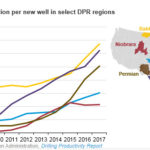

U.S. crude oil production efficiency continues to improve

EIA U.S. tight oil production increased in 2017, accounting for 54% of total U.S. crude oil production, in part because of the increasing productivity of new wells. Since 2007, the average first full month of oil production from new wells in regions tracked by EIA’s Drilling Productivity Report (DPR) has generally increased. These growing initial production rates have helped tight oil production

Anvil Capital Partners Provides Funding for Two Companies

By Tyler Losier, Energy Reporter, Oil & Gas 360 Vermilion Cliffs Partners gets $11 million senior secured loan facility On Monday, Anvil Capital Partners, a private credit special situations lending firm, announced the final close of an $11 million senior secured loan facility to Vermilion Cliffs Partners. According to Anvil, the funds will be utilized by Vermilion to support the

U.S. Shale Oil Output to Rise to Record 8.77 Million bpd in Sept – EIA

From Reuters U.S. oil output from seven major shale formations is expected to rise by 85,000 barrels per day (bpd) in September, to a record 8.77 million bpd, the U.S. Energy Information Administration forecast in its monthly drilling productivity report on Monday. The largest change is expected in the Permian Basin of Texas and New Mexico, where output is seen

Devon Energy: Q3 was an ‘Inflection Point’ in the STACK

Devon sees STACK as its second-highest funded asset in 2019 PRB is the “best emerging growth opportunity in North America” Oklahoma-based Devon Energy Corporation (ticker: DVN) reported its Q3 2018 results Tuesday. On the call, Devon President and CEO Dave Hager gave good insight into the company’s STACK developments in Oklahoma. “Beyond the Delaware, the STACK and Rockies will also

EOG on a Roll: 9500 Locations, 40 Rigs, 20 Frac Spreads, 720 Planned Completions for 2018

EOG Resources (ticker: EOG) reported its Q3 results Thursday, and held its earning call today. Highlights from the Q3 Results include: Raised 2018 Capex Guidance Range to $5.8-$6.0 billion. Third quarter 2018 net income of $1.2 billion, or $2.05 per share. Q3 operating revenues/other of $4.8 billion. To read the complete earnings release, please refer to this link. Heard on the call Chairman

Newest Push in the Permian: LNG in the Oilfields

Micro LNG plants opens way to truck natural gas to oilfields From Bloomberg It’s abundant, cheap and may slow down need to burn gas off. It’s called micro LNG, and the concept is simple. By super-cooling natural gas, they can pack three times more of it into a truck, which may help the Permian Basin deal with its growing gas

SandRidge Energy, Inc. Confirms Production in the Niobrara, Drills First Meramec Well in Oklahoma.

On November 1, 2017 SandRidge Energy, (ticker: SD) announced third quarter financial and operational results. Highlights Confirmed All Four North Park Basin Niobrara Benches (A, B, C and D) Productive Achieved $0.5 Million D&C Capital Reduction on North Park Niobrara Two-Mile XRLs Spud Initial Wells Under NW STACK Drilling Participation Agreement Confirmed Meramec/Osage Stacked Pay in NW STACK Spacing Test

Carrizo Oil & Gas Builds the Eagle Ford, Pursues New Potential in Delaware Acquisition

Carrizo Oil & Gas (ticker: CRZO) sports over 160,000 net acres across the Eagle Ford, Delaware basin, and Niobrara—with an inventory of over 2,000 net horizontal drilling locations. The company also has non-core assets in the Marcellus and Utica formations. The majority of the company’s acreage is in the Eagle Ford at approximately 103,300 net acres with over 1,200 net

PetroShare Corp. Spools Up Activity in the Wattenberg

With a pure-play focus in the Niobrara and Codell formations in the Wattenberg field, PetroShare (ticker: PRHR) holds approximately 9,900 net acres in northeastern Colorado. Petroshare has divided its focus between its Todd Creek Farms acreage and its Buck Peak Prospect. Both locations target oil and gas—with the Buck Peak displaying potential for coal bed methane and conventional gas production.

Round Two: OPEC vs. U.S. Shale

OPEC will meet to decide on further production cuts next week, but will their efforts be ruined by the power of U.S. shale producers? OPEC has been restraining production since the beginning of the year, after a group of cartel members teamed with Russia and other non-OPECs and agreed to production cuts last November. In total, the OPEC group targeted production

Nighthawk Energy: Production and Water Flood Update

Nighthawk Energy (ticker: HAWK) announced an update to current production levels, water flood injection wells, hedging and Rule 9 waiver. Production Update The Company’s production continues to remain strong through the first ten months of 2016. The effects of a natural water drive in the Arikaree Creek field, along with the efforts from the production operations team, have kept 2016 production