Silverpeak, a New York-based multi-strategy investment platform, announced it was the buyer in a $132 million acquisition of certain assets in the Uinta Basin from LINN Energy, Inc. (ticker: LNGG). LINN announced the sale of the properties in January. The assets will be managed by Altamont Energy, a recently formed affiliate of Silverpeak, according to a press release from Silverpeak.

In a January press release announcing the sale, LINN Energy said the properties had a 2017 Q3 net production of approximately 1,450 BOEPD, proved developed reserves of ~5.8 MMBOE and proved developed PV-10 of approximately $75 million.

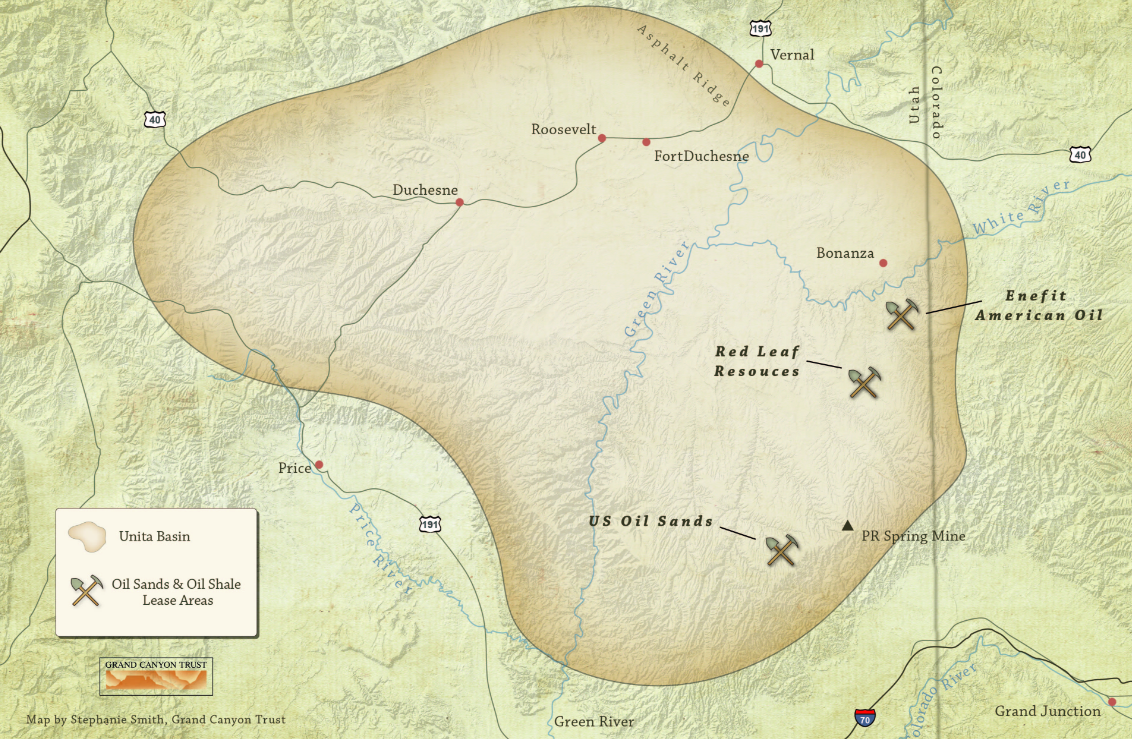

The assets include approximately 36,000 net acres, including 27,000 undeveloped acres in Utah’s Altamont Bluebell field. The acquisition includes 116 proven developed producing (PDP) wells.

Management

Dr. Jorge Manrique will lead Altamont Energy’s management team. Manrique lists his experience as a senior advisor at Occidental Petroleum (ticker: OXY), manager in unconventional reservoirs at Shell (ticker: RDS.A), and chief engineer at Hilcorp before joining Silverpeak in July 2017.

“The Uinta Basin is one of the largest hydrocarbon producing areas with OOIP comparable to the Eagle Ford and Bakken,” Manrique said in a statement.

Silverpeak was founded in 2010.