Merger with Magellan Delivers Capital Market Access to Tellurian’s Gulf Coast LNG Project

Denver’s Magellan Petroleum Corporation (ticker: MPET) has entered into a definitive merger agreement with Tellurian Investments Inc., the recently formed private company founded by ex-Cheniere CEO Charif Souki and ex-BG COO Martin Houston. Tellurian is focused on the development of a mid-scale liquefied natural gas (LNG) facility on the U.S. Gulf Coast. The project, currently in permitting and planning phase, is called Driftwood LNG.

At their new public company address, Souki will be chairman and Houston will be president.

Magellan President and CEO J. Thomas Wilson commented in a press release, “This transaction concludes our strategic alternatives review process and we believe offers a unique opportunity for Magellan’s shareholders to participate at an early stage in an investment potentially similar to Cheniere Energy’s remarkable success, under the leadership of Charif Souki. He and Martin Houston are proven leaders in the LNG industry.”

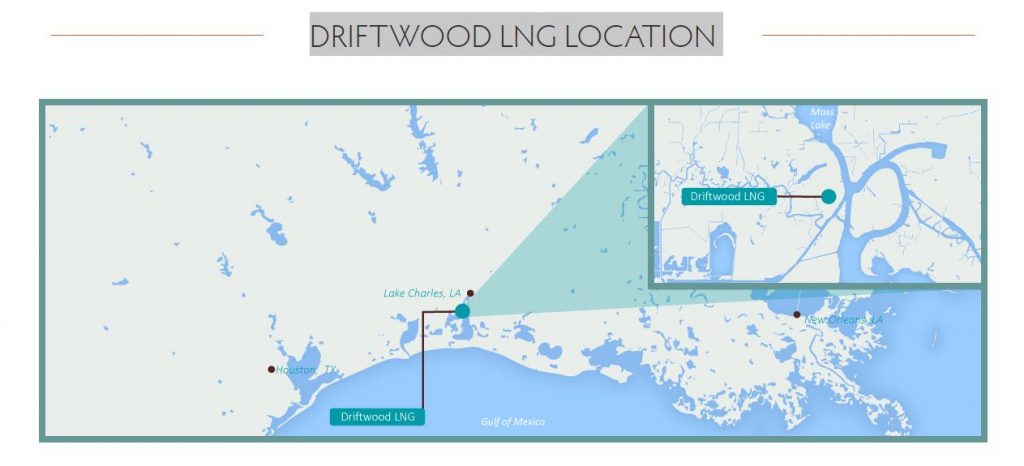

The project in focus is called Driftwood LNG LLC, owned by Tellurian Investments Inc. Driftwood LNG is developing a liquefied natural gas (LNG) production and export terminal on the west bank of the Calcasieu River, south of Lake Charles, Louisiana. When complete, the terminal will be able to export up to twenty-six million tonnes of LNG per year worldwide, according to the company.

Houston referred to Driftwood as having the potential to become “one of the most cost-competitive LNG projects globally. … With this transaction, we will be able to access more attractive financing in order to develop Driftwood LNG, which should come on stream in 2022, just as the markets for new LNG open up.”

Driftwood LNG Pipeline LLC, a subsidiary of Tellurian Investments Inc., is currently investigating the development of a pipeline to deliver gas to the Driftwood LNG facility. The proposed 96-mile feed gas pipeline would supply the facility with an annual average of 4 Bcf/d of natural gas via sections of 36-inch and 42-inch single pipeline, 42-inch dual pipeline and 48-inch single pipeline, three compressor stations and up to 15 meter stations and associated tie-ins at up to 13 sites, according to information on the Driftwood LNG website.

According to the Driftwood LNG website, the LNG project entered the FERC Pre-Filing review process in May 2016 and expects to file NGA Section 3 and 7 applications in Q1 of 2017. The company has targeted the start of construction in 2018, and projects the first LNG plant in-service in 2022 and construction complete with all plants in-service in 2025. Houston said Tellurian will partner with Bechtel and its sub-contractors, GE and Chart Industries, on the project.

Boards Approve Merger

The companies reported that the boards of directors of Tellurian and Magellan have unanimously approved the terms of the merger agreement and recommend that shareholders approve the transaction, according to the statement. Shareholder approval from both companies is still required. The companies believe the transaction will close in the fourth quarter of 2016.

Upon closing, pursuant to the terms of the merger agreement, each share of Tellurian will be converted into the right to receive 1.30 shares of Magellan. Magellan will issue approximately 122 million shares of common stock to Tellurian shareholders, representing approximately 95% of Magellan’s pro forma outstanding common stock.

The Houston Business Journal reports that Tellurian has raised at least $37.11 million in capital raises. Souki told the paper earlier this year that an initial public offering was possible.

“It’s entirely possible because we are going to do a project where we are going to raise $20 billion to $30 billion over the next few years,” Souki said at the time.

SEC filings related to the proposed merger agreement may be read here.

Magellan’s shares, which have traded mainly between $1.00 and $1.50 for the past three months, traded as high as $3.69 Aug. 3 on the news. On Aug. 4, MPET shares drifted back to between $2.40 and $2.60. With a basket full of global energy projects to fund, Magellan, like many oil and gas companies, has been hit hard by the commodities price downturn and has been selling assets to improve liquidity and avoid bankruptcy.

Charif Souki was interviewed about global LNG markets by Oil & Gas 360® at last year’s EnerCom conference when he was still CEO of Cheniere.