Earthstone Energy Makes $950 Million Acquisition of EnCap Portfolio Company

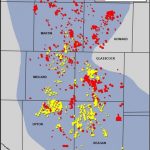

Earthstone Energy (ticker: ESTE) has entered into an agreement with Sabalo Holdings, LLC in which Earthstone will acquire all of Sabalo Holdings’ interests in Sabalo Energy, LLC and Sabalo Energy, Inc., whose assets include both producing and non-producing oil and gas assets in the northern Midland Basin. Sabalo is a privately-held oil and gas company based in Corpus Christi, Texas