Stocks fell in volatile trading Friday as Wall Street wrapped up its worst weekly performance since late March. Investors grappled with a slew of economic reports as well as increasing tensions between China and the U.S.

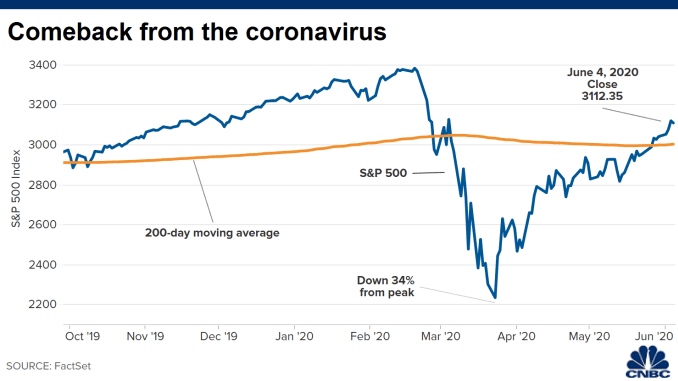

The Dow Jones Industrial Average traded 100 points lower, or 0.4%. Earlier in the day, the 30-stock average dropped more than 260 points. It also momentarily broke above the flatline around 10:20 a.m. The S&P 500 dipped 0.3% while the Nasdaq Composite slid 0.5%.

The major averages clawed back most of their losses as retail stocks turned around. The SPDR S&P Retail ETF (XRT) traded 1.1% higher after sliding more than 1.4% earlier in the session. Office Depot shares rallied more than 15% to lead the ETF higher. Best Buy, Kohl’s and Nordstrom also rose. Walmart traded 0.7% higher while Home Depot advanced 1.1%.

Friday’s turnaround also followed better-than-expected data on U.S. consumer sentiment. The University of Michigan’s consumer sentiment index unexpectedly rose in early May as U.S. fiscal stimulus measures “improved consumers’ finances and widespread price discounting boosted their buying attitudes.”

For the week, however, the Dow and S&P 500 were both down at least 3% while the Nasdaq fell 2.5%. Those would be the biggest weekly losses for the major indexes since the week of March 20, when they dropped more than 12%.

“Given the amount of uncertainty about this crisis that still looms, we should not be surprised by the setbacks we’ve seen in markets this week,” said Scott Knapp, chief market strategist at CUNA Mutual Group.

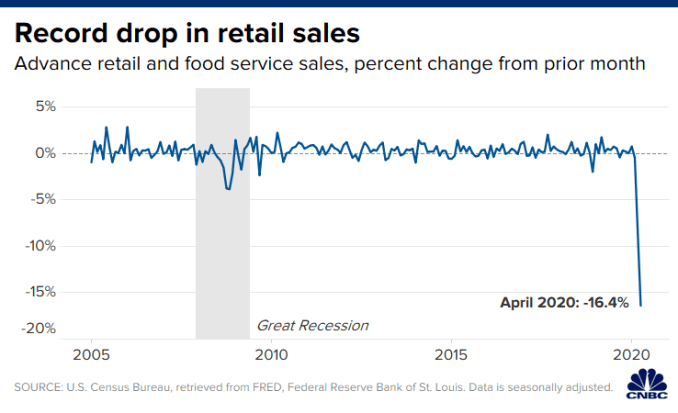

U.S. monthly retail sales fell by 16.4% in April, a record. Economists polled by Dow Jones expected a decline of 12.3%. So-called core retail sales —which exclude auto, gas, food and building materials sales — dropped 15.3%.

“I guess you could say we knew it was weak,” said John Briggs, head of strategy at NatWest Markets. “The problem is you can’t dismiss all this bad news for April. If you have a deeper hole, you’re starting point is lower.”

Stocks initially tumbled on the data. Market sentiment also took a hit amid rising trade tensions between China and the U.S.

The Trump administration has moved to block semiconductor shipments to Chinese company Huawei. The Commerce Department said it would “strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology.”

Meanwhile, Hu Xijin, editor-in-chief of Chinese state-run publication Global Times, tweeted on Friday that China would “restrict or investigate” U.S. companies including Qualcomm, Cisco Systems and Apple if the U.S. takes further action to block Huawei’s supply chain. Hu’s Twitter account was closely followed last year by traders looking for insight on the U.S.-China trade war.

Shares of semiconductor makers AMD, Nvidia and Skyworks Solutions all fell more than 0.8%. Apple shares slid 2.1% while Cisco and Qualcomm fell 0.8% and 5%, respectively.