$325 million from Model 3 deposits alone

In February of 2016, Tesla Motors announced that the company would soon be unveiling a new model of electric car, the Model 3. The grand unveiling came on March 31st with dedicated Tesla fans lining up at dealerships to preorder the vehicle before it was even officially unveiled.

Biggest one-week launch of any product ever

One week into the ordering blitz, Tesla announced that it has received 325,000 preorders for its recently unveiled Model 3. If it sells every car that’s been reserved, the company says it will earn enough revenue to make this the “biggest one-week launch of any product ever.”

The expectations for the 5-seat, $35,000 electric vehicle were far lower than actual reservations. Tesla said the new numbers are approaching three times the expectations for preorders. This means there are an incredible amount of people out there with desire for an electric car and whole lot of patience, given that the first models won’t be delivered until 2017. The incredibly fast pace of the preorders also brings into question Tesla’s ability to meet the increasingly complex manufacturing goals. Tesla announcement Monday that it was only able to ship 2,400 Model Xs last quarter due to its “hubris in adding far too much new technology.”

$325 million from Model 3 deposits

Assuming Tesla can maintain the manufacturing pace and churn out enough cars to satisfy the overzealous customers anxiously awaiting their car, the company stands to make a large amount of money. Tesla says the number of preorders it has received so far corresponds to $14 billion in implied future sales. The company has raked in $325 million on just Model 3 deposits alone. Fortunately for those more fickle fans, the $1,000 deposit is refundable. However, the $325 million in interest free money will certainly benefit the company in the short term.

March was record month for overall EV sales

In March 2016, more electric vehicles were sold than any month ever, with a total of 13,725 cars sold according to Inside EV’s. Electric cars still comprise a very small portion of total car sales. Compared to total auto sales in the U.S. of 1.59 million cars, electric vehicles comprise less than 1% of total vehicle sales.

In Forbes this week, auto industry commentator Bertell Schmitt wrote that in all his years of covering cars, “I’ve never witnessed such a high number of reservations.” That said, Schmidt said he has his doubts that Tesla will be able to meet expectations, given the company’s poor track record in meeting its orders on time. “Tesla has grappled with production problems many times, even while in boutique production mode,” Schmitt notes.

The Model 3 will be Tesla’s first mass market car – at roughly half the price of the two previous models, the Model S sedan and the Model X crossover. Tesla says, in a blog post announcing the latest numbers, that it views the introduction of its mass-market car is “a huge step towards a better future by accelerating the transition to sustainable transportation.” And it boasts that it was able to generate hype for the Model 3 without advertisements or “paid endorsements.”

Musk communicates sales stats, wow-factor via social media

Elon Musk, Tesla’s charismatic CEO and founder, took to Twitter this morning to announce that only 5% of preorders were for the maximum of two automobiles, which would entail there is little speculation on the automobile for resale.

In a Twitter Q&A, the billionaire CEO said he expects the Model 3 to crack a half-a-million preorders even before “part two” of the car is unveiled later this year. During the second part of the unveiling, Tesla will address the un-finalized steering, “Wait until you see the real steering controls and system for the 3. It feels like a spaceship,” Musk said.

EV’s and Oil Demand – Market Commentary by Jeb Armstrong

Electric vehicles are coming. By itself that statement is not in dispute. Oil investors already understand this. What matters is when EV market share gets to a size that it begins to dent oil demand. And that, as Hamlet pondered, is the question. Granted, Hamlet was pondering the existentialist dilemma of whether to be or not as opposed to EV market share, but there is a connection.

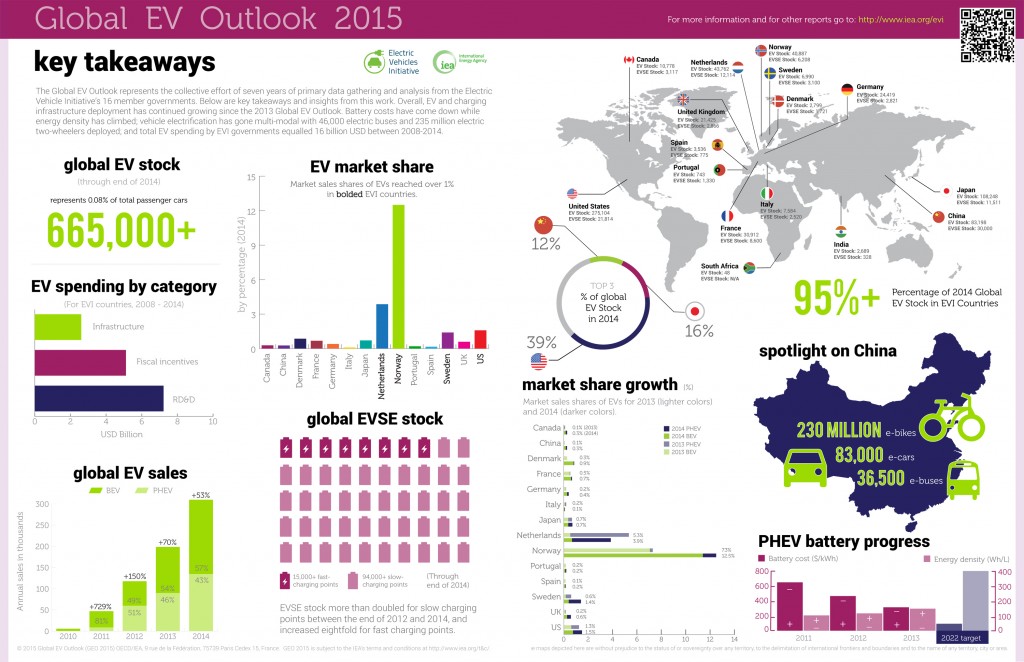

The conversation about electric vehicles so far seems to be focused on their minuscule market share. In 2015 EVs comprised 0.4% of the US new car market. EVs, plug-in hybrids, and regular hybrids in total accounted for only 2.9% of new car sales in the US. This is down from almost 4% in 2013. In contrast SUV & crossover sales grew by 30% 2013-2015 to 35% of the market. Also, total miles driven grew 5.5% to 3.15 trillion miles, setting a new record. 2014 was a record as well, sneaking past 2007 by 0.3%. It should come as no surprise that all of this is directly related to the obliteration in the price of oil. So, the long and the short of it is that EV sales could double or even triple and still hardly dent domestic oil demand.

Over the next 24-36 months, that’s probably all we’re going to see. If you’re trading E&P stocks, or even if you have a longer investment horizon, that’s really all you need to know.

However, if you’re an E&P executive or a private equity investor looking to deploy several billion dollars, the outlook is far less benign and far more impactful. Arguably, the world may be looking at one final oil bull market. It may last well into the next decade, but then it’s all over. For oil, it’s late June 1944; there’s a long way to go, but the outcome is fairly certain.

2016 is the year viable mid-market EVs emerge. GM has already unveiled the 2017 Chevrolet Bolt. This month Tesla is set to open the kimono a bit on its Model 3 project. Both will be on sale in earnest in 2017, the Bolt by the end of this year. These cars have two key points in common. Firstly, the MSRP after tax credits will be in the range of $30,000. Secondly, they will have a range in excess of 200 miles. The combination of these two features will greatly expand EV market share. Up until now EVs were either hideously expensive or had a very limited range. People buying Tesla’s Models S and X can probably afford a fleet of vehicles to meet whatever need they face. They were the only ones who could make an EV work. For the rest of us one car has to do pretty much everything.

The 200-mile range is a significant benchmark, much more so than 100 miles, or even 300 miles, for one simple reason. It’s about as far as most of us will drive in a day. Give or take 25 miles, 200 miles is the distance between San Francisco and Lake Tahoe, Denver and Aspen, Boston and Stowe, New York City and Stratton. As long as your destination has a charging port, you know you can drive your EV to almost any weekend retreat you could realistically imagine. Granted, there is still a lot of uncertainty. The technology is still new; there’s plenty that could go wrong. However, progress and innovation are not static. They might not move in a consistently linear function with time, but they seldom move backwards. EVs will only become more reliable with more range at a lower price.

Hybrids and plug-in hybrids have provided an important technological bridge to the viable 100% electric car. The purchase of an alternate fuel vehicle is not an entirely economic one. Neither is buying a BMW or a Porsche for that matter. Concern over climate change and CO-2 emissions, whether warranted or not, are a significant driver in many people’s decision making. An EV does not need to necessarily save money over the life of the car; it simply needs to be a viable option. Hybrid sales appear to be in terminal decline. EV sales are ramping, but from a small base. That means total market share for the group will likely continue to fall for the next two+ years. Probably around 2020 market share will start to set new highs and could surpass 10% by 2025. That’s likely the point where oil demand begins to falter.

For an oil & gas investor a decade might as well be a century. For a management team it might as well be tomorrow. Given that producers continue to sport ten years of proved reserves even with the collapse in the price of oil, and given that many producers trade at a substantial premium to their proved PV-10 values, it stands to reason that much of a company’s value lies in the resource potential that won’t get touched until well after year ten.

If EVs do leap in popularity and grab substantial market share, the risk grows that the value of that long term resource may end up being severely constrained. As a senior executive, you have a choice, lock in that value in the next couple of years or risk its potential dissolution. And that is a choice that most certainly matters to investors now.

Jeb Armstrong is an independent energy analyst with more than a dozen years of experience on the sell-side – Editor

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.