2017 average Q4 production was 197,000 BOEPD

Montney producer Seven Generations Energy Ltd. (ticker: VII) reported a net income of $83.6 million, or $0.23 per share for the fourth quarter of 2017. For the full year, the company posted a net income of $562.5 million, or $1.54 per share.

Fourth quarter liquids production was 115,100 Bbls/d, which included 63,700 Bbls/d of condensate. Natural gas volumes were 493.4 MMcf/d and total production reached a quarterly record of 197,300 BOEPD in Q4 2017. Overall, total production averaged 197,300 BOEPD in the fourth quarter, and 175,000 BOEPD in 2017.

The drilling and completion cost per well was $9.8 million in the fourth quarter of 2017 – down from $11.3 million in the third quarter of 2017. This was largely attributable to drilling shorter laterals due to land restrictions and optimizing the number of hydraulic fracturing stages and sand tonnage, the company said. 7G expects drilling and completions costs to average between $10-$10.5 million per well in 2018.

Seven Generations drilled 20 wells, completed 16 wells and brought 23 wells on production, with an average of eight drilling rigs running in the fourth quarter. Consistent with its development plan, 7G had 56 wells in various stages of construction between drilling, completion and tie-in at the end of the fourth quarter.

Test wells, reserves

Initial 30-day condensate production rates for the wells ranged from 775 Bbls/d to 1,350 Bbls/d, for an average improvement of about 50% relative to the company’s Nest 1 type curve. 7G said this rate is comparable to the Nest 2 condensate type curve. The average well cost for the Nest 1 pad was $9.9 million, and 7G said it was maintaining its emphasis on cost reduction with improved productivity.

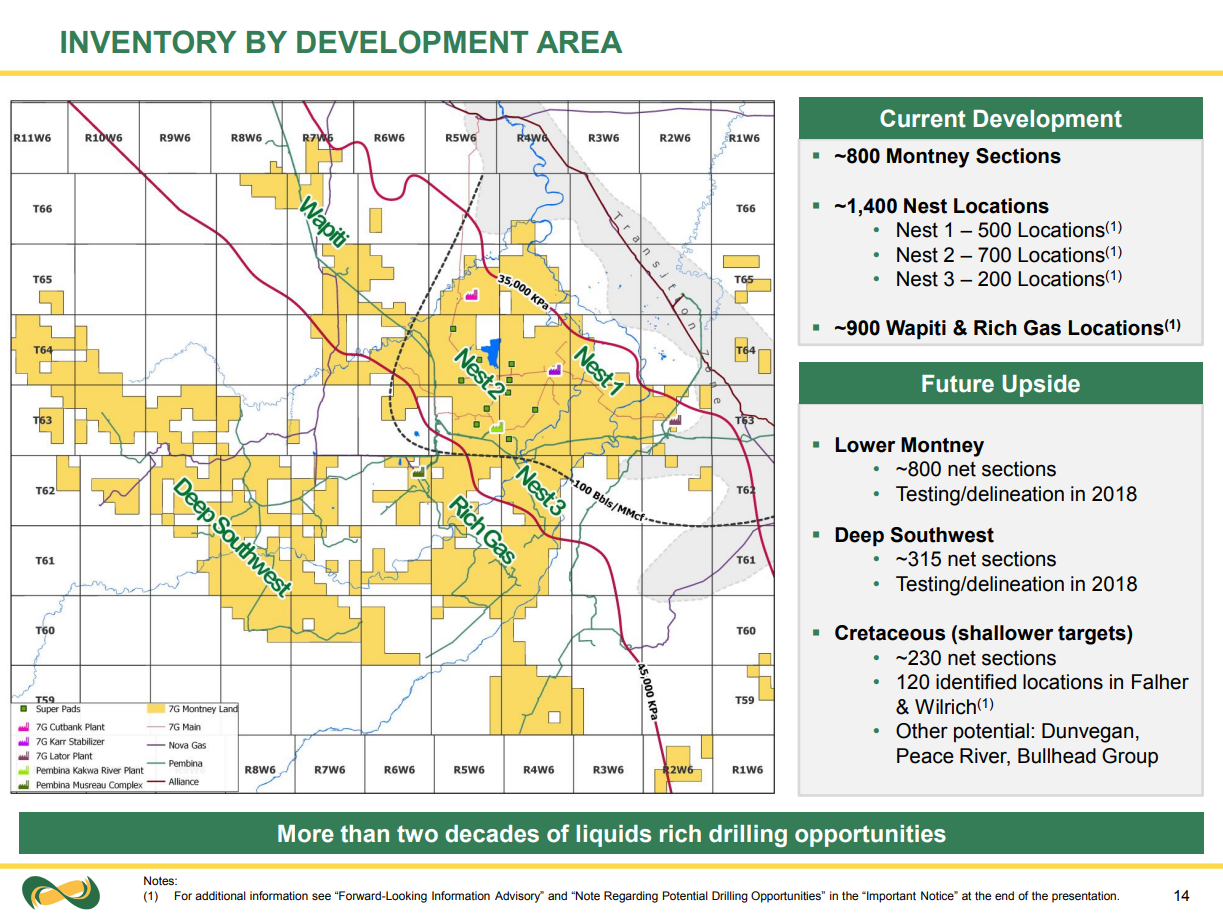

Proved plus probable reserves increased 10% to 1.7 billion BOE (NPV-10 $12 billion). Proved plus probable finding, development and acquisition costs decreased by 13% to $10.13 per BOE.

Processing plants

- Pembina Kakwa River maintenance

- Partial blockage in the heat exchanger

- An ethane extraction compressor has been offline for the first quarter of 2018, which has reduced a portion of natural gas liquids recovery

- Repairs for this compressor are planned in April

- Seven-day planned plant outage in the second quarter is expected to reduce the risk of future obstructions and improve processing rates for the remainder of 2018

- No change to the company’s 2018 production guidance

- Construction of 7G’s new natural gas processing plant at Gold Creek is on time and budget

- This new plant will expand 7G’s processing capacity by about 50% to 760 MMcf/d in three plants, complemented by up to 250 MMcf/d of third-party processing, for a total of about 1 Bcf/d of available processing capacity

- Scheduled to start operations in the fourth quarter of 2018

Debt refinancing – annual interest costs reduced by $25 million

In the fourth quarter, 7G completed refinancing transactions, repurchasing and redeeming all of its outstanding US$700 million of 8.25% senior unsecured notes due in 2020 and completing an issuance of $700 million of 5.375% senior unsecured notes due in 2025.

The refinancing will result in annual interest savings of about $25 million and extend the maturity of the notes by five years.

2018

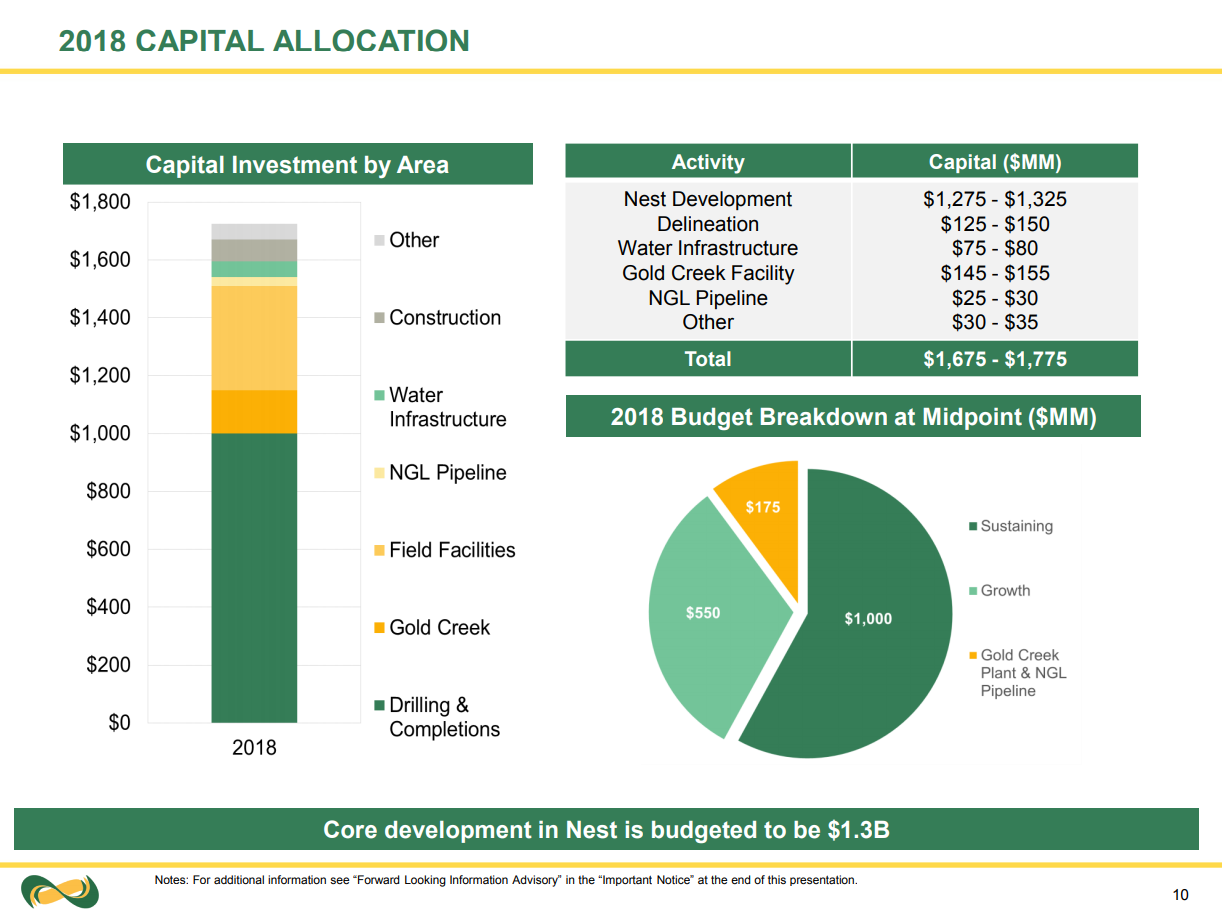

Production guidance for 2018 is estimated at 200-210 MBOEPD. The 2018 capital investment budget is approximately $1.675-$1.775 billion.

Seven Generations expects production in the first half of 2018 to average 190-200 MBOEPD.

Governance

EVP of Corporate Susan Targett retires

“After nearly 10 years of dedicated service, Susan Targett, executive vice-president, corporate, retired from Seven Generations on February 28. Susan was a founder of Seven Generations and made many contributions to the success of the company, creating value and developing strong ties with our stakeholders. Susan was instrumental in assembling 7G’s top tier asset position in the heart of the Montney play. We wish Susan all the best in her future endeavors,” President and CEO Marty Proctor said.

Derek Aylesworth joins Seven Generations as CFO

Derek Aylesworth will join Seven Generations on March 15, 2018 as CFO. He is responsible for the company’s finance, treasury, accounting, tax and capital markets functions.

Board of directors update

As part of the board of directors’ renewal process, Pat Carlson has decided that he wishes to pursue independent business and philanthropic opportunities. Therefore, he will not be standing for re-election at this year’s annual meeting on May 3, 2018.

Q&A conference call excerpts

Q: Thematically throughout the industry, we’ve start to see, you guys are converting to that free cash flow model and potentially sooner than expected, just wondering how you think about allocating that free cash flow between growth and the potential for share buybacks, which are obviously becoming a bit more thematic right now?

COO Glen Nevokshonoff: Yeah, really good question. So I think what I would like to do is just kind of step back. We’ve had free cash really since 2013. Our company has chosen to invest more than cash flow for growth. So we’ve actually generated more, more cash flow than sustaining capital since 2013. So we’ve deliberately made investments in infrastructure and in growth and in other aspects of our business that have caused us to be investing more than cash flow each year, but it was with the drive towards getting to that free cash flow point.

Now with these great pricing — with the great prices we’re receiving on condensate and even on gas, we’re probably approaching that free cash flow position, I mean, cash flow even beyond all of our expenditures — even sooner than planned. It’s premature to conclude what we will do, when we have free cash, I think we’d want to have a period of time where we have lots of free cash, so you’ll have an adequate amount available and then the choices will depend on the strategy that makes the most sense for our stakeholders at that time.

We do a lot of scenario analysis looking at what’s the best way to maximize value of this asset and we do that on a regular basis, including and probably especially during our annual meeting with our board to discuss strategy.

And I think ultimately it’s probably two years from now, we will probably have an opportunity to give back some of that cash to our shareholders, but that decision will be made in the future after reviewing it with our board.

Q: Just to clarify the other additional drilling that you’re doing in Nest 3 and then lower Montney, can you just give us a sense of how many wells you’re planning this year, I think you have four right now in Nest 3, is that right?

Nevokshonoff: Sure, yeah. Booked four within Nest 3, lower Montney, we have one well that was drilled and we’re waiting to complete, which will probably be later in Q2 and we have two other lower Montney that we’ll drill this year and complete.

CEO Marty Proctor: Well, and to add to that as well — those wells are in the vicinity of the Pembina Kakwa River plant and it’s essentially full at the moment and in fact we’ve got some production waiting on the optimization work that’s going to happen on April. So we’re drilling more where we’ve got infrastructure available for processing and handling.

Nevokshonoff: That’s a great point, Marty, we need to basically have a pipeline coming up from Nest 3… and we’re waiting on the Gold Creek commissioning in late 2018 to allow some of that gas to flow up to the north.