Spartan Energy Corp. (ticker: SPE) has approved a development capital budget of $183 million for 2018. Spartan said the capital budget includes drilling approximately 140 net development oil wells. The wells should produce an annual average production of 23,400 BOEPD and a 2018 exit production of 25,000 BOEPD, an exit production growth of 11% over 2017.

Assuming a WTI price assumption of $60 and a CDN/US exchange rate of $0.80, the company said it expects to generate funds flow from operations of approximately $267 million in 2018, yielding excess funds flow of approximately $84 million. The proceeds will be used to fund future waterflood projects, land and seismic and strategic acquisitions.

Drilling and maintenance capital

Southeast Saskatchewan

Spartan’s 2018 drilling program will be primarily focused on its Mississippian wells in southeast Saskatchewan. Greater than 80% of the budget will be directed to drilling, completions, equipping and tie-ins, with the remainder allocated to facilities, environmental, workovers, capitalized G&A and costs associated with non-operated interests in the Weyburn and Midale CO2 units.

The company plans to spend approximately 35% of its drilling budget to drill 64 net open-hole wells. These wells have an internal type curve well, delivering a half cycle rate of return of 135%-227% and are projected to pay out in 8-11 months, according to the company. Spartan has brought approximately 200 net open-hole wells on production since 2014.

Spartan has a multi-year inventory of open-hole locations, as its 64 net wells planned for 2018 represent approximately 5% of the company’s open-hole drilling inventory.

Ratcliffe at Oungre

Spartan’s 2018 program will also further develop its conventional Ratcliffe opportunity at Oungre, where drilling commenced in the second half of 2017. Approximately 22% of the 2018 drilling budget will go towards drilling 29 net Ratcliffe wells, including 1 net single leg and 11 net dual leg wells in the Oungre unit.

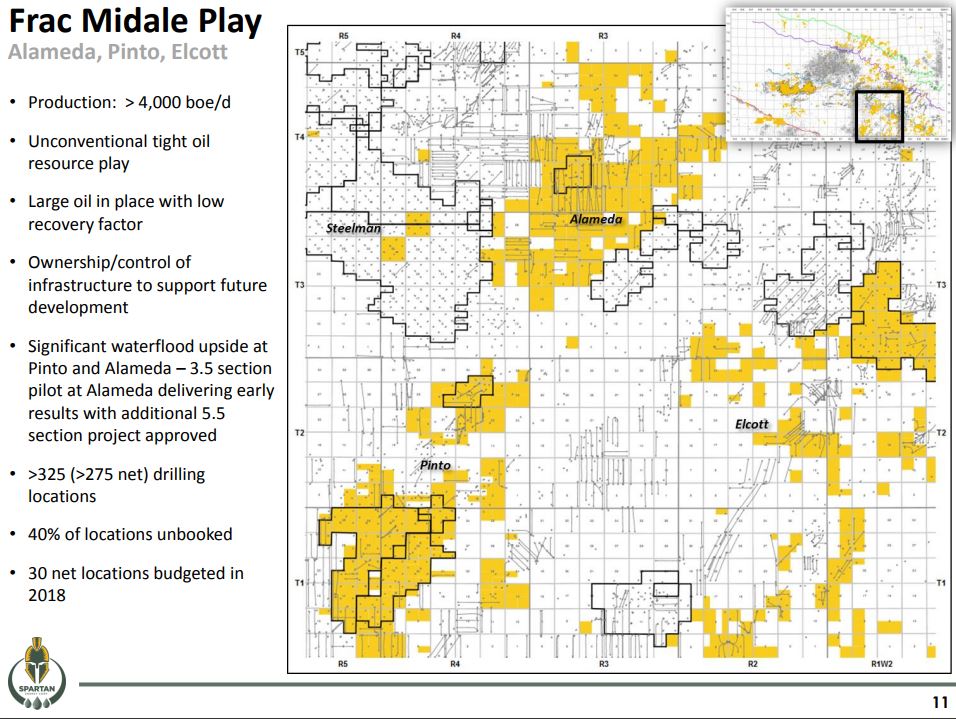

Midale

The frac Midale unconventional resource play will consume approximately 33% of the drilling budget, drilling 30 net wells on company lands at Alameda, Pinto and Elcott. The 2018 budget represents approximately 11% of net identified frac Midale inventory.

Viking at Plato

The remaining 10% of the drilling budget will be directed to the continued development of the company’s newly discovered Viking play at Plato. Due to spring breakup, the budget is weighted towards the second half of the year.

2018 financial and operating guidance summary

| Production | |||

| Average (BOEPD) | 23,400 | ||

| Exit (BOEPD) | 25,000 | ||

| Financial | |||

| Funds flow from operations ($MM)(1) | $267 | ||

| Per share – basic(1) | $1.51 | ||

| Total development capital expenditures ($MM) (1) | $183 | ||

| Excess funds flow ($MM)(1) | $84 | ||

| 2018 exit net debt to 2018 funds flow from operations (1)(2) | 0.6x | ||

| Pricing | |||

| Crude oil – WTI (US$/bbl) | $60.00 | ||

| Exchange rate ($Cdn/$US) | $0.80 | ||

| Cromer ($Cdn/bbl) | $69.50 | ||

| Netbacks ($/Boe) | |||

| Oil and gas sales | $59.53 | ||

| Royalties | $9.52 | ||

| Production expense | $16.65 | ||

| Operating netback(1) | $33.36 | ||

| G&A (cash portion) | $1.09 | ||

| Interest | $1.05 | ||

| Corporate netback(1) | $31.22 | ||

Notes:

- Funds flow from operations, excess funds flow, total development capital expenditures, operating netback and net debt are non-IFRS measures. See “Non-IFRS Measures”.

- Estimated net debt as at December 31, 2018, including 2018 principal repayments in respect of outstanding finance lease obligations but excluding the outstanding principal amount of such obligations as at December 31, 2018 of $22.3 million. Estimated net debt as at December 31, 2018 includes $22.2 million of capital spending on waterflood, land and seismic investments.