Aramco, Lebanon, Gulf Oil: A guide to Middle East risks in 2020

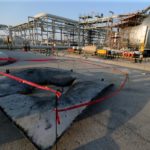

Houston Chronicle If 2019 was the year when a clutch of Middle East markets burst into the mainstream, then 2020 will test whether the foreign money keeps flooding in. The year opened with five Gulf Arab economies joining JPMorgan Chase & Co.’s emerging-market bond indexes. The spotlight stayed firmly on the region as Saudi Aramco’s $12 billion international bond debut