Gazprom Starts Development of Giant Kharasavey Gas Field

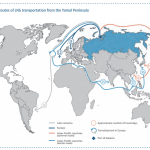

From S&P Global Platts Yamal-based field holds some 2 Tcm of gas First Kharasavey production expected in 2023 London — Russia’s Gazprom on Wednesday began the “full-scale” development of the giant Kharasavey gas field on the northern Russian Yamal peninsula as the company continues to shift its production base northward. Kharasavey — estimated to hold 2 trillion cu m of gas