March 14, 2020, BY Thomas H. Kee Jr - Editor, Stock Traders Daily |

The Spdr S&p Oil & Gas Exploration (NYSE: XOP) update and the technical summary table below can help you manage risk and optimize returns. We have day, swing, and longer-term trading plans for XOP, and 1300 other stocks too, updated in real time for our trial subscribers. The data below is a snapshot, but updates are available now.

Review the Trading Plans:

Technical Summary

| Term → |

Near |

Mid |

Long |

| Bias |

Weak |

Weak |

Weak |

| P1 |

0 |

0 |

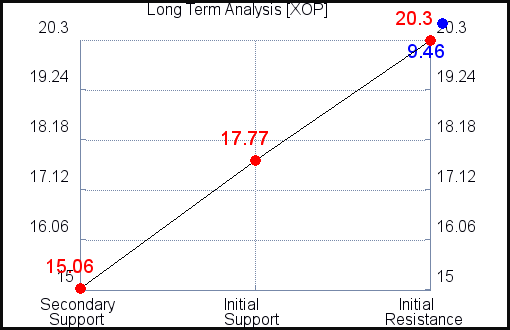

15.06 |

| P2 |

8.72 |

9.94 |

17.77 |

| P3 |

11.04 |

12.74 |

20.30 |

Long Term Trading Plans for XOP

March 14, 2020, 11:00 pm ET

The Technical Summary and Trading Plans for XOP help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this XOP Report.

XOP - (Long) Support Plan

There is no current Support Plan to trigger a buy of this stock at this time. This usually means that there are no clear support levels at this time, so buying the stock as it falls could be considered catching a falling knife. Buy signals only exist if resistance breaks higher.

This often is a signal that the stock you are watching is weak. Waiting for a turn higher may be more intelligent than trying to catch a falling knife. In any case, new support levels are usually revised to the database at the beginning of the next trading session.

XOP - (Short) Resistance Plan

The technical summary data is suggesting a short of XOP as it gets near 15.06, but the downside target is not available from the current data. This tells us to hold that position if it is triggered until a new downside target has been established (updates occur at the beginning of every trading session) or until the position has been stopped. The summary data tells us to have a stop loss in place at 15.32. 15.06 is the first level of resistance above 9.46, and by rule, any test of resistance is a short signal. In this case, if resistance 15.06 is being tested, so a short signal would exist.

Source: Stock Traders Daily

(March 14, 2020 - 11:00 PM EDT)

News by QuoteMedia

www.quotemedia.com