The benefits of the shale boom are apparent. In the six year span from 2008 to 2013, crude oil production in the United States jumped by 43.7% (12,311 MBOEPD in 2013 compared to 8,563 MBOEPD) and gas production climbed 20% (24.3 Bcf/d from 20.2 Bcf/d). The United States, long dependent on the imports of foreign oil, is now speaking aloud of both energy independence and exporting its crude resources.

Although rig counts have leveled off, U.S. production continues to set records en route to becoming the world’s greatest producer of hydrocarbons. The use of hydraulic fracturing has opened up new plays and piqued industry interest in finding “The Next Bakken.”

The effects of the game-changing method is detailed in the annual World Energy Outlook commissioned by the International Energy Agency (IEA). In 2008, the IEA used 800 fields to generate its analysis. The number of fields used in 2013’s report was 16,000 – double the amount of 2008. Decline rates also dropped from 6.7% to “around 6.0%” in the near term, with 2030 decline rates dropping from 8.6% to 8.0%.

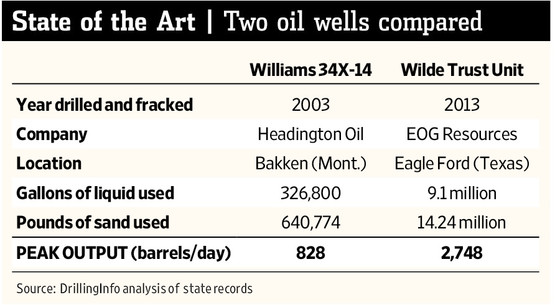

As indicated by the graphic on the right from The Wall Street Journal, completion efficiency has increased exponentially. E&Ps are now not hesitating to spend more on a well to generate a greater return, as opposed to methods from a few years ago that involved spending the least capital possible on the development of a well.

Benefits to the Community: Full Employment

The Bakken’s rise in North Dakota has propelled the state to become the fastest growing economy in the nation. In fact, North Dakota has held such a title every year since 2010. Unemployment in 2013 was a mere 2.9%, compared to the national average of 6.1% in the Department of Labor’s latest report. According to USA Today, the next three states in order of economic growth were Wyoming, West Virginia and Oklahoma – all home to burgeoning oil and gas operations.

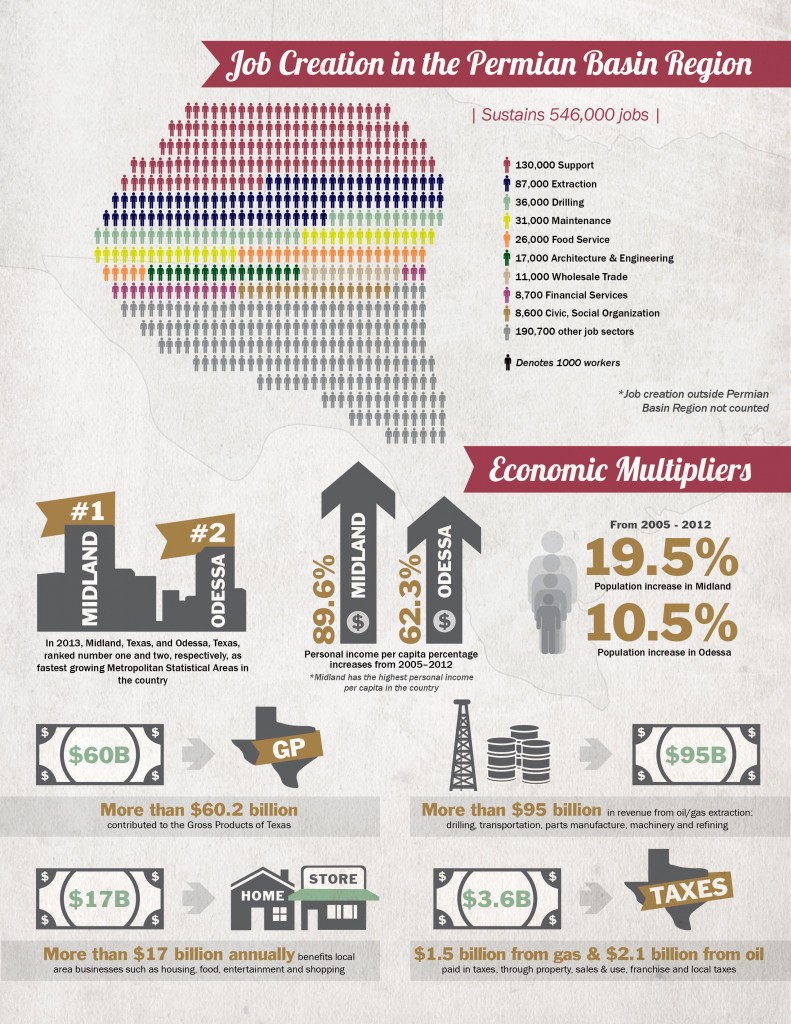

Texas, the nation’s top-ranking state by GDP, accounts for roughly 9% of all American GDP and would rank 13th in the world if it were an independent nation. A report by Texas Tech University concluded the Permian Basin alone sustains more than 546,000 jobs, generates $137.8 billion in economic output and contributes more than $71.1 billion to the gross state product.

The return involves more than just upstream operations. Texas Tech also conducted a study on the benefits of pipelines, which are comingled into the Permian findings. The benefits of Texas’ pipeline system: 165,000 jobs, $18.7 billion in gross state product and $1.6 billion in local and government revenues. The report found the midstream industry contributed $33 billion in economic impact in 2013 alone. Texas, which holds 48% of the nation’s pipelines, is expected to bring in $374 billion in economic impact over the next ten years while sustaining 171,000 jobs, injecting a total of $212 billion in gross state product and provide $19.5 billion in government revenue.

Land Owners at Odds

The use of hydraulic fracturing has caused an uproar in certain communities, with some locals enacting a ban on the practice. New York is a hot spot of such activity. Billions in revenue lie beneath its feet in the Marcellus and Utica shales, but fracing bans in more than 150 communities prevent any type of development. Pennsylvania, on the other hand, is at the focal point of America’s natural gas boom. Jake Novak of CNBC recently published an opinion piece on the matter, saying: “And this is all within view of the naked eye for New Yorkers stuck on the wrong side of the border. As CNBC contributor Larry Kudlow told me this week, the situation resembles the economic divide we saw between West and East Berlin in the 1970s! East Berliners could see, but not enjoy, economic freedom.”

New York is in the process of conducting an environmental review to determine the full effects of fracing – an act first put in place in 2008. Landowners missing out on royalties from oil and gas producers are taking their issue to the courts. The group is appealing their lawsuit after it was thrown out in June 2014.

Colorado has seen a contrary effect. A coalition group has been formed to determine the best course of action in fracing development, while Colorado judges have tossed out three fracing bans in the last few months. A report commissioned by Netherland, Sewell & Associates estimated value at between $1 billion and $2 billion for each section of land in Boulder County. A land owner holding a royalty interest of 20% in a section could generate as much as $64 million over its lifetime, according to estimates by Bloomberg.

But Fracing Can be a Four-Letter Word

The use of fracing may continue to put a portion of the public on edge, but a study by the National Academies of Sciences on Monday showed fracing does not contaminate drinking water. Rather, the blame can be placed on leaky wells, which can be fixed through better execution of cementing and casing a well.

Chris Tomlinson of the Houston Chronicle writes: “Environmentalists should stop blaming fracking for methane leaks. Activists may find it convenient to connect leaks to fracking, but science has now shown the problem is far more pedestrian and preventable. Many environmentalists anxious to stop all drilling will continue to conflate all of the everyday hazards of drilling for oil and gas with fracking, but they will eventually find their credibility damaged when scientific studies like the one released Monday proves they were wrong.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.