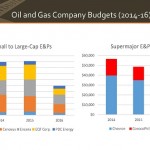

Oil and Gas Spending Cuts Already Apparent for 2016

The year over year drops in 2015 capital expenditures were significant, but apparently not significant enough. Budgets for 2016 are trickling onto the newswires, and some of the largest companies in the business are pulling back on costs yet again. Heavyweights like Chevron (ticker: CVX) and ConocoPhillips (ticker: COP) are reducing capital but abiding to their dividends; other debt-laden E&Ps