April 22, 2020, BY Thomas H. Kee Jr - Editor, Stock Traders Daily |

The Spdr S&p Oil & Gas Exploration (NYSE: XOP) update and the technical summary table below can help you manage risk and optimize returns. Here we provide day, swing, and longer-term trading plans for XOP, and we cover 1000 other stocks too. This is a snapshot, it was real-time when the report was published, but prices change and so do support and resistance levels. Update this report, and get unlimited real time reports here Unlimited Real Time Reports.

Continued Below

Clebrating 20 Years Managing Risk! Defense Wins Championships

Clebrating 20 Years Managing Risk! Defense Wins Championships

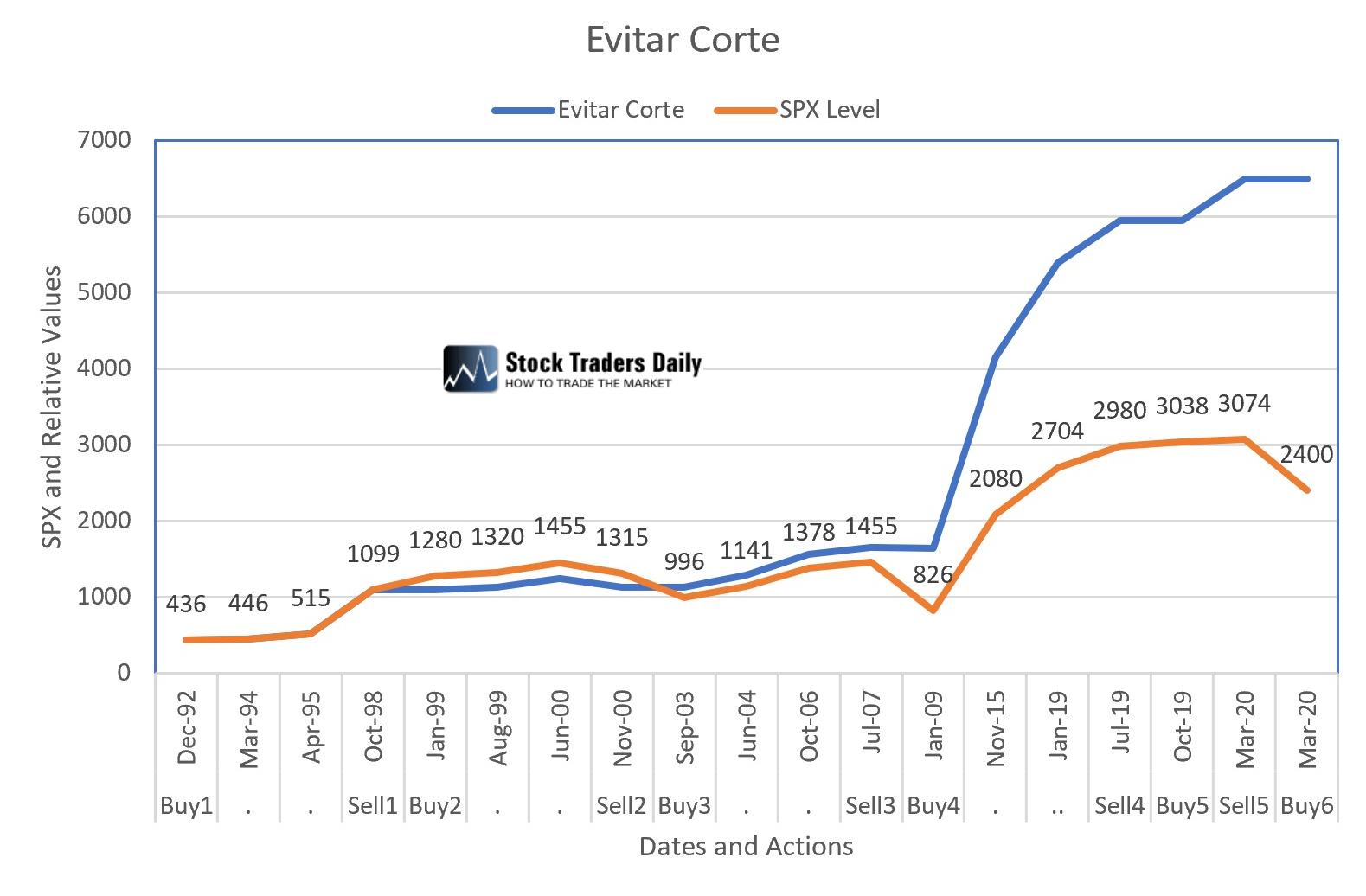

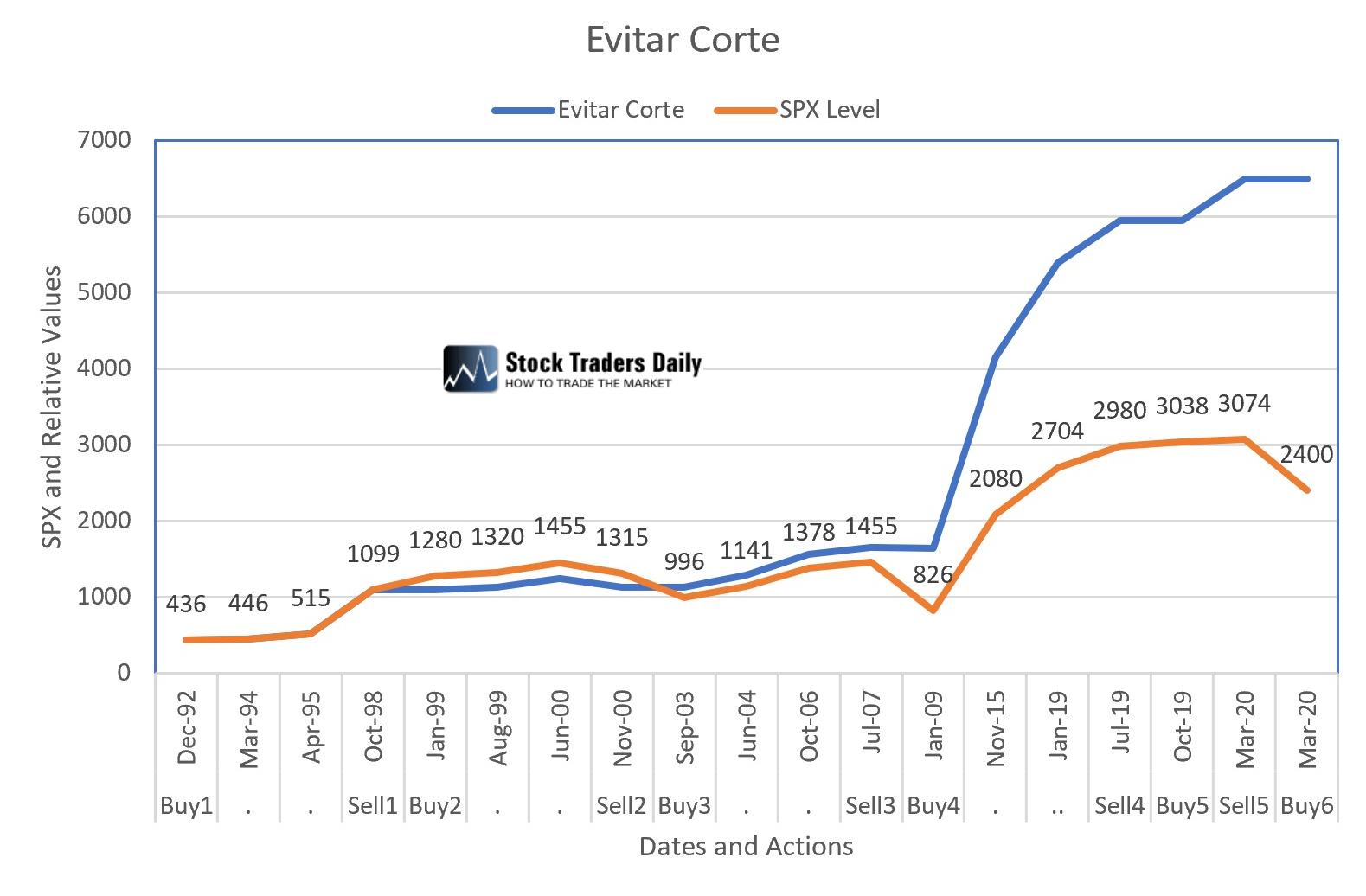

Our Evitar Corte Model Proves it (chart below):

- Performance is a Natural Byproduct of Risk Control

- Evitar Corte Beats SPX by 943% since 1992 on 10 Trades

- Evitar Corte Tells You When to Play Defense in the Market

- Our Proprietary Model Uses the FOMC as an Indicator

- Evitar Corte may be The Most Efficient Model Ever!

- Our Model Protects Entire Portfolios (not just 1 stock)

- We Also Show You How To Protect Within Seconds

- Our Method Makes Playing Defense in the Market Easy

- We Tell You When, How, and Why to Defend, in Real-Time

- Subscribe to See For Yourself...

Our Strategies and Models Have Been Featured Many Times, in Many Places:

Sign Up for Free Trial

Review the XOP Trading Plans:

Technical Summary

| Term → |

Near |

Mid |

Long |

| Bias |

Strong |

Strong |

Strong |

| P1 |

0 |

0 |

29.22 |

| P2 |

44.32 |

42.03 |

45.97 |

| P3 |

46.18 |

47.01 |

63.80 |

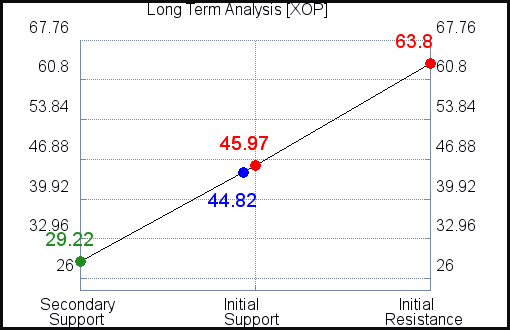

Long Term Trading Plans for XOP

April 22, 2020, 8:45 pm ET

The Technical Summary and Trading Plans for XOP help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this XOP Report.

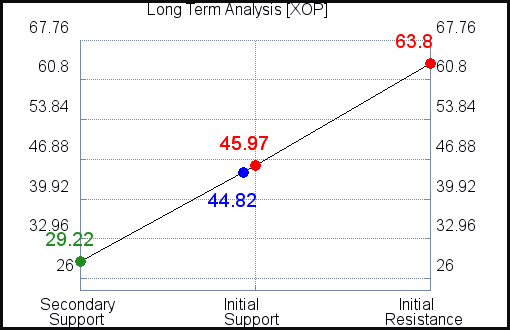

XOP - (Long) Support Plan

The technical summary data tells us to buy XOP near 29.22 with an upside target of 45.97. This data also tells us to set a stop loss @ 28.96 to protect against excessive loss in case the stock begins to move against the trade. 29.22 is the first level of support below 44.82 , and by rule, any test of support is a buy signal. In this case, support 29.22 would be being tested, so a buy signal would exist.

XOP - (Short) Resistance Plan

The technical summary data is suggesting a short of XOP as it gets near 45.97 with a downside target of 29.22. We should have a stop loss in place at 46.23 though. 45.97 is the first level of resistance above 44.82, and by rule, any test of resistance is a short signal. In this case, if resistance 45.97 is being tested, so a short signal would exist.

Source: Stock Traders Daily

(April 22, 2020 - 8:45 PM EDT)

News by QuoteMedia

www.quotemedia.com