Synergy Resources Corporation (ticker: SYRG) is a domestic oil and natural gas exploration and production company with 392,000 gross (286,000 net) acres under lease. Synergy’s core area of operations and all of its production comes from the Denver-Julesburg Basin, which encompasses Colorado, Wyoming, Kansas and Nebraska.

Synergy’s horizontal program, initiated in May 2013, doubled the company’s revenue and production on a year-over-year basis. In its fiscal Q2’14 earnings release, SYRG announced 111% increases in both quarterly revenue ($23 million from $10.9 million) and operating income ($9.5 million from $4.5 million) compared to Q2’13. Production for Q2’14 also jumped by 90% compared to Q2’13 (3,917 BOEPD from 2,067 BOEPD) and is approximately 58% liquids.

Operating the Wattenberg

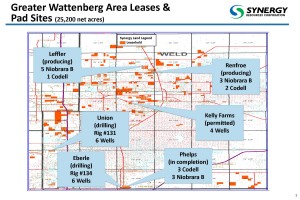

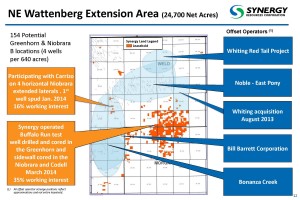

Synergy is developing its Wattenberg acreage through a two rig system – the second of which joined the fleet in January 2014. The company is currently focusing on four potential formations (the Codell and the Niobrara A, B and C benches) and estimates the region holds 630 to 945 potential locations. Two deeper formations (Greenhorn and J-Sand) are considered possibilities for future development.

As of the end of February 2014, SYRG operates 11 horizontal well and has interest in an additional 26 producing horizontal wells (4.2 net). The company is currently drilling eight more operated horizontals (eight net) and 10 non-operated wells (0.75 net).

Synergy will continue its horizontal program to exploit other formations such as the Greenhorn, management said on a conference call following the release. Vertically drilling these other formations is deemed less feasible due to the resource thickness and possible contamination of the laterals involved with horizontal drilling.

Horizontal Program Expanding

SYRG’s horizontal program is in its infancy. In an operations update on March 26, 2014, SYRG confirmed the first of six horizontals on its Eberle pad had spud. The Phelps pad was completed in March and production is expected in May 2014. Two other core areas, the Renfroe and Leffler pads, are finished and in various stages of production. The five Renfroe wells in service are currently producing 1,250 BOEPD (68% oil) six months after going online. The Leffler has six wells in production with a total average of more than 1,800 BOEPD after 30 days online.

In its conference call, Synergy said its reserve base is being evaluated by a third party and results are expected within 30 to 60 days.

Financial Update

SYRG’s aggressive drilling program has resulted in the expansion of its reserve base and, more importantly, its credit facility. At year end 2013, SYRG’s credit facility was increased to $300 million with a borrowing base of $90 million– double the amount of its initial credit facility of $150 million from July 2013.

The company plans on drilling a total of 34 operated horizontal wells in fiscal 2014 at an estimated price of roughly $3.7 million per well. The cost is significantly lower than SYRG’s original estimated price of $4.5 million per well. The company’s total expenditures for the year is $189 million and is expected to be funded through cash flow, cash from operations and availability from its credit facility. As of the end of Q2’14, SYRG held $54.4 million in cash equivalents and $37 million borrowed under its line of credit.

Neighboring Operators Reveal Upside

Two companies, Noble Corporation (ticker: NBL) and Bonanza Creek Energy (ticker: BCEI), are operating nearby and plan to increase Wattenberg development in 2014.

Bonanza Creek is testing 40-acre downspacing opportunities in the Codell formation and its extended laterals have produced consistent returns. Two of its three 9,000 foot laterals increased in rate through 60 days and are still producing at an average 90-day rate of 622 BOEPD. BCEI has a total of 10 wells online targeting the same formations as SYRG, with five focused on both the Codell and Niobrara C. The Codell wells produced a 60-day rate of 422 BOEPD (75% oil) and the Niobrara totaled 425 BOEPD (83% oil) for the same period.

Noble Energy produced an average of 100 MBOEPD from the DJ Basin in Q4’13, bringing online 90 new wells in the process. The East Pony, nearby SYRG’s acreage, produced a 90-day rate of 700 BOEPD from the Codell formation. NBL said eight of ten tested lateral wells showed estimated ultimate recovery of 400 MBOE per well.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.