Shell takes $2 billion impairment with oil sands exit in Canada

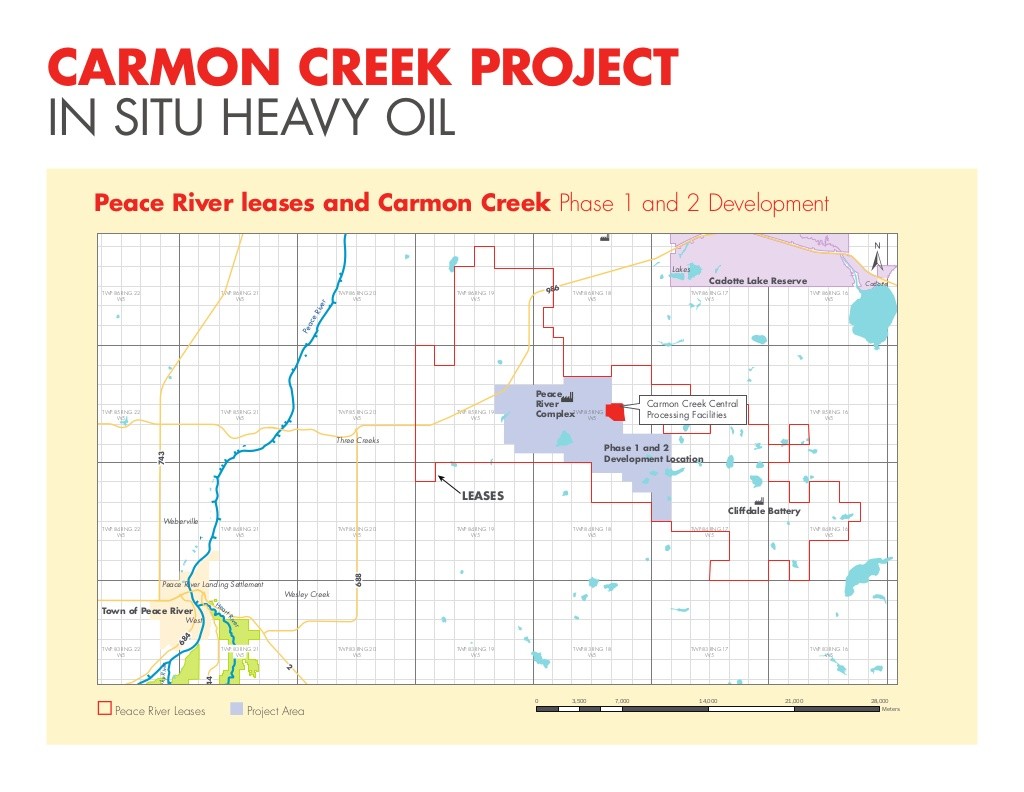

Royal Dutch Shell (ticker: RDSA) announced today that the company will not continue construction on its Carmon Creek oil sands project in Alberta. The project was expected to produce up to 80,000 barrels of oil per day (MBOPD). Carmon Creek is a thermal in situ project that is 100% owned by Shell.

The company originally sanctioned the project in October 2013 and announced in March 2015 that the project would be re-phased to take advantage of the market downturn. Shell today said that it has reviewed the potential design options, updated costs and the company’s capital priorities, and found that the project “does not rank in its portfolio at this time,” according to the press release.

“We are making changes to Shell’s portfolio mix by reviewing our longer-term upstream options world-wide, and managing affordability and exposure in the current world of lower oil prices. This is forcing tough choices at Shell,” said Chief Executive Officer, Ben van Beurden.

Shell will retain the Carmon Creek leases and preserve some equipment while continuing to study the options for this asset. The company expects to take net impairment, contract provision, and redundancy and restructuring charges of some $2 billion as a result of this decision with the third quarter 2015 results, which will be included as an identified item. The project SEC Proved Reserves estimated at 418 million barrels bitumen at end 2014 will be de-booked and the project estimated recoverable petroleum resources will be classified as Contingent Resources.

Second exit from a major project in a month

On September 28, Shell announced that it would leave its Arctic offshore projects for the foreseeable future. The news came following results from the company’s Burger J exploration well, which was drilled to a total depth of 6,800 feet. While the company did find indications of oil and gas at the well, “these are not sufficient to warrant further exploration in the Burger prospect. The well will be sealed and abandoned,” Shell said in a press release.

Shell’s Alaska position was approximately $3.0 billion on its balance sheet, according to the company. Shell expects to take financial charges for the position, as well as a further $1.1 billion for future contractual commitments. The $4.1 billion write down will be in addition to the $7 billion Shell had invested in the Arctic up to this point, including $2.1 billion to acquire its license in the Chukchi Sea, where Burger J was located.

Streamlining operations

The combined $6.1 billion impairment from leaving the two projects is hard to overlook, but the decision to get out before sinking additional capital into the projects makes sense.

“Aside from the impairments, there are no real negative effects,” an EnerCom analyst told Oil & Gas 360®. “Deciding not to sink more capital into areas from which the company might not see returns in this environment is probably a smart decision. In a constrained market, capital allocation is a major driver of future value. Making intelligent decisions now will enhance the company’s future potential.”

“Investors don’t want Shell to deliver more capex into Alaska,” said a Bernstein’s analyst following the news that Shell planned to leave the Arctic. “I imagine investors will be OK with a $1 billion hit versus tens of billions in the future.”