Southwestern effectively recapitalizing – Johnson Rice & Company

Southwestern Energy (ticker: SWN) announced the commencement of a public offering of 75 million shares of its common stock today, which the company quickly upsized to 86 million shares with a 30-day option for underwriters to purchase an additional 12.9 million shares. Southwestern expects total gross process from the offering of approximately $1.1 billion, according to a company press release.

The net proceeds from the offering will be used to repay $375 million of the $750 million term loan Southwestern entered into in November 2015, with the remaining proceeds of the offering, together with cash on hand, to fund the company’s tender of up to $750 million of senior notes.

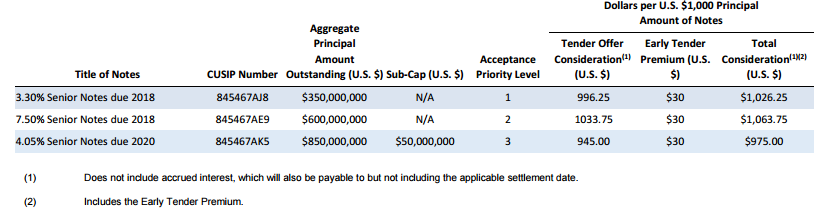

In a separate release today, SWN said it will purchase outstanding senior notes, giving priority to its $350 million in 3.30% notes due January 2018, followed by the $600 million in senior notes due February 2018. If the $750 million of notes is not tendered from those two tranches, then up to $50 million of the $850 million in senior notes due January 2020 can be tendered.

Southwestern Energy also announced that it has entered into agreements with its lenders to extend its $2.0 billion revolving line of credit and its $750 million term loan and modify some terms and conditions of the credit facility.

The principal terms include the following:

- The Company has entered a new $1.934 billion credit facility, consisting of a $1.191 billion secured term loan and a $743 million revolving credit facility, both due December 14, 2020, with the following features:

- The $1.191 billion secured term loan is fully drawn, with approximately $285 million of this balance being used to pay down the existing revolving credit facility balance in its entirety and the remaining amount available for liquidity purposes. The Company does not expect to borrow under the new revolving credit facility in the near term.

- Interest rates will be 0.50% above levels in the Company’s existing revolving credit facility. Following this transaction, the Company’s current credit ratings result in an interest rate of 2.50% above LIBOR.

- Collateral for the new secured term loan is principally E&P properties in the Fayetteville Shale area. This collateral also may support all or a part of revolving credit extensions depending on restrictions in the Company’s senior notes indentures. The facilities have no borrowing base redeterminations but require a 1.50x collateral coverage ratio.

- Financial covenants and restrictions in the new credit facility include:

- Minimum interest coverage of 0.75x in 2016 increasing by 0.25x increments to 1.50x in 2019 and 2020;

- Minimum liquidity requirement of $300 million subject to increase up to $500 million upon certain conditions; and

- Anti-hoarding provision requiring unrestricted cash in excess of $100 million to pay down any amounts borrowed under the revolving credit facility.

- The existing $750 million term loan is extended to December 14, 2020, provided at least $375 million is paid by June 30, 2017.

- The Company expects to pay down this loan, using proceeds from its previously announced $450 million sale of undeveloped properties in West Virginia or other sources, triggering this extension.

- All net proceeds from future asset sales and certain debt and equity issuances are required to reduce any amounts borrowed under the existing $750 million term loan.

- This existing term loan remains unsecured and interest rates increase to the same level as the new revolver and term loan.

- The Company’s existing unsecured revolving credit agreement due in December 2018 remains in place but with the aggregate commitment reduced to $66 million.

A note from Johnson Rice & Company today said all of this taken together “are effectively a partial re-capitalization for the company, which should poise the shares for a stretch of outperformance as the solvency risk in the name diminishes.”

The new credit facility agreement gives SWN an additional $1.6 billion in liquidity with approximately $1.2 billion in new secured term loan and $743 million from a revolving credit facility. Johnson Rice & Company said it expected about $905 million remaining after paying off the existing revolver balance of $285 million could retire nearly all the company’s bonds with 2018 maturities. “Now, with the common stock offering, the approximately $905 million from the secured term loan can fund capital expenditures, allowing Southwestern to increase capex without incurring more debt,” the group said.

Southwestern Energy will be presenting at EnerCom’s The Oil & Gas Conference 21 in Denver, Colorado, on Tuesday, August 16. To learn more about the conference, click here.