Advantage Oil & Gas Reports 2017 Profit of $95 Million

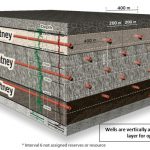

Advantage Oil & Gas Ltd. (ticker: AAV) reported a net income of $95 million for 2017, or $0.51 per share. The company said that the liquids rich wells at Wembley and Progress in Alberta contributed to this positive net income. In Q4 2017, net income was $21.4 million, or $0.12 per share. Making progress at Wembley, Valhalla and Progress Advantage’s