Estimated combined value of $3.8 billion

Silver Run Acquisition Corporation II (ticker: SRUN) announced its merger with Alta Mesa Holdings and Kingfisher Midstream last week, forming Alta Mesa Resources.

Silver Run is a special purpose acquisition company (SPAC) that rose just over $1 billion in its IPO in March. Led by James Hackett, the former chief executive of Anadarko Petroleum (ticker: APC) Silver Run is an acquisition vehicle of Riverstone’s Fund VI.

Alta Mesa, Kingfisher operate on similar acreage

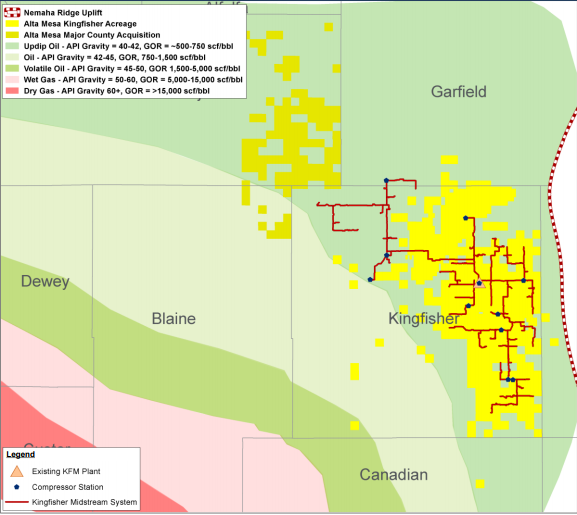

Founded in 1987, Alta Mesa Holdings is a pure-play STACK E&P with about 120,000 net acres in the field. The company has drilled 205 STACK wells since 2012, and has completed 173 of these wells with 167 on production. Alta Mesa reports that its EURs at year end should exceed 650 MBOE per well, or about 140 BOE per lateral foot. Current production is about 20,000 BOEPD, with 144 MMBOE of proved reserves.

Kingfisher Midstream is a private midstream company with significant operations in Kingfisher County. The company’s assets include over 300 miles of pipeline, 50 thousand barrels of crude storage capacity, and 60 MMcf/d of gas processing capacity with an additional 200 MMcf/d cryogenic plant expansion expected to commence operations in the fourth quarter of 2017.

Upon closing of the purchase, Silver Run II will be renamed Alta Mesa Resources and will trade on the NASDAQ under the ticker symbol “AMR”. Closing is expected in Q4 2017.

While most details of the transaction were not disclosed, the combined company is estimated to have a combined value of $3.8 billion. Alta Mesa Holdings owners will have the largest single share of the new company, with 37%. Silver Run owners will hold 27%, while Riverstone will own 22% and Kingfisher holders will have 14%. Silver Run head James Hackett will be the Executive Chairman, while Alta Mesa President and CEO Harlan Chappelle will be the new company’s President and CEO.

James Hackett commented on the merger, saying “We formed Silver Run II with the objective of acquiring low-breakeven, stacked-pay, oil-weighted assets, preferably with an integrated related midstream platform. The combination of Alta Mesa and Kingfisher is a perfect strategic match for our desired integrated platform. Alta Mesa’s highly contiguous core acreage position in Northeast Kingfisher County has among the lowest breakevens in the U.S. at around $25 per barrel. Kingfisher adds a highly strategic and synergistic midstream subsidiary with significant additional third party growth potential.”