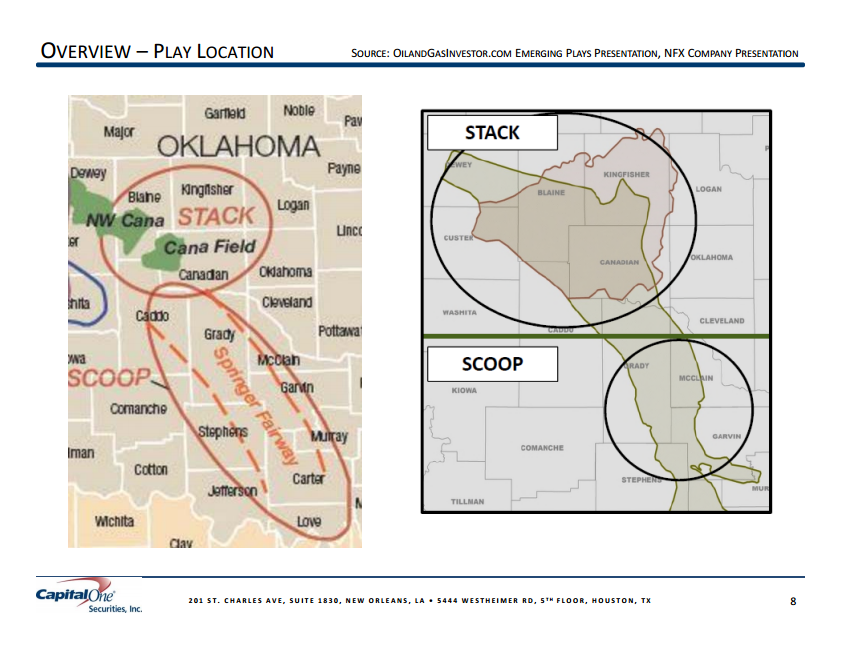

Oklahoma’s STACK and SCOOP plays are dominated by five players – 2nd most active U.S. plays

With roughly 31% of active rigs in the U.S. focusing on the Permian, it’s easy to say plays like the Delaware Basin have become the focus of the industry. Despite that, there remains a tremendous potential in the STACK and SCOOP plays, according to a report released by Capital One Southcoast (COS).

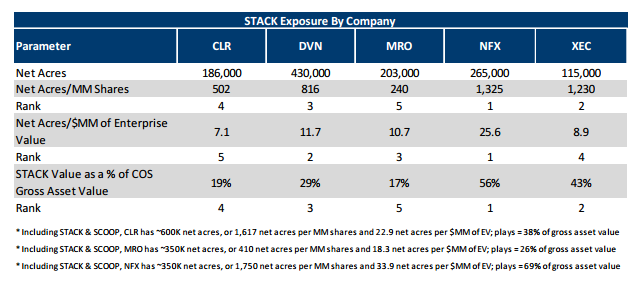

Coming in behind the Permian as the second-most active play in the United States, The STACK and SCOOP plays are dominated by:

- Continental Resources (ticker: CLR)

- Devon Energy (ticker: DVN)

- Marathon Oil (ticker: MRO)

- Newfield Exploration (ticker: NFX)

- Cimarex Energy (ticker: CVX)

Combining the total value COS ascribes to these five companies in the area, the analysts’ estimates for the value of the play “reaches upwards of $40 billion,” a figure they believe still has significant upside potential given the relative newness of the play.

The potential upside is driven by three key factors, said COS: “First, the industry is currently conducting numerous pilots across the plays to determine optimal spacing between well bores and between landing zones. As spacing continues to get tighter and tighter, drilling inventory and resource potential continue to grow. Second, as mentioned earlier, the geology of these plays allows for the potential to develop multiple different stacked pay zones. As the industry tests these new zones, operators will begin to determine how many targets really exist on this resource. Finally, the boundaries (areal extent) of these plays are still being tested. While the cores of the plays are relatively established, delineation work is currently being conducted to see how far the operators can stretch the boundaries of the resource. All of these factors will ultimately help determine the extent of the resource and drive future development.”

Given that the play is home to just a handful of companies, the area is likely to be developed in a systematic way, too.

Other public companies in the plays include Apache (ticker: APA), Chesapeake Energy (ticker: CHK), Chevron (ticker: CVX), Gastar Exploration (ticker: GST), Unit Petroleum (ticker: UNT) and XTO Energy (owned by ExxonMobil, ticker: XOM).

A preference for STACK over SCOOP

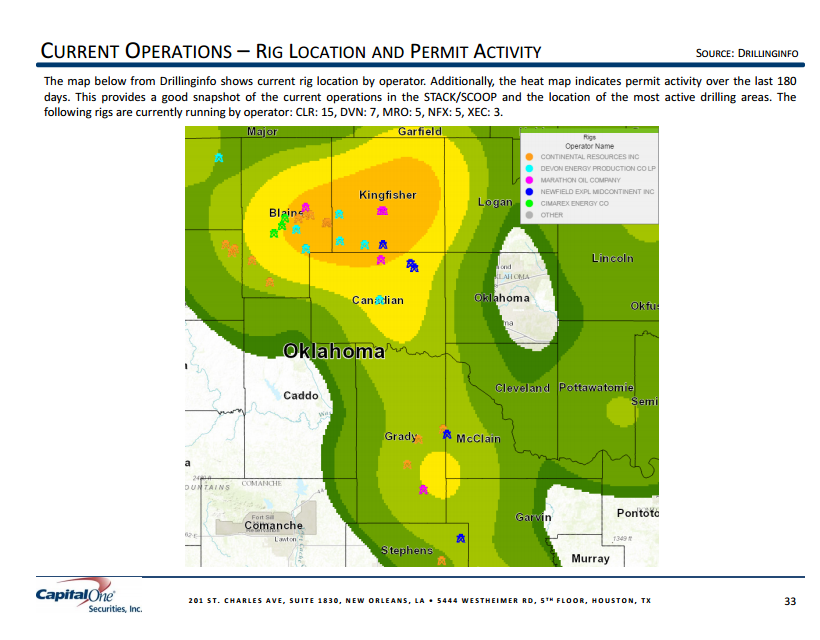

With 70% of the 64 active rigs in both plays operating in the STACK, both investors and operators appear to be more excited about assets located further north. Wells in the STACK Meramec formation generally have higher EURs and lower well costs due to shallower depths than wells drilled in the SCOOP Woodford formation, COS points out.

The SCOOP play emerged roughly 13 months ahead of the STACK, according to COS, and has more wells because of it. According to Continental Resources, 815 horizontal wells have been drilled in SCOOP by industry through the end of 2Q16. That compares to 550 horizontal wells in STACK, but this trend is likely to reverse by mid-2017 given the 45 rigs in the STACK compared to 19 in SCOOP.