Take a good look at the global oil producers’ scorecard as it stands today. In a year or two, depending on when, how and if global production begins to fall off as a result of lower commodity prices or other forces, the players may change positions.

Percent of Global Production

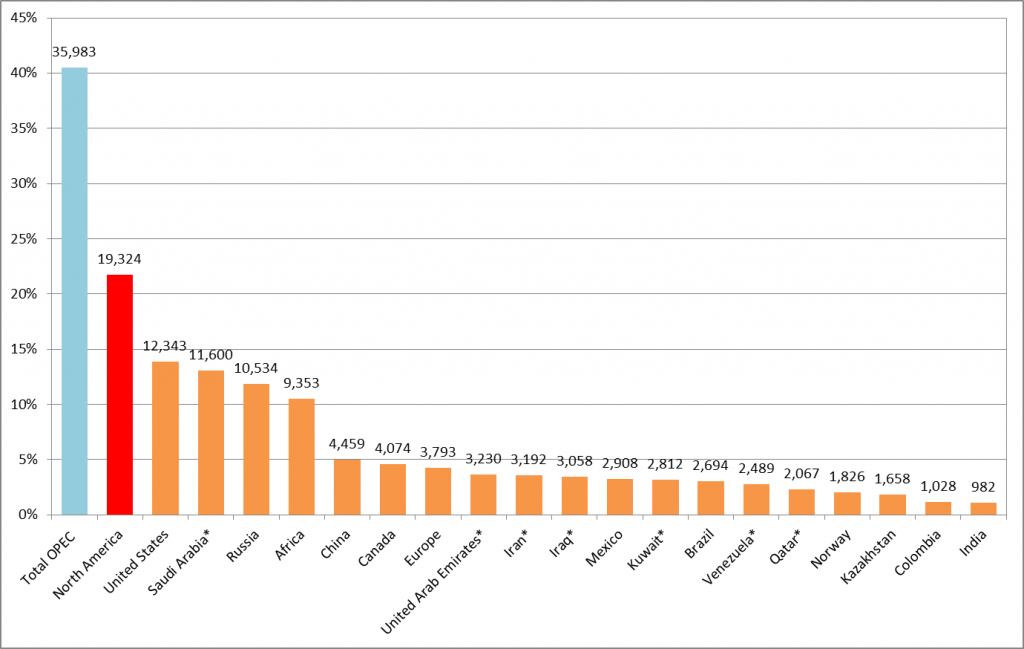

This Oil & Gas 360® chart shows the percent of global production by producing region. It includes a bar combining production of all OPEC countries in blue as well as all North American production in red, the largest producing individual country bars and the continent of Africa as a whole. On a country-by-country basis global production is led by the United States, Saudi Arabia and Russia, representing 14%, 13% and 12% of total production, respectively. Large producing countries that are individual OPEC members are marked with an asterisk.

The number atop each country bar is its production in thousands of barrels of oil per day, or MBOPD. All data is based off 2013 numbers provided by the U.S. Energy Information Administration.

OPEC Maintains Production Even as Members Suffer

OPEC’s total production makes up about 40% of total global production, with Saudi Arabia making up 32% of OPEC’s production. As the price of oil continues to drop, OPEC has remained steadfast in its position of allowing the market to decide the price, refusing to cut its own production. Suhail al-Mazrouei, the United Arab Emirates’ minister said Wednesday, “We have seen the oversupply coming primarily from shale oil, and that needed to be corrected,” reports Bloomberg. The U.A.E. plans to boost its production capacity to 3.5 MMBOPD by 2017.

The global supply glut that has been created by overproduction is beginning to take its toll on smaller members of the oil producing cartel. Venezuela, whose export revenue is 95% oil, has been hit particularly hard by low oil prices. Venezuelan President Nicolas Maduro has been on an international tour recently seeking billions in financial alliances from China and various OPEC members to replace the money the Venezuelan economy has been hemorrhaging.

Moduro was in Qatar earlier this week finalizing a deal he said would “give [Venezuela] sufficient oxygen to help cover the fall in oil prices and give us the resources we need for the national foreign currency budget.” Venezuela’s president was also in China last week where he secured $20 billion worth of investment for energy and infrastructure projects, reports NPR.

The shale revolution delivered the United States the number one producer spot, but OPEC’s November announcement to maintain production levels propelled a nosedive in crude oil prices to levels that resulted in U.S. producers announcing large cutbacks in their 2015 drilling and development programs. As rig counts fall and shale development slows, the existing oversupply will begin to work through the global market until demand driven support begins to drive prices upward, or until Saudi Arabia decides to cut its own production. As an old saying goes, the best cure for low oil prices is low oil prices.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.