Decision to leave the Alaskan Arctic a combination of factors

Royal Dutch Shell (ticker: RDSA) announced today that it plans to put an end to its operation offshore Alaska, according to a company press release. The news came following results from the company’s Burger J exploration well, which was drilled to a total depth of 6,800 feet. While the company did find indications of oil and gas at the well, “these are not sufficient to warrant further exploration in the Burger prospect. The well will be sealed and abandoned,” Shell said.

In the release about its Burger J results, Shell also said it “will now cease further exploration activity in offshore Alaska for the foreseeable future. This decision reflects both the Burger J well result, the high costs associated with the project, and the challenging and unpredictable federal regulatory environment in offshore Alaska.”

Shell’s Alaska position was approximately $3.0 billion on its balance sheet, according to the company. Shell expects to take financial charges for the position, as well as a further $1.1 billion for future contractual commitments. The $4.1 billion write down will be in addition to the $7 billion Shell had invested in the Arctic up to this point, including $2.1 billion to acquire its license in the Chukchi Sea, where Burger J was located.

Shell had planned to drill up to six wells within the Burger Prospect, located in approximately 140 feet of water about 70 miles northwest of the village of Wainwright. The Chukchi Sea is estimated to hold the equivalent of 29 billion barrels of oil and gas, according to the U.S. Bureau of Ocean Management.

A hard road

The news that Shell has decided to leave the Arctic comes after six years of navigating the U.S. regulatory system in order to obtain permission to drill offshore Alaska, and trouble exploring the harsh environment of the Arctic.

In 2010, the company pushed back plans to drill in the region after BP’s (ticker: BP) fatal spill of the Gulf of Mexico sparked a government crackdown on offshore drilling. Two years later, during Shell’s last voyage to the Arctic, the company was not able to drill to depths where oil could be found because its spill response system was damaged during a test.

On May 11, 2015, the federal Bureau of Ocean Energy Management issued conditional permits that would allow Shell to begin exploratory drilling on its federal leases.

Once Shell received permission to drill, it sent the Polar Pioneer, a 400-foot drilling platform, to Seattle harbor for cargo and equipment loading. It was then set upon by environmental activists in kayaks who were there to protest the overall concept of fossil fuel development as much as to protest the pending drilling offshore Alaska.

Once Shell received permission to drill, it sent the Polar Pioneer, a 400-foot drilling platform, to Seattle harbor for cargo and equipment loading. It was then set upon by environmental activists in kayaks who were there to protest the overall concept of fossil fuel development as much as to protest the pending drilling offshore Alaska.

Mixed reactions

Shell’s decision to pull the plug on its offshore drilling operations in Alaska was hailed as “an unmitigated defeat,” by Greenpeace UK Executive Director John Sauven. “They had a budget of billions, we had a movement of millions. For three years we faced them down, and the people won.”

While the reaction from Greenpeace was hardly surprising, many of Shell’s own investors took the news surprisingly well, with the company’s shares moving up in early trading before slipping in line with other oil and gas companies, reports Reuters.

“Alaska has been a bone of contention for many investors, thus today’s update is a positive,” said Bernstein analysts. “Investors don’t want Shell to deliver more capex into Alaska,” said Bernstein’s Oswald Clint. “I imagine investors will be OK with a $1 billion hit versus tens of billions in the future.” Clint further estimated that exiting the Arctic would bring Shell’s annual exploration expenses below $3 billion, which investors will also see as a plus, reports The Wall Street Journal.

While Arctic exploration would have given Shell a comfortable cushion of oil supply in the next decade, nearer term it has other priorities to focus on, including its $70 billion acquisition of BG Group. The acquisition will streamline Shell’s focus on assets offshore Brazil and in liquefied natural gas.

The reaction from the Alaska Oil and Gas Association (AOGA) was much less upbeat than investors’.

“It is a sobering day for Alaska; both in the short and long-term. Today’s news from Shell is a painful reminder that exploration is expensive, involves huge risk, and does not guarantee success. Shell’s departure underscores the need for legal, fiscal, and permitting certainty and predictability,” said Kara Moriarty, president and CEO of AOGA.

“There are very few companies that could meet these federal requirements and expensive demands, but even large companies with the financial resources like Shell will walk away from mega opportunities when they cannot continue to spend billions of dollars without any promise of a return. The Arctic Offshore has rightly been viewed as the next generation of oil and gas development in this state, so for those plans to disappear overnight is beyond painful.”

A bad sign for Arctic drilling

“Other companies who held leases in the OCS were waiting to see what happened with Shell,” said Moriarty in an email. “I do not have any expectation that we will see exploration or development in the OCS for some time.”

Other oil majors have also been putting off plans to develop in the Arctic due to low oil prices and geopolitics. ExxonMobil (ticker: XOM) shelved plans to drill in the Russian Arctic after the U.S. imposed sanctions on Moscow’s energy industry following the annexation of Crimea; Chevron (ticker: CVX) put its exploration of the Arctic on hold until prices move higher, and a consortium including Exxon and BP suspended its Canadian Arctic exploration program in June.

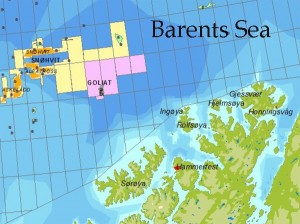

Even if Shell had decided to continue its program offshore Alaska, the difficulties of producing from the region would have remained pronounced. Italian energy company ENI (ticker: E) and Norwegian Statoil (ticker: STO) are just now moving into production on the Goliat field – 15 years after it was discovered.