Equinor Snatches GOM Asset from Delek’s Outstretched Hand

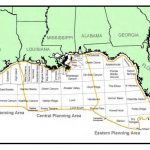

Expands Caesar Tonga interest By Richard Rostad, analyst, Oil & Gas 360 Equinor (ticker: EQNR), formerly Statoil, announced several moves this week, expanding its offshore activities in both the GOM and North Sea. On Monday Equinor announced it has exercised its option to expand its interest in the Caesar Tonga oil field, a major oil play located in offshore Louisiana.