Heavy crude becoming more expensive, light crude becoming cheaper

The global crude oil supply is currently undergoing a major change as production changes drive shifts in the oil quality mix, according to a note by the EIA.

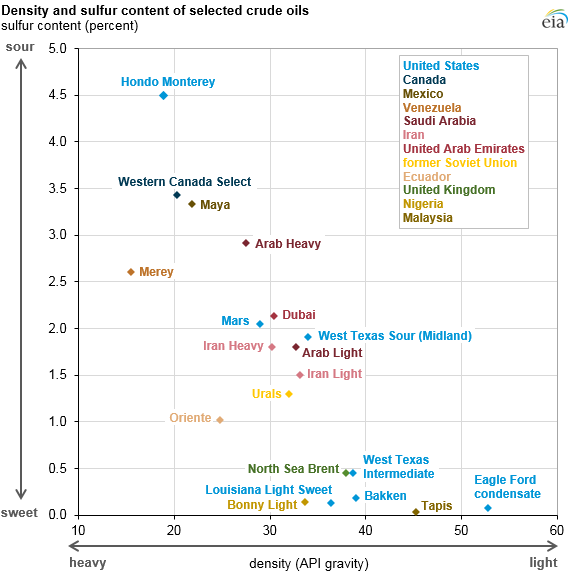

Crude oil is not all created equal, and many major producing locations have their own grades. One of the most important and commonly used attributes for comparing crude is its density. More dense oil generally requires more complex refineries to process and often trades at a discount to lighter grades.

OPEC cuts mostly bring heavy oil offline

Recent supply developments have begun to change this, though.

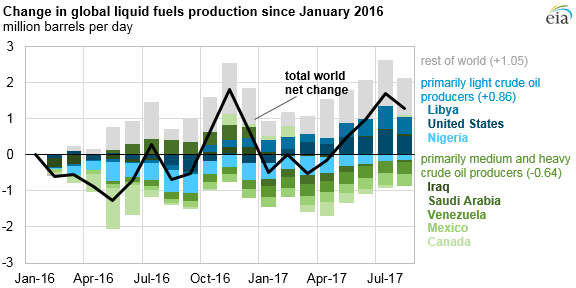

One of the most important oil supply developments at present is the OPEC production cut. While compliance is not total, it has been successful in bringing some production off the global oil market. Most of this production is heavy and medium crude, as Saudi Arabia and Iraq are among the largest medium oil producers and Venezuela is one of the foremost heavy oil producers. Developments in Canada and Mexico have compounded this trend.

The Canadian oil sands are one of the largest sources of heavy oil in the world, currently producing around 2 MMBOPD. However, production outages have temporarily shut down parts of this volume. The massive 2016 Fort McMurray wildfire, which was only fully extinguished in early August 2017, forced many companies to temporarily suspend or curtail operations. More recently, a fire at the Syncrude mining and upgrading project in April forced several companies to reduce operations.

Continually declining production from Mexico, which typically produces heavy, sour crude, has also taken heavy crude off the market.

U.S., Libya, Nigeria adding production in 2017

Light crude producers, on the other hand, have been growing quickly. U.S. unconventional shale operations produce exclusively light oil, and have already added significant production from the lows seen in 2016. The two OPEC countries excluded from the cut agreement, Libya and Nigeria, also produce light oil. With both countries currently attempting to return production to normal levels, further light oil is coming on the market.

Narrowing differentials squeeze complex refiners

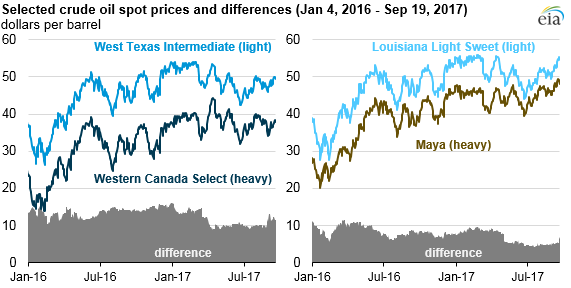

These trends have caused the light-heavy differential to fall in recent months. On the U.S. Gulf Coast, the premium for Louisiana Light Sweet (LLS) oil over heavy Maya oil from Mexico narrowed from $9 per barrel (b) in March to $5/b in August. In the Midwest, the premium for light West Texas Intermediate (WTI) over heavy Western Canada Select (WCS) also narrowed from $13/b in March to $10/b in August.

These changes will likely pressure Gulf Coast refineries.

Gulf Coast operations are mostly complex, expensive facilities set up to process heavy sour crude. A wider price differential between light and heavy crude benefits complex refiners, as they are able to secure cheaper product. The recent decline in differentials means simpler refineries, like those on the East Coast, are more competitive with Gulf operations than in previous years.