Chevron and Noble Midstream Partners LP complete merger transaction

Chevron Corporation (NYSE: CVX) (“ Chevron ”) and Noble Midstream Par…

Chevron Corporation (NYSE: CVX) (“ Chevron ”) and Noble Midstream Par…

Simplifies governance and corporate structure Enables further integration i…

More than $185 million in Free Cash Flow 1 Expected in 2021 Noble…

Chevron Corporation (NYSE: CVX) announced today that it has submitted a non-binding pro…

Houston Chronicle Six pipeline operators have cut a combined $1.9 billion from their 2020 budgets as record low oil prices and weakened demand from the coronavirus dampens plans for new projects, a new research note from Houston energy investment banking firm Simmons Energy reported. Noble Midstream Partners, Rattler Midstream, Targa Resources, EnLink Midstream, Oneok and Pembina Pipeline made the

Oil and Gas 360 Noble Midstream Partners LP (NASDAQ: NBLX) (the “Partnership” or “Noble Midstream”) announced that Robin H. Fielder was appointed President and Chief Operating Officer of Noble Midstream and Senior Vice President, Midstream, of Noble Energy, Inc. (NASDAQ: NBL), effective January 13, 2020. She will report to Brent Smolik, the Partnership’s CEO, who is also President and Chief Operating

Crude, NGL, Natural gas pipeline ownership changing By Richard Rostad, analyst, Oil & Gas 360 Several Permian midstream assets changed hands today, changing the landscape for producers that are only now seeing relief from the punishing differentials of 2018. EPIC Midstream, which is building a crude and NGL pipeline transporting production from the Permian to the Gulf, has seen ownership

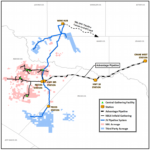

Noble Midstream Partners LP (ticker: NBLX) announced on Tuesday that it has entered into a letter of intent with Salt Creek Midstream LLC to provide infield gathering infrastructure in the Delaware Basin. The goal is to establish a strategically located asset in the Delaware Basin, and to expand intermediate crude and oil infield gathering, extending into the Advantage Pipeline System.

Noble Midstream Partners receives more than anticipated for IPO Noble Energy (ticker: NBL) announced a public offering for its MLP subsidiary Noble Midstream Partners (ticker: NBLX) last week with the hope of garnering an offer price between $19.00 and $21.00 roughly 10 months after the company postponed an IPO of the same assets. Today, Noble announced that it received $22.50

Noble Energy sites weak markets Houston-based Noble Energy (ticker: NBL) announced today that it will postpone an IPO of its wholly owned subsidiary Noble Midstream Partners, which the company planned to list on the New York Stock Exchange with the ticker NBLX. According to Noble, the company made the decision “as a result of unfavorable equity market conditions.” Noble said

Sign up to receive daily news and stock prices from Oil & Gas 360® directly in your email inbox.

Market Data ©2020–2024 QuoteMedia. Data delayed 15 minutes unless otherwise indicated (view delay times for all exchanges). RT=Real-Time, EOD=End of Day, PD=Previous Day. Market Data powered by QuoteMedia. Terms of Use.