Johan Castberg will cost $6 billion

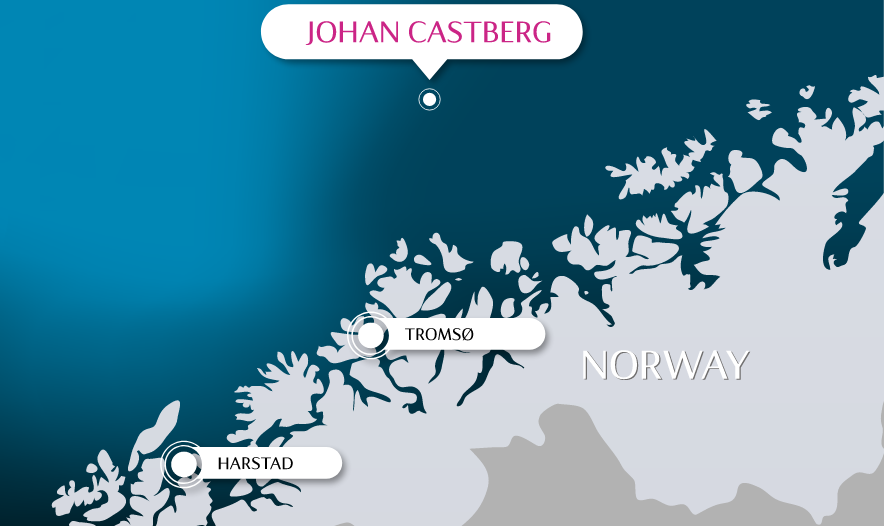

Norway’s Statoil (ticker: STO) approved the largest offshore development this year today, approving the Johan Castberg project in the arctic Barents Sea.

Discovered in 2011, Johan Castberg is farther north than Prudhoe Bay in Alaska. Several exploratory wells have indicated the field has significant oil reserves, but its remoteness makes development a challenge. Original plans called for more than $12 billion in capital expenditures, and had a breakeven above $80/bbl. This was good enough before the oil price crash, but plans were overhauled after 2014.

Statoil now expects to spend NOK 49 billion, or just under $6 billion developing the field. This means the project has a breakeven of $35/bbl, much more plausible given the current market environment. Statoil estimates it will be able to recover 450 – 650 MMBOE from the field using the new development plan.

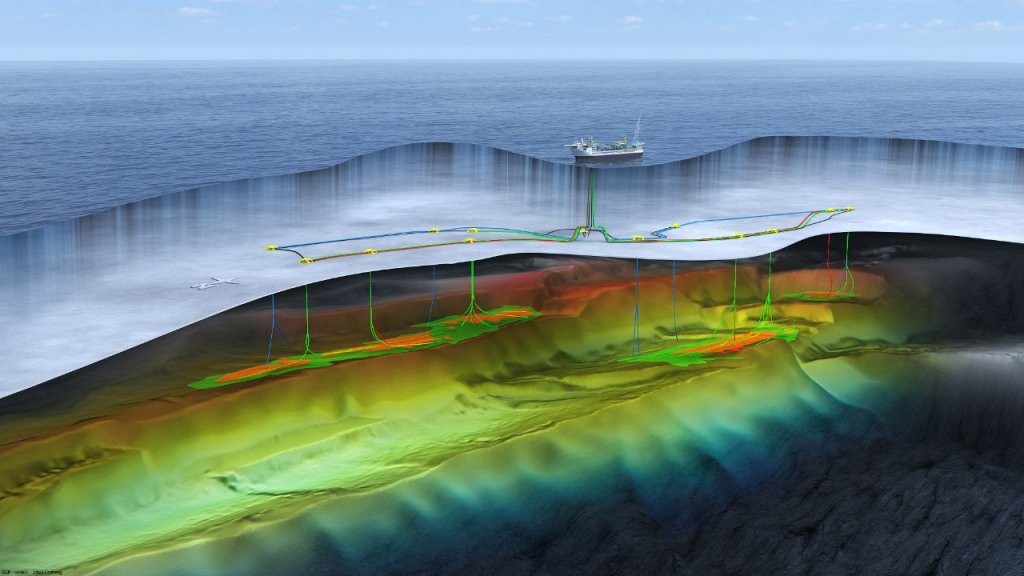

Johan Castberg will use a floating production, storage and offloading (FPSO) vessel to produce the field, a vessel that will be built by Sembcorp Marine for about $600 million. The vessel will produce from what statoil describes as “the biggest subsea field under development in the world today, including a total of 30 wells, 10 subsea templates and two satellite structures. The project will develop two separate fields, which are about 4 miles apart.

First oil is expected in 2022, and the field should operate for 30 years. Statoil also plans to build a helicopter base in Hammerfest to supply the ship. Johan Castberg is operated by Statoil, which holds a 50% stake in the project. ENI holds 30%, while Petoro owns the remaining 20%.

Statoil’s executive vice president for technology, projects and drilling Margareth Øvrum commented “This is a great day! We have finally succeeded in realizing the Johan Castberg development. The project is central part of the further development of the northern regions, and will create substantial value and spinoffs for Norway for 30 years.”

Development may spur northern oil terminal

Developing Johan Castberg will also allow the company to evaluate a stand-alone oil terminal on Veidnes, near the northern tip of Norway. The onshore terminal could also be an alternative in combination with offshore oil offloading. There are significant cost differences between offshore offloading and bringing oil to shore using a pipeline, however. Statoil expects to make a decision on the proposed terminal in 2019.

The terminal decision will undoubtedly be affected by the results of Statoil’s 2018 Barents Sea drilling program, as a big find would better justify the terminal. The company currently plans to drill five or six wells in the Barents next year. Statoil had a relatively disappointing drilling program this year, and did not make any finds large enough to be developed.