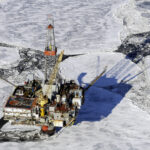

EIA forecasts Alaska crude oil production will grow in 2026 for the first time since 2017

(World Oil) – In its March 2025 Short-Term Energy Outlook, the U.S. Energy Information Administration (EIA) forecast crude oil production in Alaska will increase by 16,000 barrels per day (bpd) in 2026 to 438,000 bpd after remaining relatively flat in 2025. Two new oil developments in Alaska — the Nuna and Pikka projects — are expected to boost crude oil