SM Energy closes $765.8 million Williston Basin divestiture

SM Energy (ticker: SM) announced Thursday after market close that the company has completed its previously announced divestiture of its Williston Basin assets located outside of Divide County, North Dakota to Oasis Petroleum (ticker: OAS). Net cash proceeds from the deal amount to $765.8 million, according to the company’s press release.

Third quarter 2016 production associated with these assets was approximately 14,350 BOEPD (78% oil). The company plans to apply the proceeds from this divestiture towards its acquisition of assets from QStar LLC and a related entity, a transaction that SM Energy expects to close later in December, and for general corporate purposes.

QStar acquisition this week adds 4,100 acres to SM Energy’s Midland assets

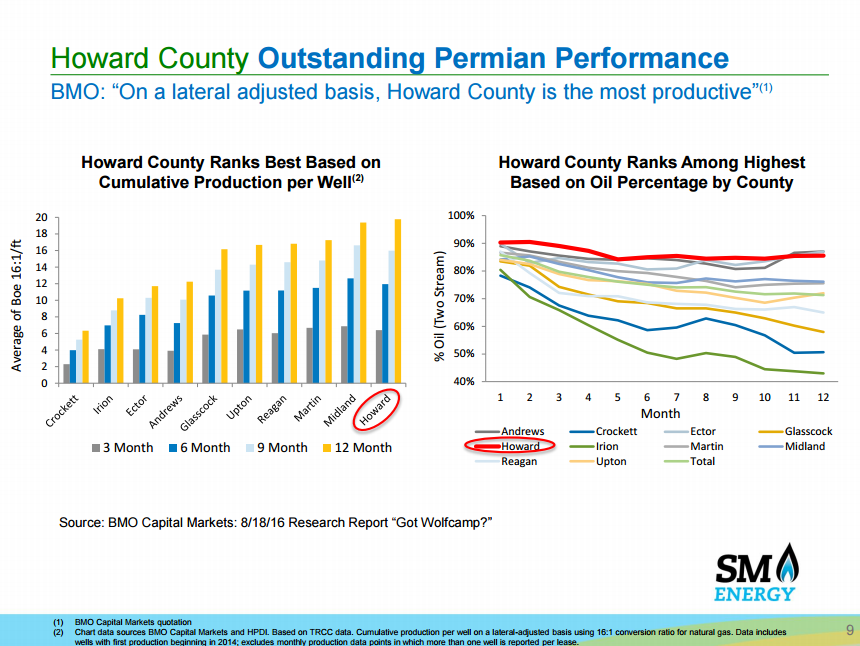

In addition to the divestiture, SM Energy announced that it will acquire approximately 4,100 acres of assets that complement its Howard County footprint for $120 million. Production on the new assets was not disclosed, meaning the deal works out to approximately $29,300 per acre, well below the $40,000-$45,000 per acre SM Energy paid for QStar assets in October.

The new properties bolt-on to the legacy QStar position and will facilitate SM in drilling long laterals (9,000-10,000 feet), according to a note from Stifel.

SM Energy is financing the deal through a public offering of the company’s common stock. The offering was upsized to 9.5 million shares, which SM Energy expects will amount to $363.4 million in gross proceeds. SM intends to use the net proceeds from the offering to pay for the Midland bolt-on, to reduce its debt, and for general corporate purposes, the company said in a press release.

The company’s revolver was reduced to $1.2 billion from $1.4 billion, but SM currently has just $350 million drawn. Assuming net proceeds of $350 million, Stifel models debt reduction of $230 million. Stifel’s report models outspend of $175 million and $300 million for 2017 and 2018, respectively. After using the $230 million to pay down debt, SM Energy will have debt-to-TTM EBITDA of approximately 3.9x and 2.4x in 2017 and 2018, respectively.

The equity deal will increase the company’s shares outstanding approximately 11%, and could have a negative value impact due to the dilutive effect of the offering, according to a note from KLR Group.

SM reported a Howard County three well IP average of 1.6 MMBOEPD (4.9 MMBOEPD total), which compares favorably to two previously disclosed IP rates in the area of 0.7 MMBOEPD and 1.6 MMBOPEPD.