Holding the title of the United States’ third largest natural gas producer, and with activities in the Northeast Appalachia, Southeast Appalachia, and the Fayetteville Shale, Southwestern Energy (ticker: SWN) is primarily focused on building and maintaining its natural gas production.

Southwestern reported its 2016 reserves as 5,253 Bcfe and its cumulative 2016 production at 875 Bcfe. In its Northeast Appalachia acreage, the company holds 245,805 net acres. It holds 321,563 net acres in its Southwest Appalachia assets, and—in its Fayetteville assets—holds 918,535 net acres. The Fayetteville assets are the largest assets and also account for the majority of the company’s cumulative production, with 43%—or 375 Bcf—of the total production.

Southwest Appalachia

In its SW Appalachia assets, Southwestern believes that approximately 4,200 future drilling locations exist, and that the asset provides a reasonable degree of flexibility in its liquid potential. Increased NGL prices resulted in an approximately $25 million improvement in margins across Q1, 2017 and Q1, 2016. The increased demand for ethane—at approximately 530 MBPD, and the ability for the company to export approximately 200 MBPD by 2019, fueled the newfound focus in NGLs.

Southwestern is also testing new completions designs to ascertain optimal completions methods. The tests have focused on increasing sand loading from approximately 1,000-1,300 lbs. per foot, to 2,000 lbs. per foot, 3,600 lbs. per foot, and—most recently—5,000 lbs. per foot. The increases have been paired with smaller cluster spacing—and have resulted in more desirable decline profiles.

Northeast Appalachia

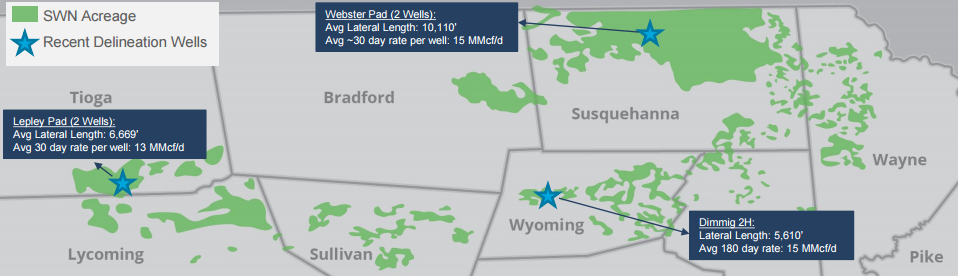

The NE Appalachia assets averaged 1,273 Mmcf per day in Q1, 2017 and Southwestern announced the success of three delineation wells across the acreage. The delineation wells were drilled in Tioga, Wyoming and Susquehanna County.

Southwestern also noted that it had undertaken the optimization of completion and flowback methods on 30 of its wells in the NE Appalachia area, but did not detail the steps it had taken for optimization. It did, however, announce that the initial EUR of Susquehanna wells increased by 25% where optimized techniques were utilized.

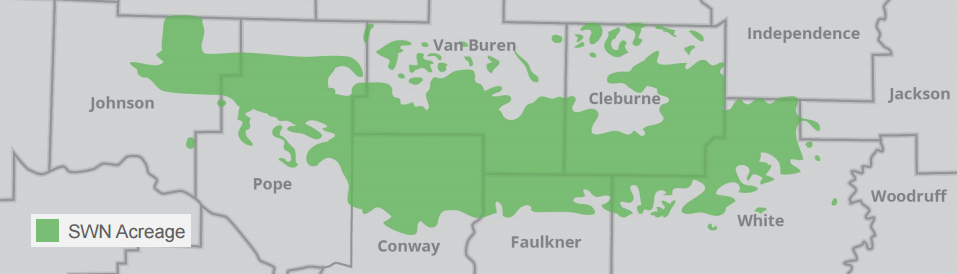

Fayetteville

Within the Fayetteville assets, Southwestern’s gross operated production was 1,342 Mmcf per day in Q1, 2017. The company has added seven wells on one pad in the Moorefield area within the first quarter of 2017. These wells bring the Moorefield well count up to 13 since mid-2015.

Moving into 2017

Southwestern’s 2017 capital program is fully funded from its cash-flow and its equity issuance. In its capital breakdown, the company allocated between $810 and $860 million to drilling and completions, between $115 and $130 million to land, seismic, and miscellaneous costs, between $225 and $245 million to capitalized interest and expense, and the remaining $25 to $40 million to midstream and corporate costs.

In 2017, the company expects that its Appalachian assets, both those in the Northeast and Southwest, will grow by approximately 17% over the 2016 reported production volumes.

Southwestern Energy is presenting at EnerCom’s The Oil & Gas Conference® 22

Southwestern will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.