremental development dollars.

“As we anticipate increasing volumes through our expanded system in 2018 and the years to come, we have preemptively put ourselves in a position to continue to grow the partnership while being disciplined with capital. Accordingly, we see the new, expanded joint venture as a key step in positioning the partnership for continued growth in South Texas.”

Lilis expands gathering capacity

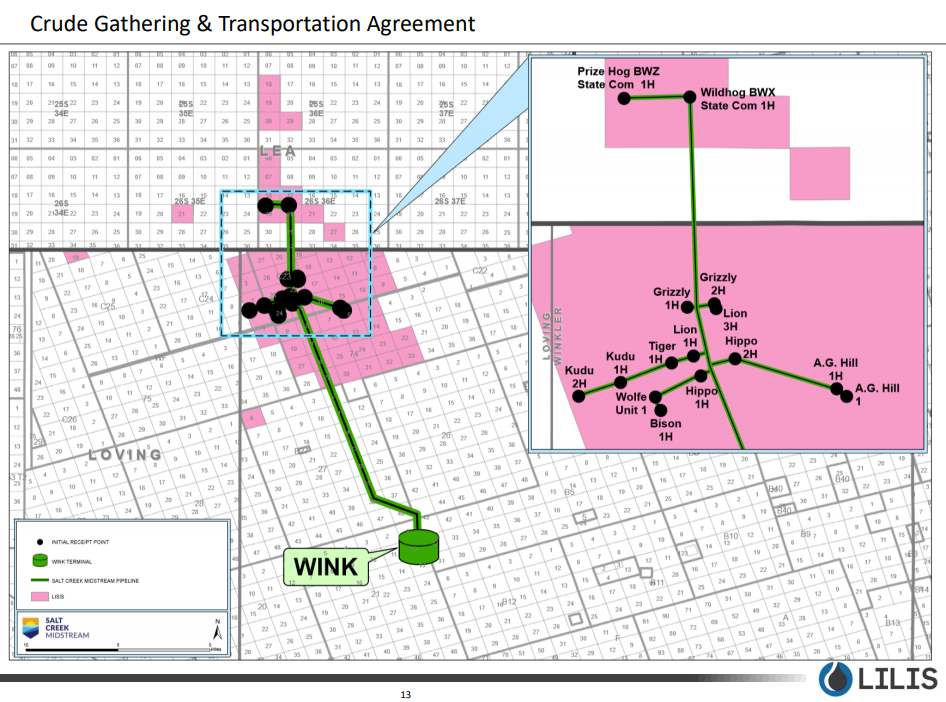

Permian-focused Lilis Energy (ticker: LLEX) also expanded its gathering capacity today, with an agreement with Salt Creek Midstream, an affiliate of ARM Energy Holdings.

Salt Creek is building a new regional pipeline system that will gather and transport Lilis’ oil production in Texas and New Mexico to a terminal in Winkler County, Texas. Lilis has dedicated its entire acreage to this gathering system, but has made no volume or capital commitments. Salt Creek will provide all capital for the system itself.

In addition, Lilis received cash in exchange for granting Salt Creek options to provide midstream services for gas Lilis produced.

Lilis Chairman and CEO Ron Ormand commented “This agreement brings numerous benefits to Lilis, and resolves for the Company many of the issues that producers in the Delaware Basin are facing. Notably this project will be built at no cost to Lilis; has no volume commitments, and will significantly lower our gathering costs and transportation costs in the future. In the interim, we have firm trucking agreements in place for oil and do not anticipate any interruptions in takeway for our rapidly growing production base. As we continue to grow our production and acreage positions, this project will ensure the efficient deliverability of our production, and maximize strong price realizations.”