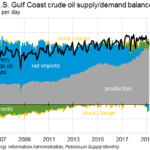

U.S. Gulf Coast Crude Oil Imports at Lowest Level Since 1986

Domestic production has reduced imports approximately 83% since peak As of March of this year, the EIA estimates that the United States Gulf Coast imports approximately 1.8 million barrels of crude oil per day (BOPD), the lowest recorded rate since 1986. The highest recorded rate of imports occurred in Mach of 2007 when the average was approximately 6.6 million BOPD.