Plant will make Iraq largest petrochemical producer in the Middle East

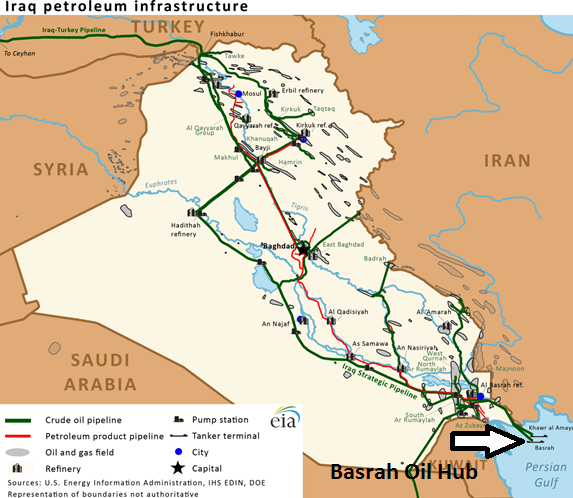

Royal Dutch Shell (ticker: RDSA) signed a deal with Iraq on Wednesday for $11 billion to build a petrochemical plant in the southern oil hub of Basra. Shell has so far declined to comment on the size or types of output expected from the facility, but the facility is expected to produce 1.8 million tons of petrochemical products per year, reports Reuters.

Iraq’s Industry Minister Nasser al-Esawi told a news conference that the Nibras complex is expected to come online within five to six years, helping the country reach its goal of becoming a major regional energy player and of diversifying its economy. Currently, Iraq relies on oil for more than 90% of its revenue.

“The Nibras complex will be one of the largest (foreign) investments (in Iraq) and the most important in the petrochemical sector in the Middle East,” Esawi said.

“Shell has been working with the Iraqi ministers of industry and minerals and jointly with the ministries of oil and transport to develop a joint investment model for a world-scale petrochemical cracker and derivative complex in the south of Iraq,” a Shell spokesman said.

Shell is one of the main major oil companies operating in south Iraq, operating the Majnoon oilfield and leading the Basra Gas  Company joint venture. It signed a memorandum of understanding with the ministry for the Nibras project in 2012.

Company joint venture. It signed a memorandum of understanding with the ministry for the Nibras project in 2012.

The project will utilize ethane feedstock separated out from flared natural gas recovered from southern oil fields by the Basra Gas Company JV of state firm South Gas, Shell and Japan’s Mitsubishi. Iraq currently flares around 70% of gross 1.9 Bcf/day; 80% of which is produced in the south, according to the Middle Eastern Economic Survey.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.