Oil prices see the largest percent gain in six years

The U.S. crude oil benchmark West Texas Intermediate closed today 10.3% higher at $42.56 per barrel. In percentage terms, that is the largest gain seen in WTI prices in one day since March 12, 2009. In dollar terms, it was the largest gain in three years. Global benchmark Brent crude oil saw similar gains today, finishing the day out 10.3% higher at $47.56 per barrel.

The gains came on the back of several factors, including better than expected U.S. economic data, improvements in the Chinese economy, and a 5.5 million barrel draw on crude oil inventories that came when analysts expected a 1 million barrel build.

Bullish U.S. economic data

The Bureau of Economic Analysis released its National Income and Product Accounts Gross Domestic Product report for the second quarter, which the bureau revised up after taking more complete data into consideration. The bureau’s latest estimate for U.S. GDP growth in the second quarter of the year is 3.7%, up from its “advanced” estimate of 2.3% last month.

“The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures, exports, state and local government spending, nonresidential fixed investment, residential fixed investment, and private inventory investment,” read the Bureau’s release today.

GDP growth through the first half of the year averaged 2.2%, in line with expectations, reports The Wall Street Journal. “Despite some sharp swing in the quarterly growth rates, we don’t look for this to change much,” said Richard Moody, chief economist at Regions Financial Corp.

This data will also be used by the Federal Reserve as it considers whether or not to raise interest rates. The most recent data from the Bureau of Economic Analysis is backward looking, however, and does not take into account recent market volatility in China, which has casted some doubt on whether or not the Fed will chose to raise its key interest rate.

China rebounds after closing lower five consecutive sessions

News out of China today indicated that the Shanghai Composite Index rose 5.3%, its first gain in six days. Raw materials with the greatest dependency for demand growth from China saw some of the largest gains today, with copper prices posting their largest gains in percent terms in two years, and sugar prices posting their largest single-day rally in more than a year.

Unexpected inventory draw

Adding to the macroeconomic drivers behind a push higher in oil prices today was a draw on crude oil inventories when analysts forecasted a build. The weekly numbers provided by the Department of Energy showed a draw of 5.5 million barrels of oil for the week ended August 21, 2015. Analysts expected that the DOE would report a build of approximately 986 thousand barrels.

The draw came in response to a 10% reduction in U.S. crude oil imports, according to a note from KLR Group. The U.S. imported about 6.7 MMBOPD last week, continuing a trend of decreasing crude oil imports.

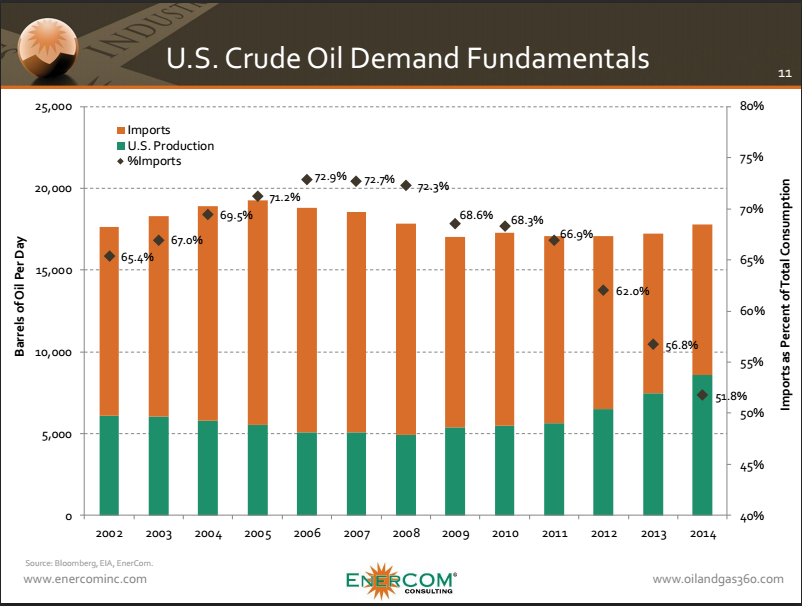

Speaking at EnerCom’s The Oil & Gas Conference 20®, James Constas, managing director at EnerCom, discussed how quickly imports have decreased as domestic production rose. “In 2006 and 2007, we were importing around 73% of our oil. Powered by the shale revolution, that number fell to 52% last year. That’s a pretty dramatic drop.”

The bullish crude oil draw was dampened by lower demand for gasoline and crude distillates, however. Gasoline inventories increased by 1.7 million barrels, while distillate stocks increased by 1.4 million barrels. Analysts expected a draw of 1.3 million barrels for gasoline, and a build of just 900 thousand barrels for distillates last week. Gasoline inventories are currently 1% over last year’s level, while distillate stocks are 22% above last year.

A note from BMO Capital Markets called the news a mixed bag. “The much larger-than-expected crude draw can’t be ignored, but was largely driven by lower imports, while overall petroleum product inventories increased on the back of demand weakness for key petroleum products, namely gasoline and distillates.”

Not out of the woods yet

“Today’s move, while it seems spectacular, is nothing more than short-covering,” said Anuraag Shah, portfolio manager of the $130 million Los Angeles hedge fund Tusker Capital. “It’s people getting washed out.”

Other analysts pointed out that, despite the size of the rebound today, the market has only recovered to the levels it was at a week ago. “Any time you have a rebound like this one or two days after a cataclysmic, broad-based selloff, you have to take it with a grain of salt,” said Katrina Lamb, head of investment strategy and research at asset manager MV Financial. Movement might also have been exacerbated by thin trading in the market, with contract volume less than 30% of recent averages.

CIBC’s Head of Commodities Strategy Katherine Spector, in an exclusive video interview Oil & Gas 360®, said: “We may not be at the lows, but we’re probably near them.”

Light at the end of the tunnel

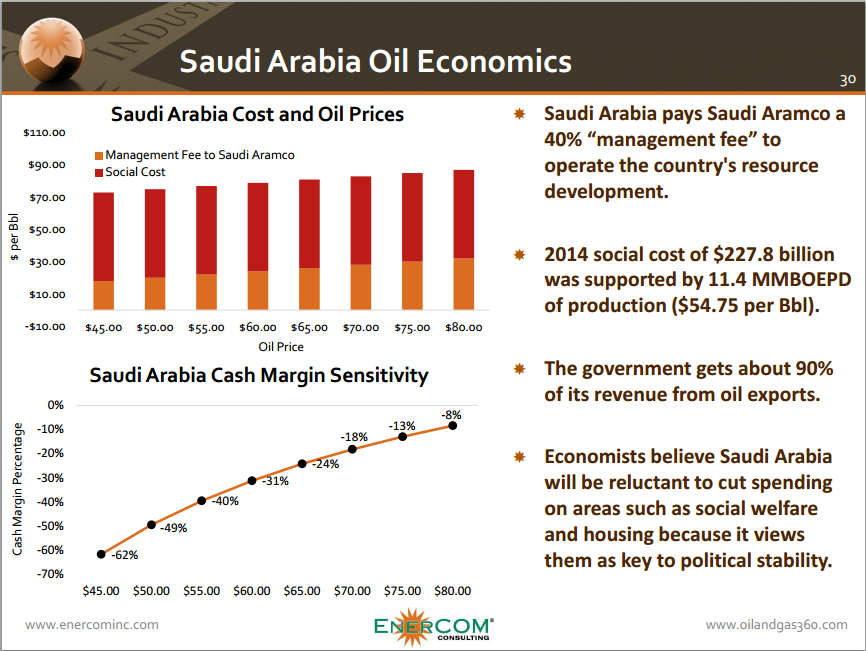

Many are waiting to get their hopes up, with global crude markets still oversupplied and production from OPEC at record highs. Still, with OPEC countries, particularly Saudi Arabia, burning through their sovereign wealth funds at record rates, OPEC may need to reconsider its strategy soon.

During an interview with Oil & Gas 360, Tom Petrie, chairman of Petrie Partners said he believes 12 months is the outer limit Saudi Arabia might be able to continue to lead a strategy of continued production. Already, Saudi Arabia is looking to cut 382 billion riyals ($102 billion) from its government spending in order to soften the blow from lower oil prices, and other members of OPEC are reporting historically large draws from their sovereign wealth funds.

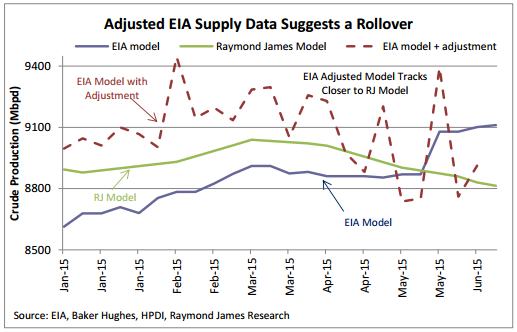

On top of OPEC quickly spending its reserves to support its production, reports point to a production rollover in the U.S. back in March. Estimates made by Raymond James show a 44-year high in U.S. production in March at 9.7 MMBOPD, but that number fell to 9.5 MMBOPD afterwards.

The short term price should also be bolstered by news from Africa today that Shell (ticker: RDSA) declared force majeure on its Bonny Light crude oil exports in Nigeria. Shell said in a statement that it closed the Trans-Niger Pipeline due to a leak and the Nembe Creek Trunkline to repair damage caused by oil thieves.