Flatbed truckload operators have been unprofitable for most of 2019

Oil & Gas 360 Publishers Note: We have been watching the Oil Field Service (OFS) take serious losses due to the investor demand for short-term returns. Investors are calling for less CapEx spending, Free Cash Flow (FCF) and ultimately less drilling. Less drilling is adversely affecting the OFS companies at an alarming rate. More OFS companies will fail in 2020 with a few accidents, insurance rate increases, and overall changes in the market.

Texas-based flatbed and oilfield truckload carrier Fleetwood Transportation hauled its last loads on Tuesday after deciding to shutter operations, citing insurance costs.

SaferWatch reports that the carrier had 252 trucks, 673 trailers and employed 240 drivers. The fleet, based in Diboll, Texas (100 mile north of Houston), primarily hauled building materials and oilfield equipment. The company had been operating for 63 years, having commenced operations in 1956.

The Lufkin Daily News first reported the news on Dec. 17, having received an email tip that the carrier planned to shutter. On the same day, the chairman of the board sent a letter to owner-operators of the carrier, citing the inability of the fleet to secure insurance as the primary reason for deciding to cease operations.

Carriers that have had questionable safety records are struggling to find insurance. Chad Eichelberger, founder of Reliance Partners, a leading provider of insurance services to the trucking industry, said carriers could see insurance rates double or triple in 2020 if they had any accidents with fatalities in the past year.

Eichelberger says a carrier being faulted as the cause isn’t a requirement for rates to jump if there was a fatality in an accident involving the carrier. “Insurance carriers know that if there is a fatality involving a truck, juries will be sympathetic towards the [non-trucking] injured party and may reward damages in the nuclear category regardless of fault.”

[contextly_sidebar id=”gfB28AUUYKXHTpWVeOcZ34BBPYRFhLxF”]

A small carrier with a clean history will pay $5,000-$7,000 in insurance per truck, according to Eichelberger. If a carrier is based in a high-risk jurisdiction, the rate could be 25-30% higher. He lists Louisiana, New York, New Jersey, Florida and California as the highest-risk states. He also suggests that rates in Georgia and Texas are increasing dramatically as payout levels accelerate.

The Truckload Carrier Association’s (TCA) TPP benchmark platform reports that truckload fleets are currently paying $6,800 per truck for insurance. The TPP data is the most reliable fleet costing data in the entire trucking market, providing performance and financial benchmarking of nearly 500 data points per month. TPP fleets feed their monthly operating and financial data into a benchmarking platform that allows them to compare costs between fleets.

In the past two years, the TPP fleets have seen 11% increases in their insurance premiums. According to Chris Henry, who runs the TPP platform on behalf of TCA, the reason the TPP fleets have not seen as dramatic an increase versus the rest of the market is their use of captives.

Captives are effectively insurance companies owned by the companies they insure. A captive lets a fleet self-insure or group insure up to $100,000 per claim. Anything above that is covered by an umbrella policy. The risk is pooled between other carriers in the group.

SaferWatch lists two separate accidents involving fatalities that Fleetwood Transportation was involved in within the past 24 months — both in 2018.

According to transportation attorney Cassandra Gaines, two fatalities for a 260-truck carrier over two years would not be exceptionally high. In her view, other circumstances likely played a role in the carrier’s demise.

The company had two primary lines of business: hauling sand to oil fields and flatbed trucking. Both markets have been decimated in 2019.

Sand is used in oil field fracking operations to blast rocks in hydraulic drilling. Over the past decade, oil drillers hauled sand from hundreds of miles and paid top dollar to get the commodity moved. In the past two years, this business has changed. Oil drillers found local sources of sand and didn’t require it to be trucked from other places. There has also been a shift in investor sentiment toward exploratory oil drilling.

A number of large fleets that were involved in hauling fracking sand and oil field work have shuttered or downsized in 2019, including Stevens Tanker Division, Halliburton (NYSE: HAL) and Schlumberger (NYSE: SLB).

[contextly_sidebar id=”AMK8zT98pns1pS66j6uDoI91o4zn8PCx”]

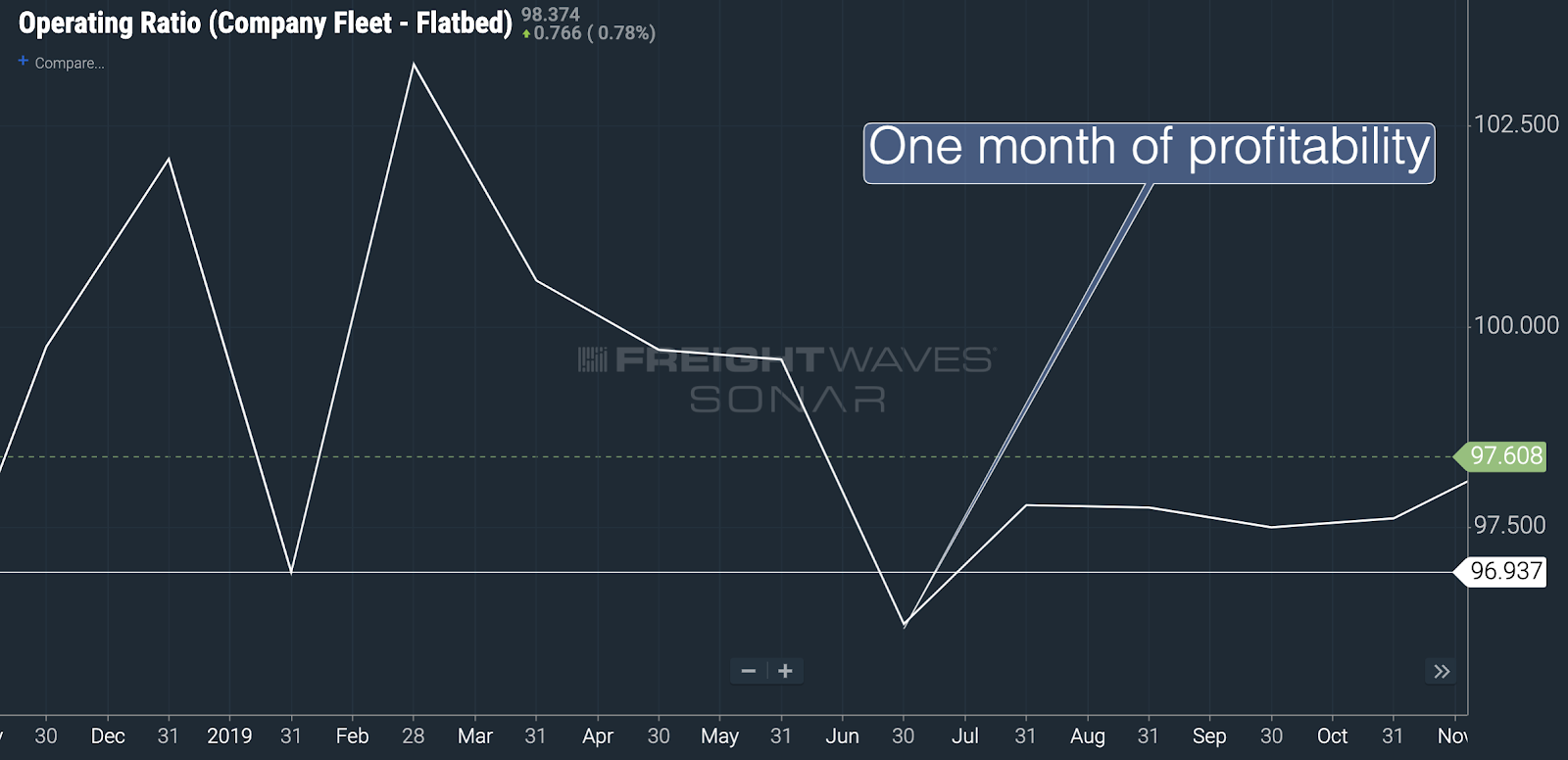

The other core part of their operations involved flatbed truckload services. Flatbed trucking has been struggling for most of 2019, after enjoying a red-hot market in 2018. According to TPP data, the average flatbed operator has been operating in the red all year. Operating ratios (OR), or a measurement of operating profitability, have hovered above 97 for most of 2019. For most truckload carriers, a carrier should generate below a 97 to generate a profit. For the flatbed industry, this happened only one month in 2019, June.

The company was also a party to a class action lawsuit filed against the company in Lake Charles, Louisiana, because the company allegedly failed to pay overtime to drivers. The lawsuit claims that intrastate truck drivers were hired on a per-job or per-hour basis to haul wood chips from a lumber mill to a paper mill. The company did not pay overtime for drivers involved in the runs, even when their work exceeded a 40-hour work week.

Class actions are extremely expensive to defend, even if the company ultimately prevails.

Regardless of the reason for Fleetwood’s decision to close the doors — whether insurance costs, the market or litigation related to the class action labor lawsuit — this case demonstrates the perilous position most trucking fleets have been in throughout 2019.

With new regulations coming and an increase in trucking-related nuclear lawsuits likely to plague the industry for years to come, trucking bankruptcies will remain a never-ending story.

Craig Fuller, CEO at FreightWaves

[contextly_sidebar id=”SQfvo4g8GZS1FpmdfJRTjJmkxtDkDelA”]