SM Energy announces the results of 8 Midland wells on its recently acquired acreage

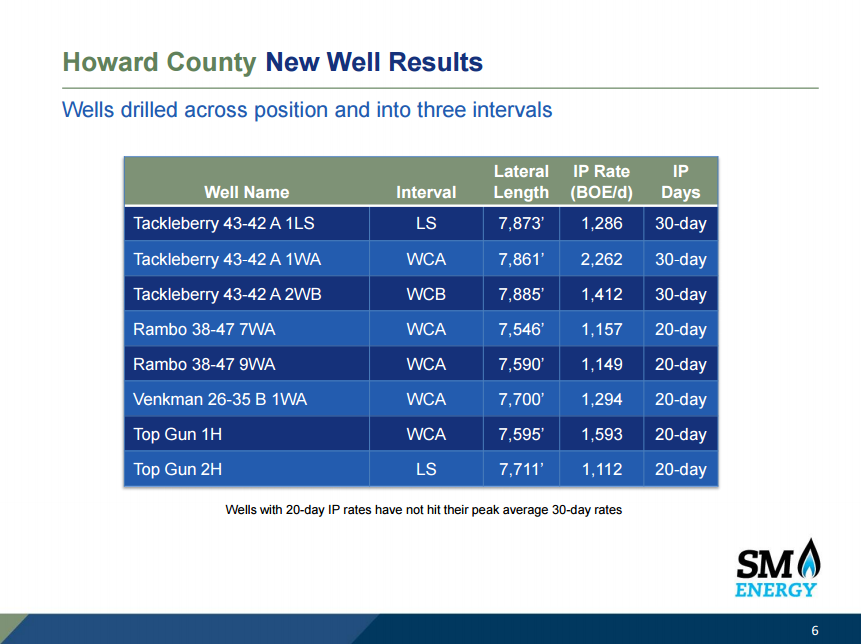

SM Energy (ticker: SM) released initial production results from eight wells drilled on acreage the company acquired from Rock Oil and QStar, saying that the IP rates on the wells exceed pre-completion estimates.

SM’s Tackleberry 43-42 A 1WA well performed especially well, the company said in a press release, producing a peak average 30-day initial production rate of 2,262 BOEPD from the Wolfcamp A.

Five of the wells are targeting the Wolfcamp A, two are targeting the Lower Spraberry and one well is targeting the Wolfcamp B, SM said. The wells were drilled along the southeastern flank of the company’s RockStar acreage position.

“Results from the three wells drilled and completed on the southeast edge of our acreage position are an important confirmation of our geologic model in that area,” SM Energy President and CEO Jay Ottoson said.

“During 2017, we expect that our capital program will focus on drilling and completing wells like those we are announcing today, resulting in accelerated high margin production growth on our retained assets. In addition, we will be working to improve completion techniques and further delineate our Midland Basin position to ensure that our future development plans are optimized.”

SM Energy working on delineating Howard County

SM Energy working on delineating Howard County

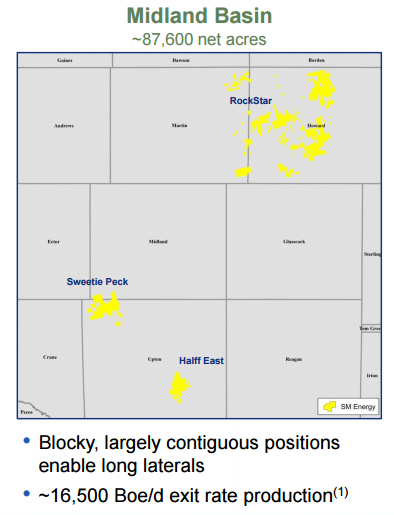

SM Energy said in a company presentation released along with the well results today that it plans to further delineate its Howard County assets and demonstrate that the assets have been relatively underappreciated thus far. In 2013, only four “modern” horizontal wells were drilled in Howard County, the company said, making Howard County a late entrant to Midland activity.

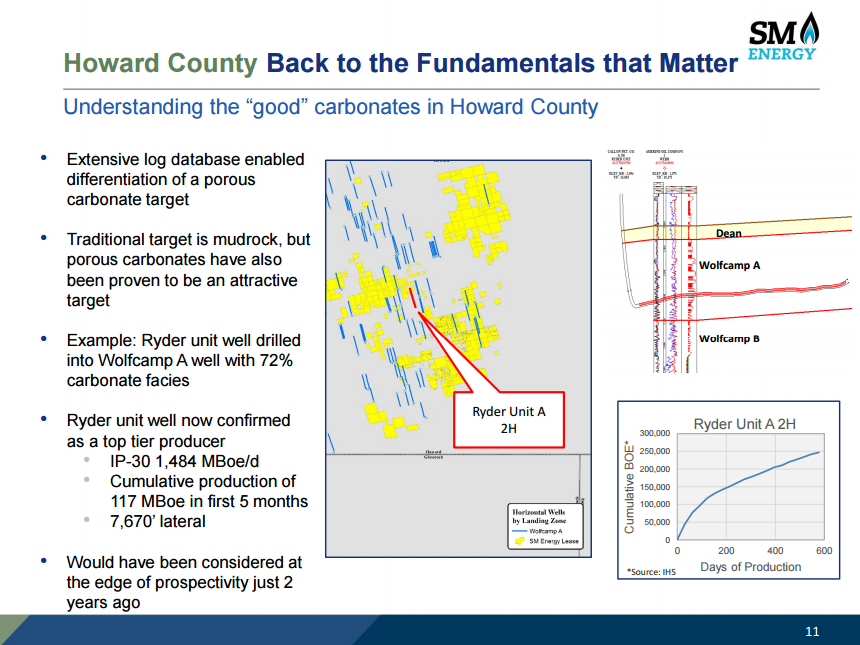

Traditionally, wells in Howard have targeted mudrock, but SM believes benches of porous carbonate in the area will be an attractive target for future drilling.

Because of the history of vertical well drilling in the area, SM Energy has been able to analyze more than 950 open-hole well logs to map the hydrocarbons in the area. E&P operators have been moving eastward in the Midland Basin to further delineate the resource, and SM Energy believes that much of its acreage sits inside of the play’s sweet spot.

SM Energy releases year-end 2016 production metrics

Along with its well results, SM Energy also put out its year-end 2016 production numbers, which were in-line with expectations, the company said. Full-year production reached 55.3 MMBOE, including fourth quarter production of 13.4 MMBOE. SM Energy said production for both Q4 2016 and full-year was approximately 30% oil.

Production from the Midland Basin increased nearly four-fold from year-end 2015 exit rates. The company is increasingly focused on the region, with the company divesting its Eagle Ford assets earlier this month for $800 million. Analysts expected the proceeds from the sale would likely help cover outspend associated with developing the new Midland assets this year.

SM plans to sell its remaining Williston Basin assets around the middle of 2017, the company said in the press release.