COS Counters SU Offer by Adopting Shareholder Rights Plan

The board of Canadian Oil Sands (ticker: COS) turned down a $5 billion offer from Suncor (ticker: SU) two days after its initial proposal, offering a shareholder rights program and providing additional insight into negotiations between the two oil sands companies.

The shareholder program is being referred to as a “poison pill” by the investment community, and is a course of action designed to make the hostile takeover more difficult for Suncor. As part of the program, existing shareholders can execute a share purchase right on each share outstanding as of 2:01 a.m. Eastern Time on October 6, 2015. The rights will officially be triggered if anyone buys 20% or more of the company, which will then allow shareholders to buy stock at a “substantial” discount.

Timing is the major issue between COS’ shareholder program and SU’s hostile takeover. In its release, COS says the board and its shareholders will need a minimum 120-day period to consider and review all offers. SU’s takeover bid is set to expire on December 4 – sixty days after the attempt was kicked off. The extended review period also extends the opportunity for competing bids to be made, according to analysts from Bloomberg Intelligence.

Additional details on the shareholder rights plan will be public once Canadian Oil Sands files the report in full with the necessary regulatory agencies.

COS’ Side of the Story

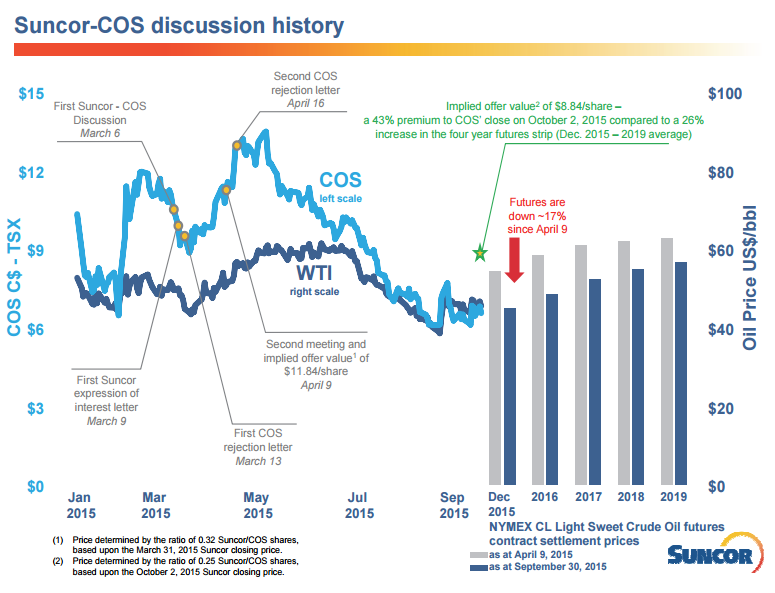

Suncor’s October 5 offensive on Canadian Oil Sands was highlighted by a press release, presentation and even a conference call to highlight the reasoning behind the planned takeover. SU management said it approached the COS board on separate occasions in both March and April but failed to reach an agreement. SU appealed directly to COS shareholders in its recent takeover bid, outlining its perceived beneficiaries of voting in favor of the deal. Cash flow, dividend growth and a stake in Canada’s largest energy company (by market cap) were all presented in an effort to sway COS shareholders in their favor.

Canadian Oil Sands management responded with much more candor today, a much different approach from its October 5 release which simply urged stockholders to take no action. In today’s announcement, COS explained: “Suncor initially approached the Company in March with a letter that contained no offer and provided no basis for further discussions. The Board then received a non-binding expression of interest (the “proposal”) on April 9, 2015, and with the assistance of its financial and legal advisors, the Board carefully reviewed that proposal; it was unanimously rejected for several reasons as not being in the best interests of the Company and its Shareholders and the Board advised Suncor of that decision.”

COS went on to say the latest SU proposal is “substantially less” than the rejected offer of April 2015. Seymour Schulich, a 5% owner of COS, vows to go to court before accepting the offer. He alleges SU’s offer is worth less than half the replacement value of the Syncrude joint venture, of which COS holds a 37% stake. “It’s not a low-ball offer, it’s a no-ball offer,” Schulich said, according to the Financial Post. “The bid is ridiculous.”

ORIGINAL ARTICLE

Suncor Energy (ticker: SU), Canada’s largest oil and gas company in terms of market capitalization (roughly $38 billion), commenced a hostile takeover for Canadian Oil Sands Limited (ticker: COS) on October 5, 2015.

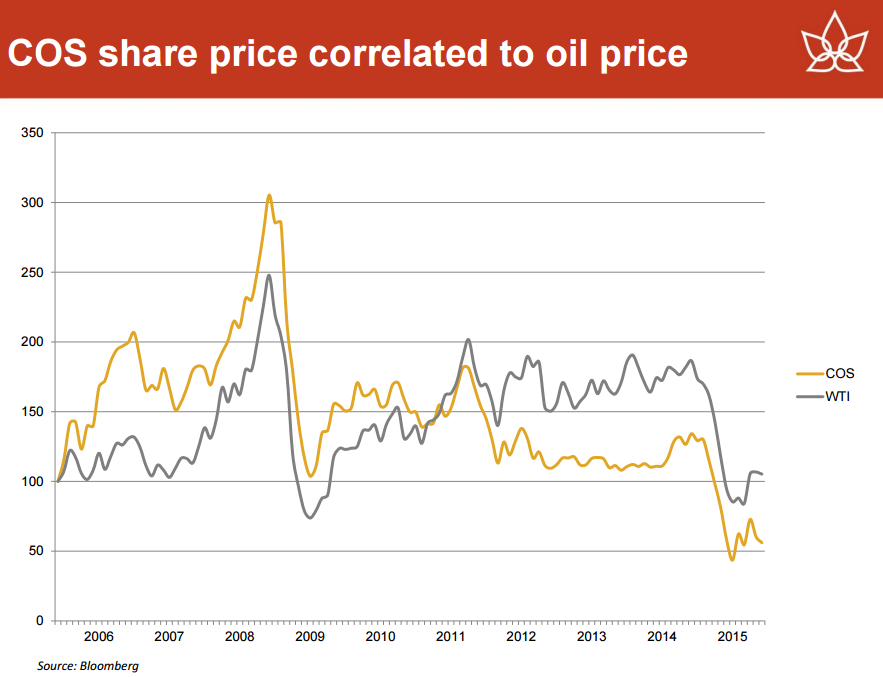

The unsolicited offer values COS outstanding shares at US$3.3 billion (CN$4.3 billion), representing a 43% premium compared to closing prices on October 2, 2015, and a 35% premium on a trailing 30-days share price average. The total value of the deal, including the assumption of existing debt, is approximately US$5.0 billion (CN$6.6 billion).

Shares of COS skyrocketed by more than 50% in day trading, closing above $9.00 for the first time since July 2015.

Canadian Oil Sands Primer

COS is the leading interest holder (about 37%) in Alberta’s Syncrude project, which is Canada’s largest single source producer. Five other companies have a stake in the massive project, including Suncor, who holds 12% ownership interest. In Q2’15, Syncrude averaged production volumes of 207 MBOPD from the oil sands operations and is backed by a non-declining production profile with 4.4 billion barrels of proved and probable reserves. Estimated reservoir recovery is greater than 90%.

Canadian Oil Sands is a pure-play in the Syncrude project, but Suncor, on the other hand, has multiple energy projects scattered throughout North America and overseas. Suncor’s relationship with COS led to speculation that the former could potentially launch a takeover attempt. SU’s footprint on the oil sands market is significant; the company reported Q2’15 volumes of 559.9 MBOPD, with oil sands operations contributing 448.7 MOBPD (about 80%).

Canadian Oil Sands Balance Sheet

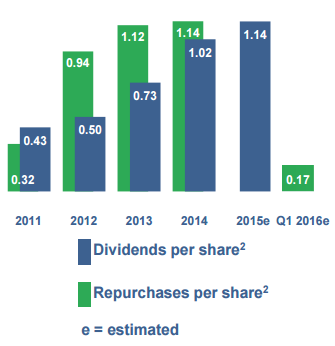

The oil price downturn has squeezed margins for COS, and the company took some significant steps to preserve liquidity in recent months. Its annual dividend allotment of CN$100 million is about 85% less than its 2014 dividend payout total of $678 million, and the company formed a Cost Analysis and Strategy Taskforce to identify potential savings. The identified reductions are expected to save anywhere from $260 to $400 million net to COS and will not impact its forecasted production range.

The company has assured shareholders that its capital expenditures and dividend payouts are secure in the new commodity environment. “Net debt is expected to decline through the balance of the year, now that the major maintenance is behind us, and we have no maturities due until 2019,” said Ryan Kubik, President and Chief Executive Officer of COS. “Our credit facility provides us with sufficient liquidity to weather this period of low oil prices.”

Other growth metrics have slowed, based on data from EnerCom’s International E&P Weekly. Its EBITDA margin of 30% is below the industry median of 53% from 53 peer companies, while its net debt to trailing twelve months EBITDA ratio of 2.7x was above the median of 1.7x.

The company’s net debt, as of June 30, 2015, rose to about $2.3 billion – up about 27% from year-end 2014’s total of $1.8 billion. Oil prices and a weakening Canadian dollar led to the increase, but COS management expressed confidence in near-term liquidity by mentioning the company’s net debt to total net capitalization was 36%.

Suncor’s Case

In a presentation accompanying the announcement, Suncor acknowledged it has been in pursuit of COS since March 2015 and submitted two letters expressing acquisition interest. SU materials released today targeted COS’ liquidity and long-term dividend as inhibitors to its future growth, highlighting SU’s cash flow and industry strongholds as benefits. Canadian Oil Sands cut its dividend by 85% earlier this year to preserve liquidity, even though some analysts believe COS would be better off eliminating dividend entirely.

Accepting the Suncor offer, however, would increase the dividends of COS shareholders by 45% on a per-share basis. Suncor is also in the midst of a shareholder return program that has generated a five year compounded annual growth rate greater than 20%, and a repurchase program that bought back $5.3 billion of shares from 2011 to 2014. Suncor also brought to light its free cash flow superiority ($0.50 per share in H1’15, compared to negative free cash flow for COS) and its credit profile, which received a A- rating (strong) from Standard & Poor’s compared to a BBB- rating (adequate) for COS.

Suncor’s presentation highlighted its expertise in the oil sands industry as a major benefit for the merger, and added the combination would allow SU to escalate its interest in the Syncrude project to about 48%.

COS management responded to the unsolicited offer a few hours after SU’s announcement, saying it will review the process. COS urged its shareholders to take no action at the moment and would make a recommendation “as soon as possible.” If the takeover does in fact take place, COS shareholders will own 7.7% of SU shares as a result.

SU’s offer is open for 60 days and expires on December 4, 2015. A source with Business New Network said the COS board was not going to accept the latest offer, leaving the next step in the hands of the shareholders.