EnerCom Conference Presenters will Outline Permian Economics

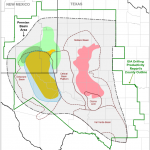

The Permian Basin, the gift that keeps on giving—from an oil and gas standpoint—has spent the last few years as the site of numerous producers’ core acreage. In many instances, lower oil prices and the relative volatility of the oil and gas market has pushed operators onto acreage that they consider bomb-proof as far as oil prices are concerned. The