Husky adding $100 million to Deep Basin, Montney Programs

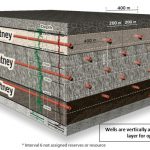

From JWN Energy Husky Energy is accelerating spending on drilling in the Deep Basin and Montney plays while slowing primary heavy oil production. The shift is tied to the current blowout in the light-heavy oil differential, executives said last week. Husky has increased its capital spending guidance by $200 million, $100 million of which will be directed to increased