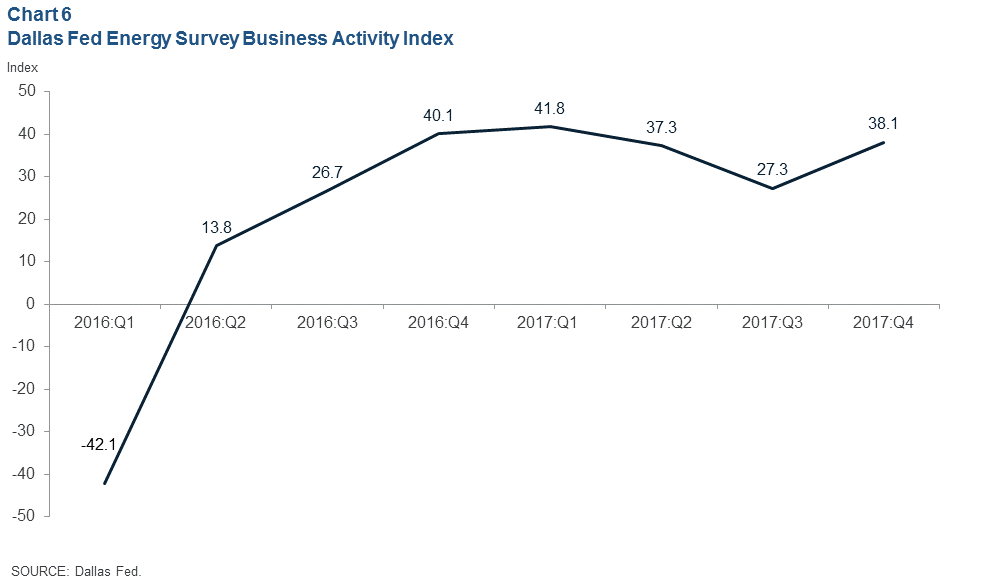

Activity in the Eleventh Federal Reserve District’s energy sector gained momentum in the fourth quarter of 2017, according to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of business conditions—climbed over 10 points to 38.1, with the increase driven by the exploration and production side of the industry.

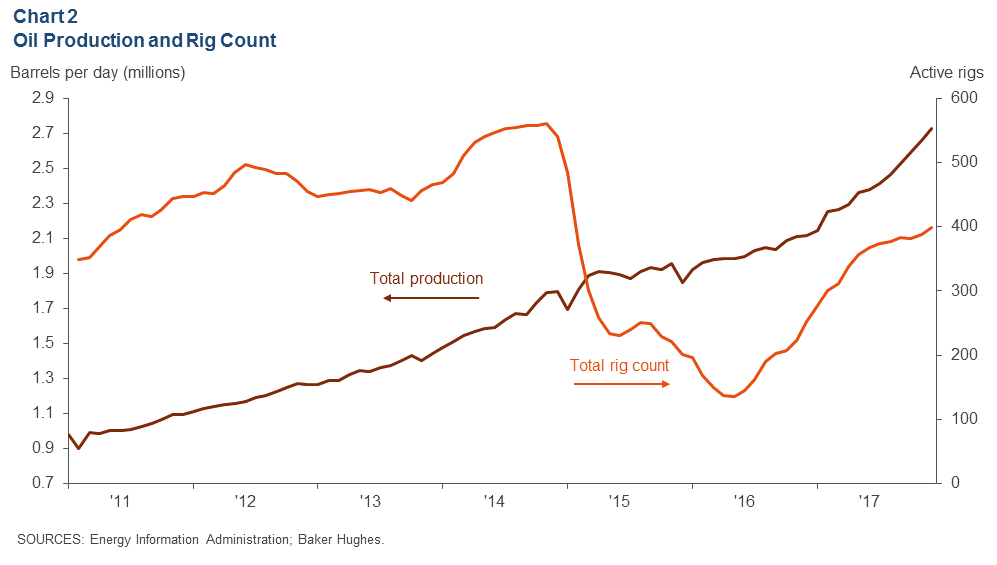

Oil and gas production increased for the fifth quarter in a row, with responses suggesting production rose at an accelerated rate. The Dallas Fed did a survey for this quarter and found that a little more than half of respondents think the oil rig count will be higher six months from now, but almost all respondents think WTI crude prices need to be more than $60 to see a substantial increase in the oil rig count.

Employment and eleventh district production

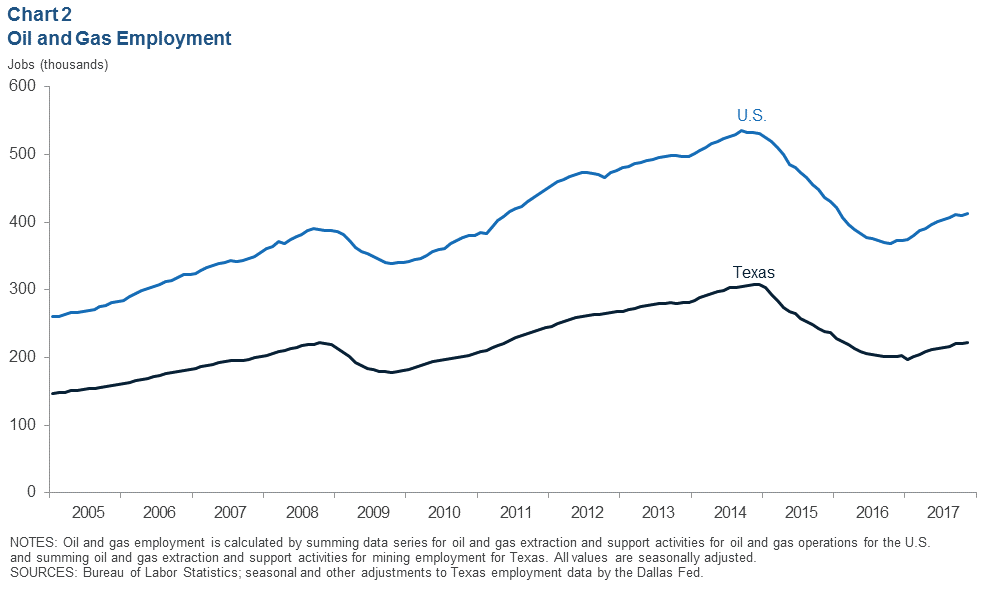

U.S. oil and gas employment increased in November by 3,500 jobs to roughly 413,400, with Texas accounting for 54% of the total. Texas oil and gas employment expanded in November by 1,600 jobs to roughly 222,600 jobs.

Permian Basin production rose in December by 69,700 BOPD to 2.72 million barrels per day and Eagle Ford production was up 2,200 BOPD to 1.24 million barrels per day.

The EIA forecasts Permian production to grow to 3.6 MMBOPD by the end of 2019.

Permian basin economic indicators

Production in the Permian basin increased by about 66,000 BOPD between November and December as production expanded to about 2.73 million barrels per day. Today, the Permian basin is producing 29% more barrels per day than in December 2016.

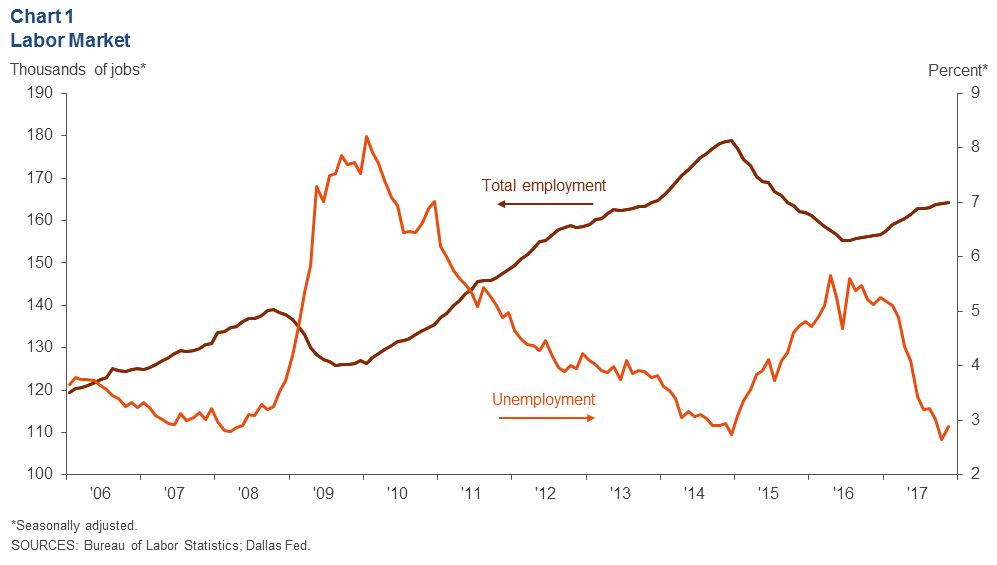

Labor market

Employment in Midland–Odessa grew to 164,200 in November. November’s reading brings year-to-date annualized employment growth to 5.3%—an improvement from the 3.2% decrease in employment in 2016. The recently released fourth quarter Dallas Fed Energy Survey pointed to expanding employment and employee hours, but the growth was concentrated in oilfield services firms.

The unemployment rate in the Permian Basin ticked up to 2.9% in November. The unemployment rate in Midland–Odessa remains well below the Texas rate of 3.8%.