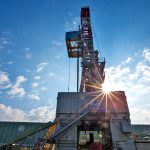

Oil and gas upstream M&A deal value hits highest Q1 levels since 2017

Nasdaq An ongoing consolidation in the U.S. shale industry has driven up global M&A deal value in the oil and gas exploration sector to its highest first-quarter level in seven years, industry experts said. Deals worth more than $55 billion have been announced in the first two months of 2024, according to analytics firm Enverus, as publicly traded companies take