Synergy Resources (ticker: SYRG), a small-cap exploration and production company based in Colorado, posted net income of $4.7 million ($0.05/share) in its Q2’15 results for the period ended February 28, 2015. Production averaged 7,745 BOEPD for the quarter – a 98% jump compared to volumes from Q2’14. Total revenues of $23.7 million were an increase of 3% compared to the quarter from the previous year, and were offset by a reduction of 48% in the company’s realized sales price per BOE.

Operations Update

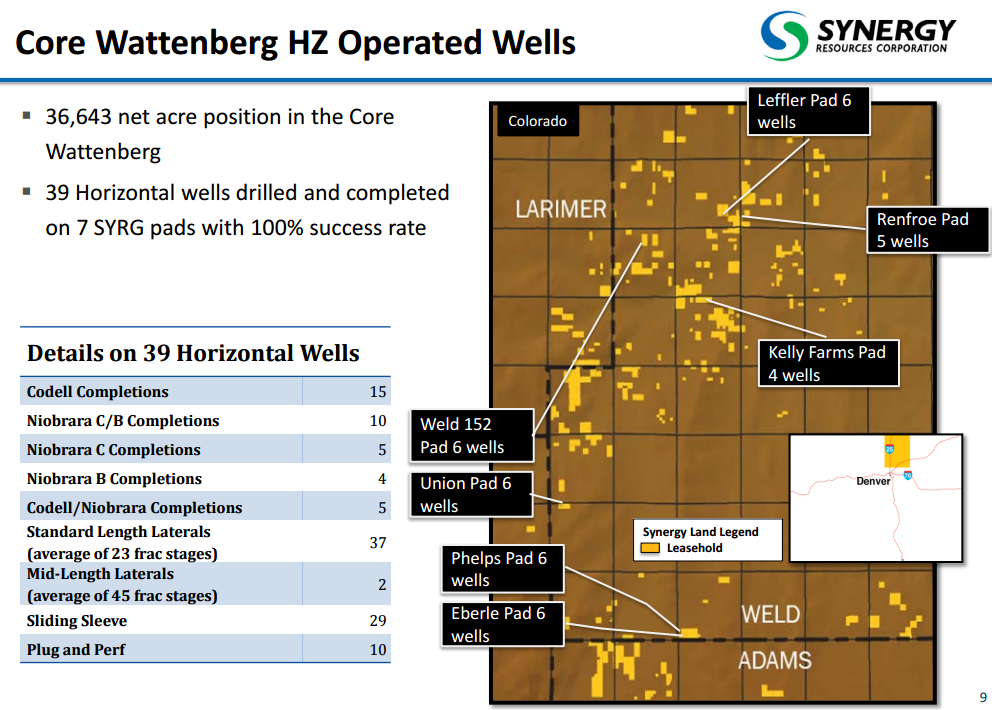

Synergy Resources is focused exclusively on the Denver-Julesburg (DJ) Basin and has amassed a land position of 446,000 gross (313,000 net) leased acres in four states. The company has identified 1,060 horizontal drilling locations and currently operates 39 gross producing horizontals in the Wattenberg. An additional 40 operated wells were either being drilled or in the process of completion at the end of February. Approximately 60% of its proved properties are undeveloped, according to information from EnerCom’s E&P Weekly for the period ended April 2, 2015.

Synergy expects volumes for Q3’15 (ended May 31, 2015) to range from 8,000 to 8,600 BOEPD, representing a quarter-over-quarter increase of 7% at its midpoint. SYRG management expressed confidence that all 40 wells currently being completed will be online by the end of fiscal 2015 (August 31, 2015) and elevate production volumes to 13,000 BOEPD, which would represent respective increases of 68% and 121% compared to Q2’15 and Q4’14.

Management is also waiting on results from its position targeting the Greenhorn formation in the northeast Wattenberg. “The results we get on our Greenhorn could really alter our direction for 2016,” said Ed Holloway, co-Chief Executive Officer. Holloway also denied hearing from other E&Ps about the potential of the formation. He said: “That chatter isn’t coming our direction. We’re trying to find out, everyone’s keeping tight lipped on it. All we do know is [Noble and Anadarko] each has three tasks going. We still haven’t got any information, we think we possibly will be able to share data. We’re going to reach out to do that and see what they’re coming up with. But, that’s our goal, but to date we’ve had zero information from either one of the operators or public information.”

The Details

Synergy management said it has set a company goal of lowering well costs to $2.5 million apiece, down from current Wattenberg well costs of $3.1 to $3.5 million. Drilling days have declined to less than 10 per well and involve 22 stage completion utilizing sliding sleeves. Holloway described operations in the call: “The variable is sliding sleeve versus plug-and-perf, but also a Codell versus the Niobrara. The Codell is a little less expensive with the completion of the slick water, and we’re again liking the hybrid gel frac in the Niobrara.”

Approximately 75% of wells completed to date have employed the sliding sleeve method.

Craig Rasmuson, Chief Operating Officer, admitted that takeaway capacity has been a challenge, particularly in the northern section of the play. However, DCP Midstream plans on completing its Lucerne II Plant in May and will increase total takeaway capacity by 33% to 800 MMcf/d. Synergy plans on placing some of its wells online in the same time frame.

“Besides Lucerne II, one of the things we’re even more excited about is the Grand Parkway that DCP is going to be installing,” said Rasmuson. The fee-based gathering system is expected to come online by late 2015 and will further alleviate capacity constraints in the area.

Balance Sheet

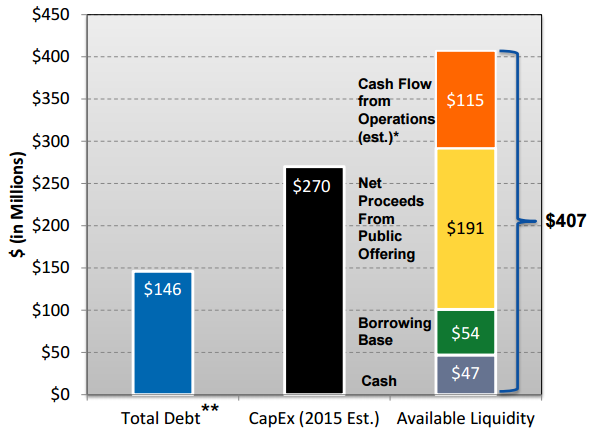

Synergy has a reputation for developing its assets without building considerable debt, and the cash-conscious company has managed to stave off the significant value declines that have hit the oil and gas industry since the commodity decline. In EnerCom’s E&P Weekly, Synergy’s 6% debt to market cap percentage ranks third among its 87 peers. SYRG is one of only six companies on the Weekly who can say their stock has appreciated in the last six months.

The company raised $190.7 million in net proceeds from an equity offering that closed on February 2, 2015, with the intentions of paying down indebtedness or purchasing assets. Holloway described acquisition opportunities as “rich” in the conference call. “The opportunities are coming to us… We expect there to be activity in that regard this year,” he said.

Its reported cash and cash equivalents equal $218.5 million, and $46 million of available liquidity remains on its $192 million credit facility, which carries an interest rate of just 2.5%.

“This quarter’s financial results reflect the benefits we are reaping from maintaining a keen eye on controlling costs as we achieved a 63% operating cash margin on revenues in the quarter, even while commodity prices were falling,” said Monty Jennings, Chief Financial Officer of Synergy Resources. “The strength of the balance sheet and low cost of our debt positions the company to grow its asset and production with cash on hand and free cash flow from operations.”

A note by Stifel believes SYRG will continue to increase volumes and decrease well costs, while maintaining a balance sheet that was referred to as “best-in-class.” Management said it expects to release its reserve report and borrowing base redetermination sometime in May.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.