Synergy will pursue further A&D opportunities in the DJ

Synergy Resources Corporation (ticker: SYRG) announced it has entered into a purchase-sale agreement with a private party to divest 10,000 net undeveloped acres and approximately 700 BOEPD of associated production for $71 million. The divested acres are outside of its core Wattenberg development area in Colorado’s DJ Basin.

The transaction is expected to close in the first quarter of 2017, the company said in a press release.

“The opportunity to strengthen Synergy’s liquidity through monetization of non-contiguous acreage outside our area of planned development further fortifies the company’s balance sheet and helps consolidate our footprint,” said Synergy Chairman and CEO Lynn A. Peterson. “We will continue to pursue accretive opportunities that complement our high quality acreage position as well as divest of properties that are not in our drilling plans over the next several years.”

“Work on the two Evans Pads continues on schedule and we are pleased to have resolved the litigation related to the Wiedeman wells, allowing us to commence completion operations. These developments will help us grow our production and deliver on our 2017 goals.

“The Company exited 2016 with approximately 50% of 2017 guided production volumes hedged for both oil and gas and we will continue to be opportunistic in managing risk. Our industry has started the year with a much better commodity price outlook than in 2016 which, when combined with Synergy’s balance sheet, top tier assets and production growth profile, significantly sets us apart from many of our peers.”

Drilling update

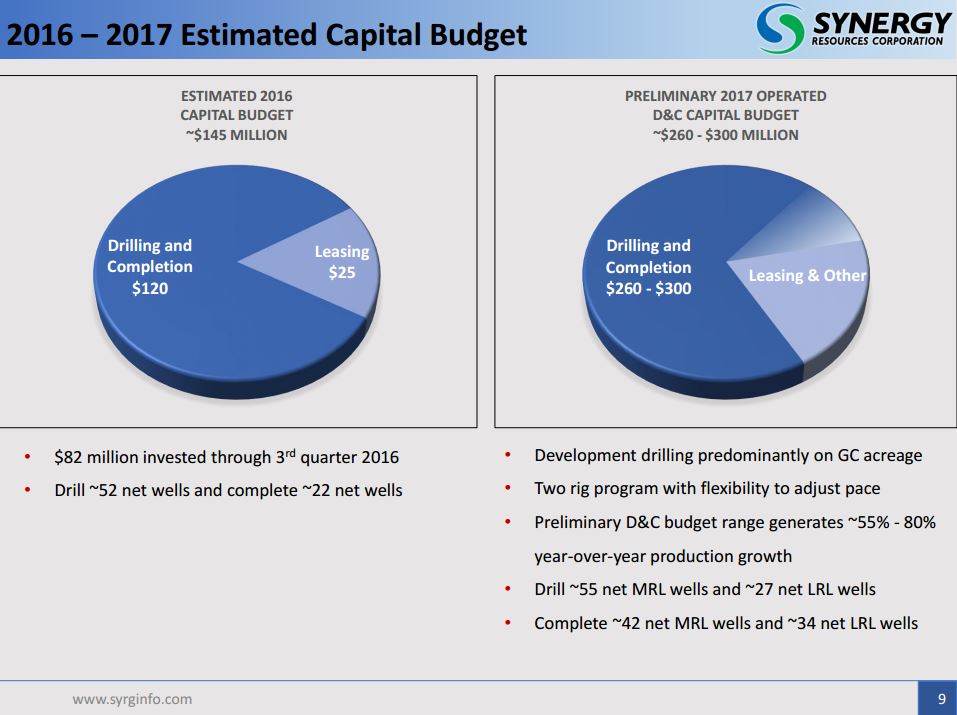

On the operations side, Synergy said it is running two drilling rigs and expects to utilize the rigs throughout 2017, Synergy said in a press release. In late 2016 the company entered into a 1-year term contract for one of the rigs and will maintain the second rig on a pad-to-pad basis. The decision to term out one rig was based on the quality of the rig and management’s goal to de-risk continuity of operations.

Completion update

Stimulation operations on the first tranche of six long-reach lateral (“LRL”) wells on the Evans East Pad have been completed and frac plugs are currently being drilled out with flowback to follow. Stimulation operations for the next tranche of six wells has commenced on the Evans West Pad. All six are extended-reach lateral (“XRL”) wells. Completion operations on the remaining ten wells will follow in two tranches of five wells each.

Synergy reported that it has resolved litigation regarding four standard reach laterals (“SRL”) and four LRL wells drilled during 2014 on the Wiedeman pad, and it has scheduled a second completion crew in late January to commence completion operations on the pad.

Midstream update

Synergy said that it was pleased by DCP’s recently announced plans to expand gathering and processing capacity in the DJ basin. The plan includes a new 200 MMcf/d processing plant (Mewbourn 3) as well as the expansion of the Grand Parkway gathering system, both expected to be completed by the end of 2018. Additional compression and plant bypass infrastructure will add 40 MMcf/d during the summer of 2017 to address shorter term needs. In addition, the producers and DCP have agreed to the framework for an additional 200 MMcf/d processing plant expected to be in service by mid-2019. This additional gathering and processing capacity should significantly reduce the potential natural gas midstream constraints that may arise with increased operator activity in the basin.

Pad summary:

Fagerberg

- 14 gross mid-reach lateral (“MRL”) wells – ~96% WI | 2 Nio A, 4 Nio B, 4 Nio C, 4 Codell

- All 14 wells are producing at pressure-managed rates consistent with management expectations

Evans

- 22 gross – 13 LRL & 9 XRL wells – ~96% WI | 4 Nio A, 6 Nio B, 6 Nio C, 6 Codell

- Stimulation operations completed on the first tranche of 6 wells

- Coiled tubing unit drilling out frac plugs

- Stimulation operations commenced on the second tranche of 6 wells

Wiedeman

- 4 SRL ~65% WI & 4 LRL ~76% WI wells | 3 Nio B, 2 Nio C, 3 Codell

- Completion operations are scheduled to commence in Q1, 2017

Kawata

- 10 gross MRL wells – ~66% WI | 1 Nio A, 3 Nio B, 3 Nio C, 3 Codell

- Drilling operations completed on 8 of 10 wells

- Completion operations are expected to commence in Q2, 2017

Williams

- 9 gross MRL wells – ~100% WI | 3 Nio A, 4 Nio C, 2 Codell

- Drilling operations completed on all 9 wells

- Completion operations are expected to commence in Q1, 2017

Orr

- 12 gross MRL wells – ~95 % WI | 1 Nio A, 4 Nio B, 2 Nio C, 5 Codell

- Mobilizing drilling equipment to site

Orr State

- 12 gross MRL wells – ~93% WI | 1 Nio A, 3 Nio B, 3 Nio C, 5 Codell

- Drilling operations to commence following Kawata Pad rig release

Synergy plans to issue its fourth quarter and year-end earnings release on Thursday, February 23, 2017 after the close of trading on the New York Stock Exchange with a conference call the following day.