Statoil ASA (ticker: STO) and Petroleo Brasileiro S.A. – Petrobras (ticker: PBR) have agreed that Statoil will acquire a 25% interest in Roncador, a large oil field in the Campos Basin in Brazil.

The transaction nearly triples Statoil’s production in Brazil. Total consideration comprises an initial payment of $2.35 billion, plus additional contingent payments of up to $550 million.

Courtesy of Ole Jorgen Bratland/Statoil

“This transaction adds material and attractive long-term production to our international portfolio, further strengthening the position of Brazil as a core area for Statoil. We are also pleased to advance our strategic partnership with Petrobras by expanding our technical collaboration, sharing technology, competence and experience to increase oil and gas recovery,” said Eldar Sætre, president and CEO of Statoil.

Roncador was the largest discovery offshore Brazil in the 1990s and is currently the third largest producing field in Petrobras’ portfolio, with around 10 billion BOE in place and an expected remaining recoverable volume of more than 1 billion BOE.

“The ambition is to increase the recovery factor by at least 5 percentage points, bringing the total remaining recoverable volumes to more than 1,500 million BOE,” said Statoil. “The field has been in production since 1999 with output, during November 2017, of around 240,000 BOPD plus around 40,000 BOEPD of associated gas.”

The transaction increases Statoil’s equity production in Brazil by 175% to 110,000 BOEPD, up from 40,000 BOEPD. Petrobras retains operatorship and a 75% interest.

“Strategic partnerships are an important part of our business plan and Statoil’s knowledge and experience in increasing the level of oil recovery in mature fields will add value not only to our joint operations in Roncador, but to other mature fields in the Campos Basin, with huge potential to positively impact future production in the area,” said Pedro Parente, CEO of Petrobras.

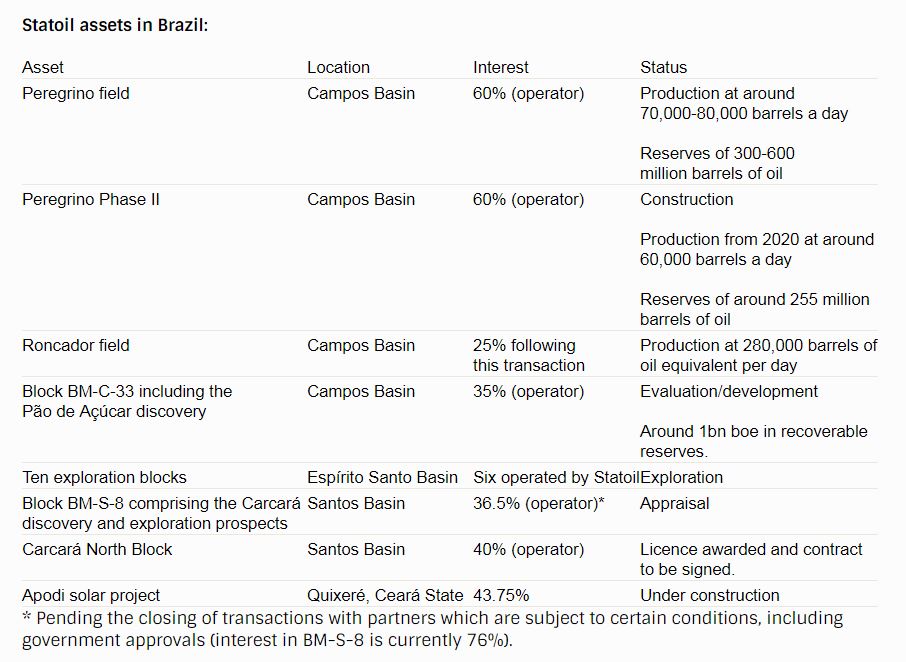

Petrobras and Statoil are partners in 13 areas in either the exploration or production phase, ten of which are located in Brazil and three abroad. The acquisition will strengthen Statoil as one of the biggest oil producers in Brazil, operating the Peregrino field and block BM-C-33, both in the Campos Basin, and the BM-S-8 block in the Santos Basin.

Statoil and Petrobras have also agreed that Statoil will have the option to utilize part of the capacity at Petrobras’ Cabiunas natural gas terminal to allow for the future development of BM-C-33, where both companies are partners and which contains the Pao de Acucar discovery.