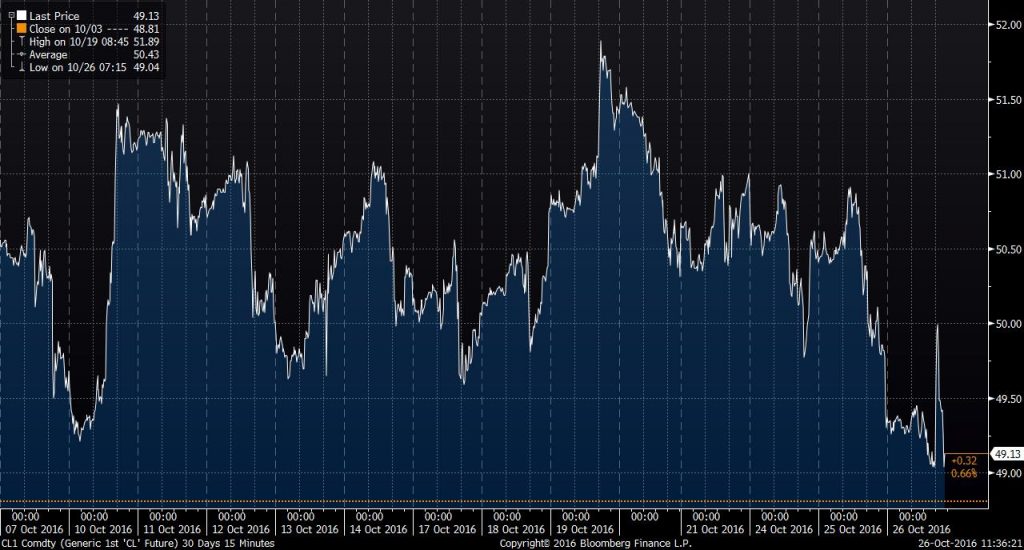

Oil bounces back after official data shows yet another crude inventory draw

Oil prices came back from a nearly 2% decline Wednesday morning following news from the Energy Information Administration that U.S. crude oil inventories fell last week. The oil inventory draw is the seventh time in the last eight weeks that stores of crude went lower despite analysts’ expectations that there would be a build. The EIA reported a draw of 0.6 MMBO for the week ended October 21, 2016, versus an expected build of 4.8 MMBO from industry group American Petroleum Institute.

Both WTI and Brent crude were trading below $50 ahead of the crude inventory report today as many expected bearish news. U.S. benchmark WTI fell to $49.00 per barrel this morning before jumping back to $49.99 on news of the surprise draw.

Iraq says “No Deal”

Adding to the most recent weakness in crude oil prices, the market is beginning to doubt the probability of an actual limit to production being pulled off by OPEC.

Iraq, the group’s second-largest producer, said that it does not want to join in production cuts. Iraq said that data from secondary sources tracking its production are inaccurate, and Iraq also believes that it should receive and exemption from cuts to help offset the expense of fighting the Islamic State.

OPEC says it will exempt Iran, Libya and Nigeria from cuts

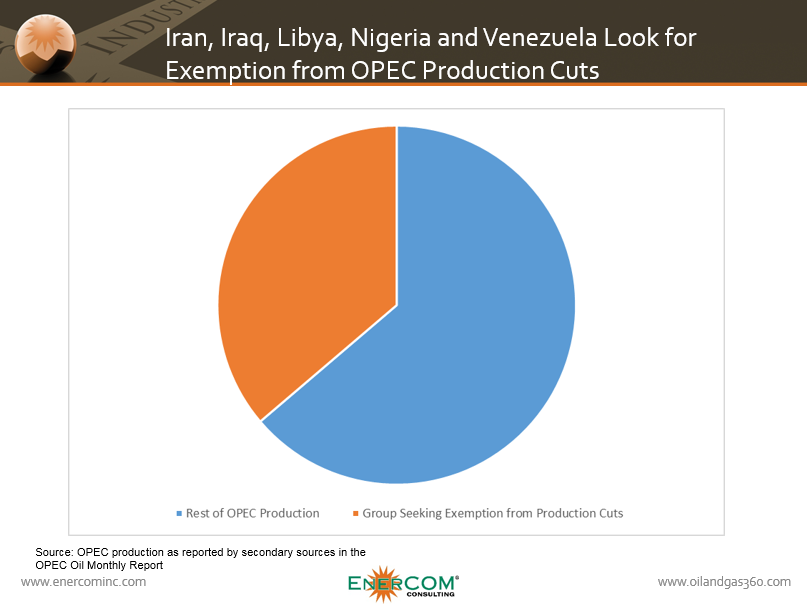

So far, OPEC has said that it plans to exempt Iran, Libya and Nigeria from production cuts as the Islamic Republic recovers from international sanctions, and the other two OPEC members struggle to maintain production amid a civil war and rebel attacks on infrastructure, respectively.

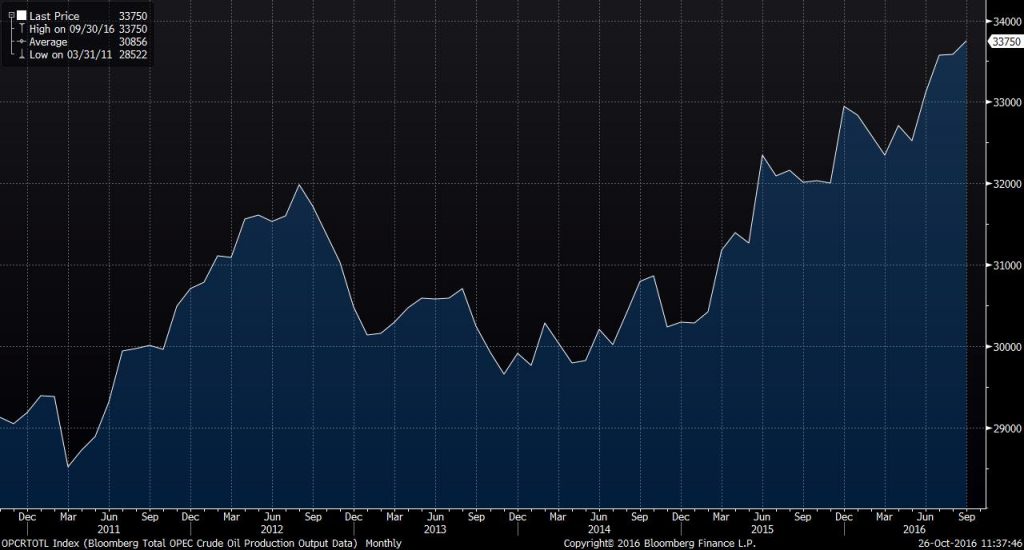

Combined with Iraq, and potentially Venezuela as well, the group of exempt members makes up approximately 12.1 MMBOPD of production, based on the group’s most recent report. With total production of 33.4 MMBOPD in September, the members of OPEC seeking exemptions make up approximately 36% of the group’s total production.

Unless Russia, the world’s largest producer, decides to join in production cuts, the onus will fall on Arab producers in the Middle East, namely Saudi Arabia, Kuwait and the United Arab Emirates. Russia has said that it is willing to freeze production, but a cut seems unlikely with the country’s most influential oil executive, Rosneft CEO Igor Sechin, saying his company will not take part in the deal.

OPEC is expected to finalize its production deal at its next meeting in Vienna November 30.