Matador closes $1.6 billion Delaware basin acquisition from EnCap

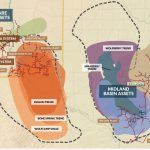

World Oil (WO) – Matador Resources Company announced the closing of its wholly-owned subsidiary’s previously-announced acquisition of Advance Energy Partners Holdings, LLC (“Advance”) from EnCap Investments L.P., including Advance’s oil and natural gas producing properties and undeveloped acreage in Lea County, New Mexico and Ward County, Texas (the “Advance Transaction”). The consideration paid upon the closing of the Advance Transaction