Vermilion Energy will become operator when transaction closes

Shell (ticker: RDS.A) announced today the sale of its share of the Corrib gas venture, marking its exit from the upstream business in Ireland. Including conditional payments, the transaction is valued at $1.23 billion.

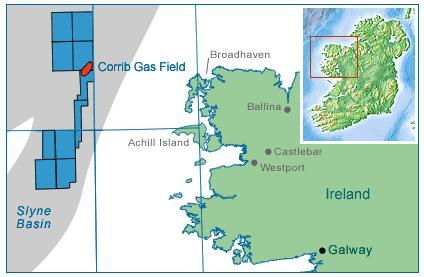

First discovered in 1996, the Corrib offshore gas field began production in late December 2015. The field produces from six offshore wells, with peak production of 260 MMcf/d of gas. Shell reports its share of production from the venture was about 162 MMcf/d in 2016.

Prior to the sale, Shell operated the venture with a 45% stake and was joined by Statoil (ticker: STO) (36.5%) and Vermilion Energy (ticker: VET) (18.5%). Vermilion will take over duties as operator if the transaction is completed.

An unexpected buyer: Canada Pension Plan Investment Board

Shell’s 45% interest in the Corrib field will be purchased by a subsidiary of Canada Pension Plan Investment Board. Shell has signed an offtake agreement for about 40% of the Corrib gas venture’s production for up to three years following completion. The transaction is expected to close in Q2 2018.

Accounting charges of up to $750 million

Shell will receive an initial consideration of $947 million, with additional payments totaling up to $285 million between 2018 and 2025, depending on gas prices and production. Shell reports that this transaction will result in an impairment charge of about $350 million in Q2 2017 and a negative non-cash cumulative currency translation difference of about $400 million upon completion.

When the sale closes Shell will have only one presence in Ireland, its aviation joint venture Shell and Topaz Aviation Ireland Limited based near Dublin airport.

$20 billion in divestments since 2016

This transaction is the latest in a series of divestments by Shell, as part of the company’s overall divestment strategy. In March, for example, the company sold most of its Canadian oil sands to Canadian Natural Resources (ticker: CNQ) for $7.3 billion. January saw Shell sell many of its UK North Sea assets to Chrysaor in a deal valued at $3.8 billion.

Shell is now halfway through its $30 billion divestment program, and has announced deals valued at a total of more than $20 billion. According to Shell’s Upstream Director Andy Brown, the strategy focuses on “concentrating our Upstream footprint where we can add most value.”

One of the partners in the venture, Vermilion Energy, is presenting at EnerCom’s The Oil & Gas Conference® in Denver, Colorado – Aug. 13-17, 2017. To register for the conference please visit the conference website.