EQT Records $2.3 Billion Non-Cash Impairment Charge

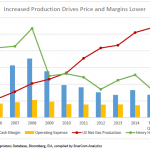

EQT Corporation (ticker: EQT) reported a net loss of income attributable to EQT of $1,586 million, or $(5.99) per diluted earnings per share. The net loss attributable to EQT for the first quarter of 2018 was impacted by an impairment charge of $2.3 billion associated with the Huron and Permian Plays, increases in other operating costs, lower gains on derivatives